XRP Stuck Between $2.00 and $2.20 as Network Activity Hits 3-Month Low

XRP is once again trapped in tight consolidation, extending a rangebound pattern that has held the altcoin for several days. The altcoin is drawing renewed attention from traders, but this interest has not yet translated into meaningful market participation or price expansion. XRP Investors Pull Back The number of active addresses on the XRP Ledger

XRP is once again trapped in tight consolidation, extending a rangebound pattern that has held the altcoin for several days.

The altcoin is drawing renewed attention from traders, but this interest has not yet translated into meaningful market participation or price expansion.

XRP Investors Pull Back

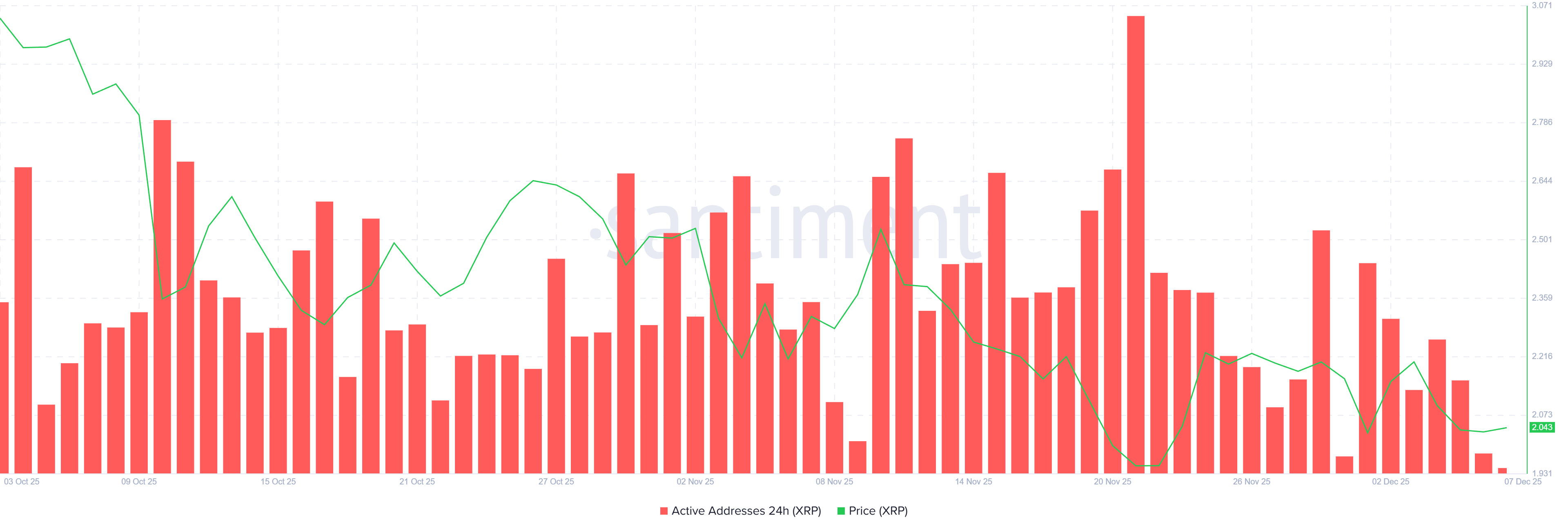

The number of active addresses on the XRP Ledger has dropped sharply, falling to 35,931 — the lowest level in more than three months. This decline highlights waning investor engagement as users pull back from transacting on the network. The lack of consistent activity reinforces the perception that XRP is struggling to generate momentum.

This retraced participation weakens the foundation needed for a sustainable recovery. When network activity falls this low, price rallies often lose strength quickly. This is making it difficult for XRP to build the demand required to break out of its established range.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Active Addresses. Source:

XRP Active Addresses. Source:

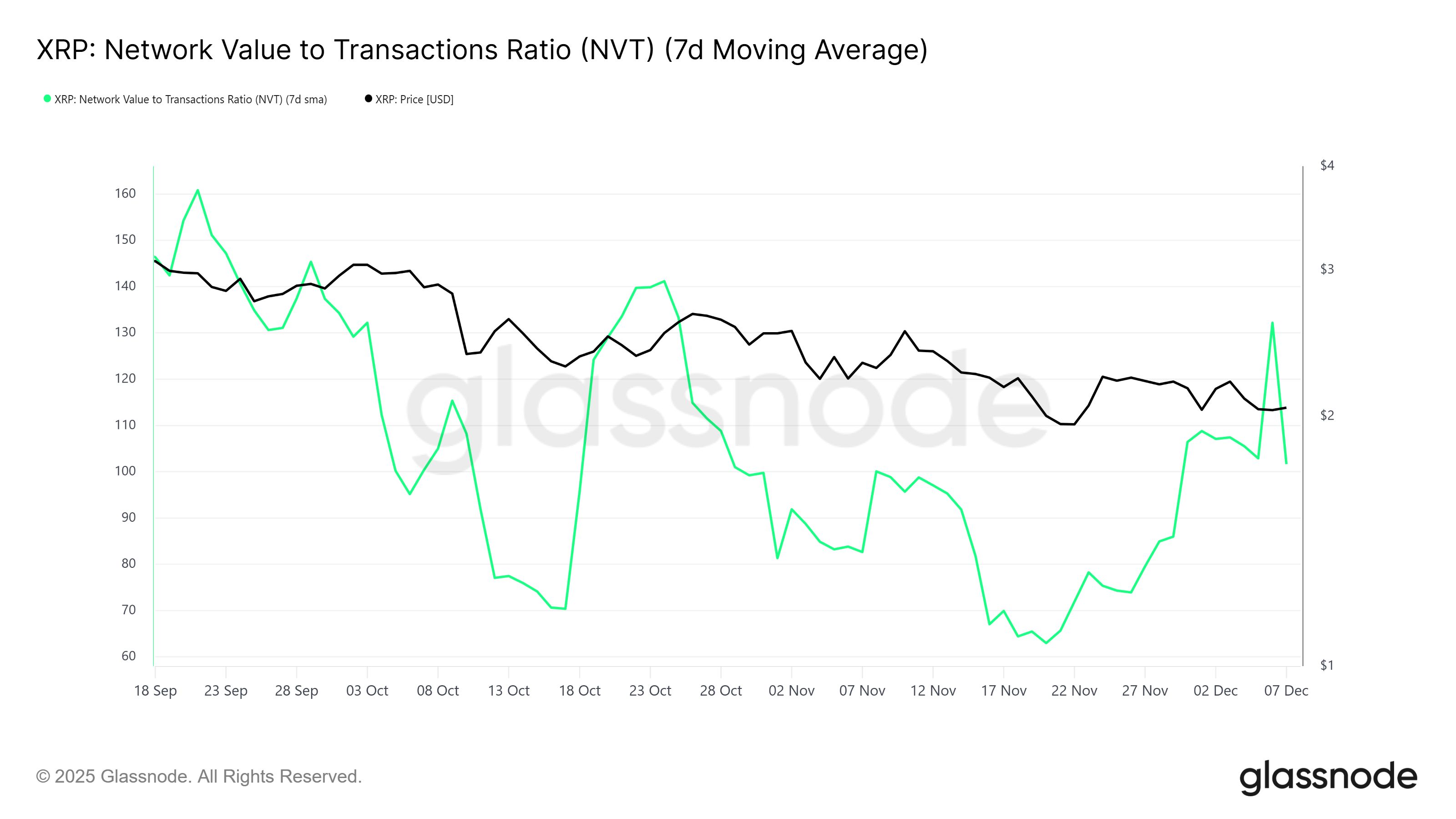

The NVT ratio is flashing another warning sign as it surges to a two-week high. A rising NVT typically suggests that an asset is overvalued relative to its transaction volume. In XRP’s case, subdued on-chain activity and elevated valuation pressure form a bearish combination that complicates recovery prospects.

This imbalance indicates that investors may be pricing in optimism that the network’s current fundamentals do not support. Until transaction activity increases, XRP will likely remain vulnerable to correction despite brief speculative rallies.

XRP NVT Ratio. Source:

XRP NVT Ratio. Source:

XRP Price Faces Sideways Movement

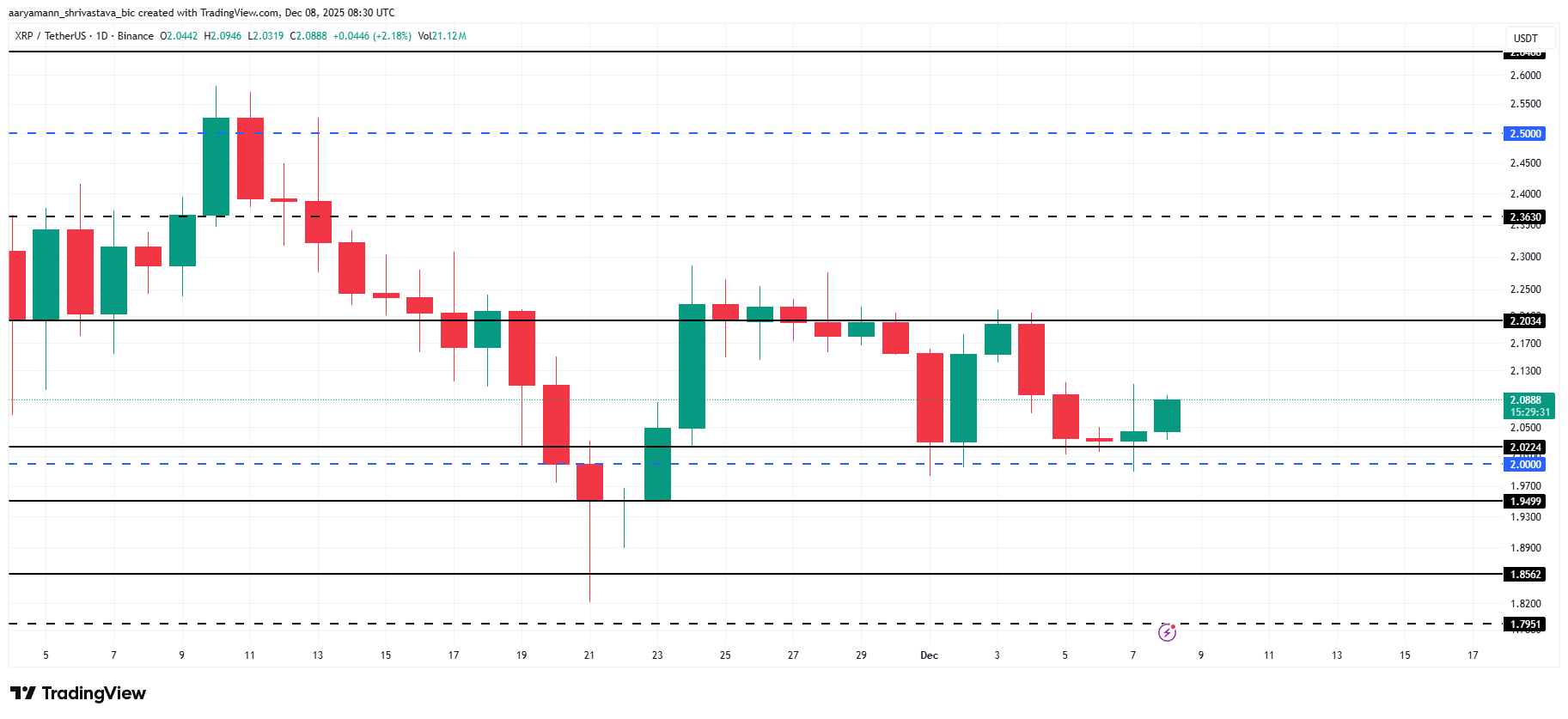

XRP is trading at $2.08 at the time of writing, maintaining a position above the $2.02 support. The altcoin has been stuck between $2.20 and $2.02 for several days. This reflects a lack of directional conviction.

The $2.00 zone remains a critical psychological and structural support. XRP may appear to bounce off $2.02 at times, but given current sentiment and macro signals, it will likely remain capped below $2.20 unless buyer interest strengthens.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If market conditions deteriorate further and XRP loses both $2.02 and $2.00, the bullish-neutral thesis would collapse. A breakdown could send the price below $1.94 and toward $1.85, exposing XRP to deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin