Date: Mon, Dec 08, 2025 | 06:36 PM GMT

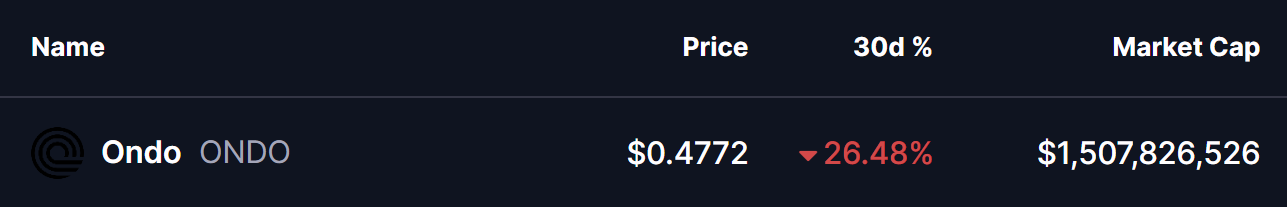

The broader crypto market remains under pressure, with Ethereum (ETH) shedding nearly 8% over the past 30 days. This weakness has spilled over into altcoins, and the RWA-focused token Ondo (ONDO) has not been spared — posting a sharp decline of more than 26% in the same period.

Despite the heavy selling, ONDO’s daily chart is beginning to hint at something more constructive. The structure currently forming aligns closely with a classic “Power of 3” setup — a market pattern that often appears before strong trend reversals.

Source: Coinmarketcap

Source: Coinmarketcap

Accumulation Phase

For several months, ONDO traded in a tight sideways range between $1.1050 as resistance and $0.7095 as support. This long period of consolidation suggested quiet accumulation, with smart money building positions while price volatility steadily contracted.

This phase built a strong base, but also created a clear range that the market later used as a liquidity target.

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

Manipulation Phase

In early November, ONDO broke decisively below the key $0.7095 support level. This breakdown triggered stops and forced weak hands out of the market. Price dropped to a local low near $0.4550, before stabilizing around the $0.4760–$0.4800 region.

This red-shaded area on the chart represents the manipulation zone — where false breakdowns often occur before a true trend direction is revealed.

What Comes Next?

Right now, ONDO remains inside this manipulation zone, which means some sideways chop or minor downside is still possible. However, if buyers continue to defend this region and price reclaims $0.7095, the next phase — expansion — could begin.

Key technical levels to watch:

- Immediate resistance: 100-day MA near $0.7556

- Major breakout zone: $1.1050

A clean break above both of these levels could open the door toward the projected target near $1.75, representing significant upside potential from current prices.

Final Thoughts

While the structure is slowly turning constructive, ONDO remains vulnerable as long as it trades below $0.7095. Bulls need to reclaim this level to confirm any serious shift in trend. Until then, caution remains justified, but the technical foundation for a recovery is clearly starting to form.