Crypto market sentiment is strengthening rapidly as analysts begin identifying the tokens most likely to lead the next major cycle into 2026. Among the highest-ranking contenders are Ozak AI, BNB, and Solana—three assets showing powerful accumulation patterns, rising adoption, and strong structural momentum.

While BNB and Solana represent the most reliable large-cap performers heading into the next bull phase, Ozak AI stands out as the early-stage project with the steepest upside curve, supported by advanced AI-native functionality. Together, these three form one of the strongest breakout trios currently on analyst radars.

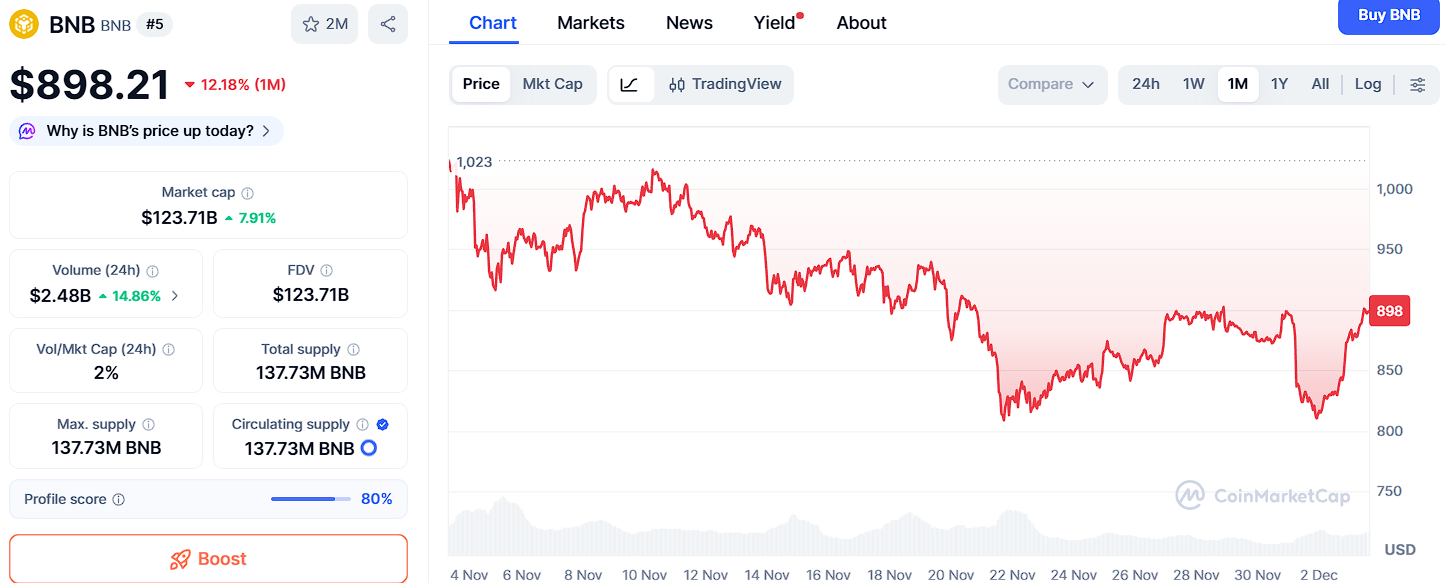

BNB Shows Strong Bullish Structure Ahead of a Major Expansion

BNB, trading around $898, continues to reinforce its dominance within the exchange and DeFi landscape. The token is maintaining solid support at the $875, $846, and $818, levels where long-term investors are accumulating aggressively. This foundation has helped BNB stay resilient even during periods of market volatility.

To unlock a deeper rally, BNB needs to break above $921, $954, and $989, resistance zones that historically triggered multi-week continuation moves. With BNB Chain activity rising and Binance’s global footprint expanding, analysts expect BNB to remain one of the top-performing large-cap assets into 2026. Still, as a high-valuation asset, BNB’s potential is noticeably lower than smaller early-stage tokens poised for exponential upside.

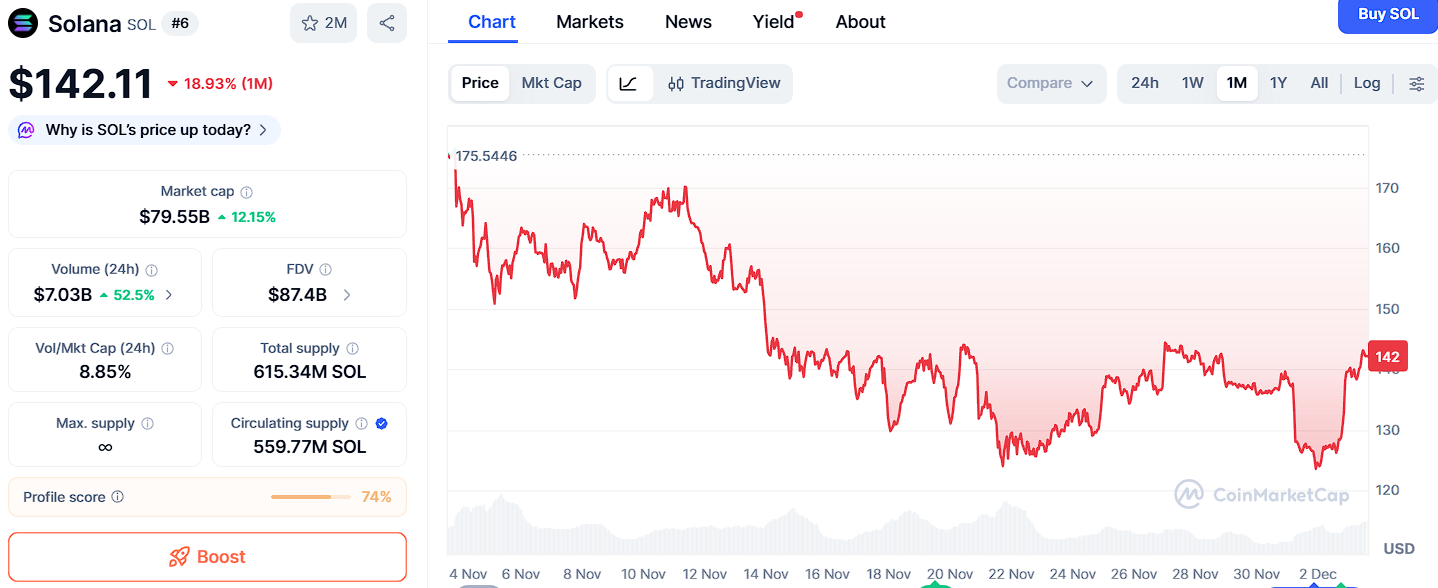

Solana Continues Its High-Speed Climb

Solana (SOL), currently near $142, has re-emerged as one of the most powerful layer-1 networks in the market. Developer activity remains high, transaction throughput is unmatched, and liquidity continues to flow into new protocols across the Solana ecosystem. SOL maintains support at $136, $129, and $122, zones that have protected the trend during recent dips.

For Solana to push into its next major breakout, it must clear resistance at the $147, $155, and $166, levels tied to previous high-volume surges. The network’s strong fundamentals position Solana as a top contender for major price expansion before 2026 — though even with its strength, analysts note its ROI potential remains significantly lower than Ozak AI’s early-stage trajectory.

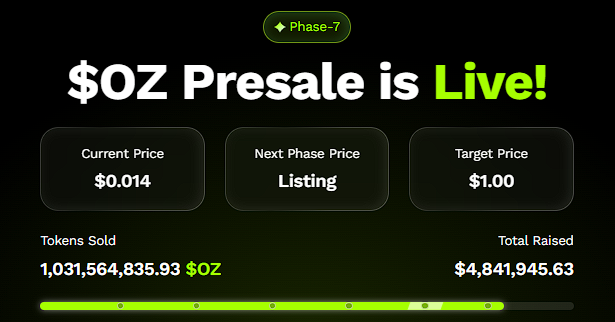

Ozak AI Leads Growth Forecasts

While BNB and Solana are proven leaders, Ozak AI (OZ) consistently ranks higher in long-term ROI forecasts due to its early-stage price, AI-native technology, and rapidly expanding ecosystem. Ozak AI stands out as a next-generation Web3 intelligence layer powered by millisecond-speed AI prediction engines, cross-chain analysis modules, and a 30 ms ultra-fast signal infrastructure through its HIVE partnership. Its integration with SINT’s autonomous AI agents further enables real-time execution, workflow automation, and blockchain analytics at a level unmatched by other emerging tokens.

Three Strong Breakout Projects

BNB offers stability and ecosystem strength, Solana provides unmatched speed and network expansion, and Ozak AI delivers the steepest growth potential due to its low market cap and AI-powered architecture.

All three are poised for strong performance before 2026, but Ozak AI remains the standout for investors seeking exponential returns. BNB and Solana may lead the large-cap rally—but Ozak AI is positioned to lead the next wave of breakout gains.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.