Crypto Fund Inflows Hit $716 Million as Bitcoin, XRP, and Chainlink Lead Institutional Shift

Crypto funds recorded a second consecutive week of inflows, pulling in $716 million as investor sentiment across crypto markets continued to stabilize and improve. The fresh capital increased total assets under management (AuM) to $180 billion, marking a 7.9% rebound from the lows in November. However, this is still significantly below the sector’s all-time high

Crypto funds recorded a second consecutive week of inflows, pulling in $716 million as investor sentiment across crypto markets continued to stabilize and improve.

The fresh capital increased total assets under management (AuM) to $180 billion, marking a 7.9% rebound from the lows in November. However, this is still significantly below the sector’s all-time high of $264 billion.

Crypto Inflows Hit $716 Million as Crypto Sentiment Turns Higher

According to weekly flow data, crypto inflows were broad-based across major regions, signaling renewed global participation. The US led with $483 million, followed by Germany with $96.9 million and Canada with $80.7 million.

This highlights a coordinated return of institutional interest across North America and Europe.

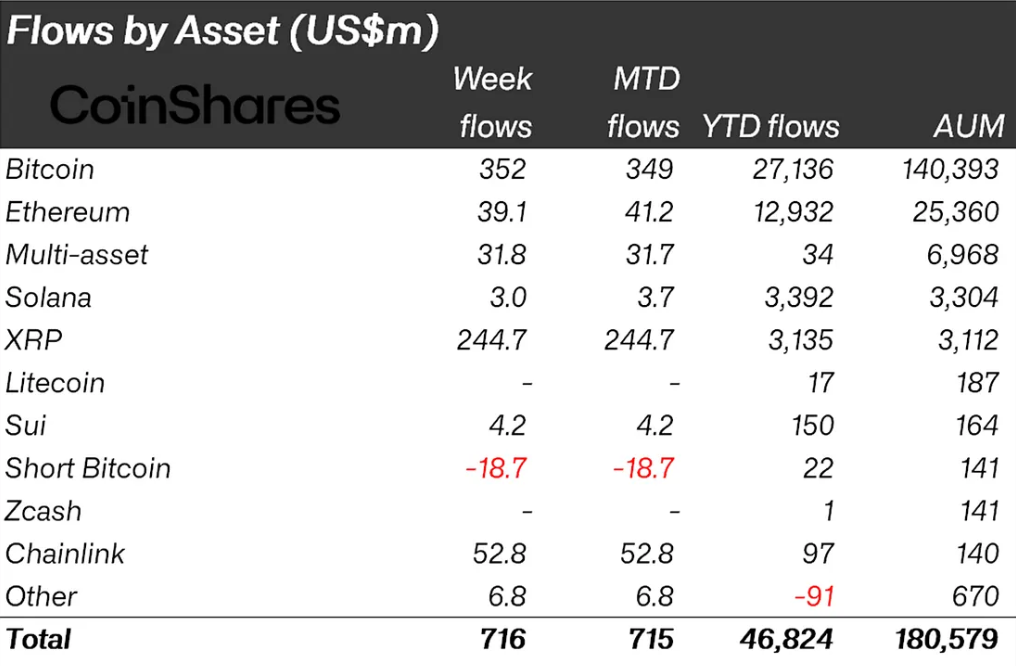

Bitcoin once again emerged as the primary beneficiary, attracting $352 million in weekly inflows. That brings Bitcoin’s year-to-date (YTD) inflows to $27.1 billion, still trailing the $41.6 billion recorded in 2024, but showing renewed momentum after months of hesitation.

At the same time, short-Bitcoin products saw outflows of $18.7 million, the largest withdrawal since March 2025.

Crypto Inflows Last Week. Source:

CoinShares

Crypto Inflows Last Week. Source:

CoinShares

Historically, similar outflows have coincided with price bottoms, suggesting that traders are increasingly abandoning bearish positioning as downside pressure weakens.

However, daily data showed minor outflows on Thursday and Friday, which analysts attribute to the release of fresh US macroeconomic data indicating persistent inflation pressures.

“Daily data highlighted minor outflows on Thursday and Friday in what we believe was a response to macroeconomic data in the US alluding to ongoing inflationary pressures,” wrote CoinShares’ James Butterfill.

That brief pause suggests that while sentiment is improving, it remains sensitive to interest rate expectations and signals from the Federal Reserve.

XRP and Chainlink Post Standout Demand

Beyond Bitcoin, XRP continued its strong multi-month run, recording $245 million in weekly inflows. This pushes XRP’s YTD inflows to $3.1 billion, dramatically outperforming its $608 million total for all of 2024.

The sustained demand reflects ongoing optimism surrounding XRP’s institutional use cases and regulatory positioning in key jurisdictions.

Chainlink posted one of the most striking performances of the week, with $52.8 million in inflows, its largest weekly intake on record.

Notably, this figure now represents over 54% of Chainlink’s total ETP AuM, highlighting how fast capital is rotating into oracle and infrastructure-focused crypto assets.

Sentiment Shifts After November’s Surge

The latest inflow streak follows an even stronger period at the end of November. For the week ending November 29, crypto funds recorded a powerful $1.07 billion in inflows, driven largely by rising expectations of potential 2026 interest rate cuts.

Together, the late-November surge and the current $716 million follow-up suggest a gradual yet consistent shift in institutional sentiment, even as concerns about inflation remain unresolved.

While total AuM remains well below peak levels, the steady return of capital into Bitcoin, XRP, and Chainlink suggests growing confidence that the worst of the recent risk-off cycle may be behind us.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving: What It Means for Cryptocurrency Investors in 2025

- Zcash's 2028 halving will reduce annual inflation to 1%, reinforcing its deflationary model after prior 50% block reward cuts in 2020 and 2024. - The 2024 halving triggered 1,172% price surge followed by 96% drop, highlighting volatility risks despite growing institutional investments like Grayscale's $137M Zcash Trust. - Privacy-focused hybrid model (shielded/transparent transactions) attracts institutional interest but faces EU MiCA regulatory scrutiny, requiring selective compliance strategies. - Inve

CleanTrade and the Evolution of Clean Energy Markets: Market Fluidity, Openness, and the Role of the CFTC

- CleanTrade, a CFTC-approved SEF, transforms clean energy markets by integrating VPPAs, PPAs, and RECs under institutional-grade transparency. - The platform unlocks liquidity through real-time pricing and centralized trading, accelerating net-zero transitions for corporations and utilities . - Enhanced transparency via project-specific REC data combats greenwashing, while regulatory alignment boosts investor confidence and market legitimacy. - By bridging traditional and renewable energy markets, CleanTr

The CFTC-Authorized Clean Energy Marketplace: An Innovative Gateway for Institutional Investors

- REsurety’s CleanTrade platform, CFTC-approved as a SEF, addresses clean energy market illiquidity and opacity by centralizing VPPAs, PPAs, and RECs. - Within two months of its 2025 launch, it attracted $16B in notional value, enabling institutional investors to streamline transactions and reduce counterparty risk. - By aggregating market data and automating compliance, CleanTrade enhances transparency, aligning with ESG priorities and regulatory certainty for institutional portfolios. - It democratizes a

SOL Drops 50%: Is This a Healthy Market Adjustment or the Onset of a Major Sell-Off?

- Solana's 50% price drop sparks debate over whether it signals a bear market correction or deeper structural selloff. - On-chain metrics show liquidity contraction and reduced exchange supply, but ETF inflows and validator activity suggest structural resilience. - Corporate transfers and the Upbit hack highlight volatility risks, while Solana's alignment with Bitcoin's trend underscores macroeconomic influence. - Key watchpoints include liquidity recovery timelines, ETF inflow sustainability, and potentia