The DASH Aster DEX Launch: Exploring New Horizons in Decentralized Finance (DeFi)

- Aster DEX's hybrid AMM-CEX model and multi-chain interoperability redefine DeFi liquidity, privacy, and scalability in 2025. - DASH's listing drove 1,650% ASTER token value growth and $781M+ trading volume via cross-chain accessibility and 5x leverage. - Strategic partnerships with Binance/YZi Labs and RWA integration (gold/equities) expanded institutional adoption while 2M+ daily users validated hybrid model efficiency. - Despite regulatory scrutiny and temporary DefiLlama delisting, 2026 roadmap target

DASH Launches on Aster DEX: A New Era for Decentralized Finance

The introduction of DASH to Aster DEX in 2025 marks a pivotal development in the decentralized finance (DeFi) landscape. This move merges advanced technology with strategic market positioning, reshaping the standards for liquidity, privacy, and scalability within the crypto sector. By adopting a hybrid approach that combines automated market maker (AMM) features with centralized exchange (CEX) capabilities and supporting multiple blockchain networks, Aster DEX has become attractive to both individual traders and institutional investors. This overview explores the strategic and market impact of DASH’s integration, referencing leading DeFi analytics and industry standards.

Innovative Hybrid Architecture Enhances Liquidity and Performance

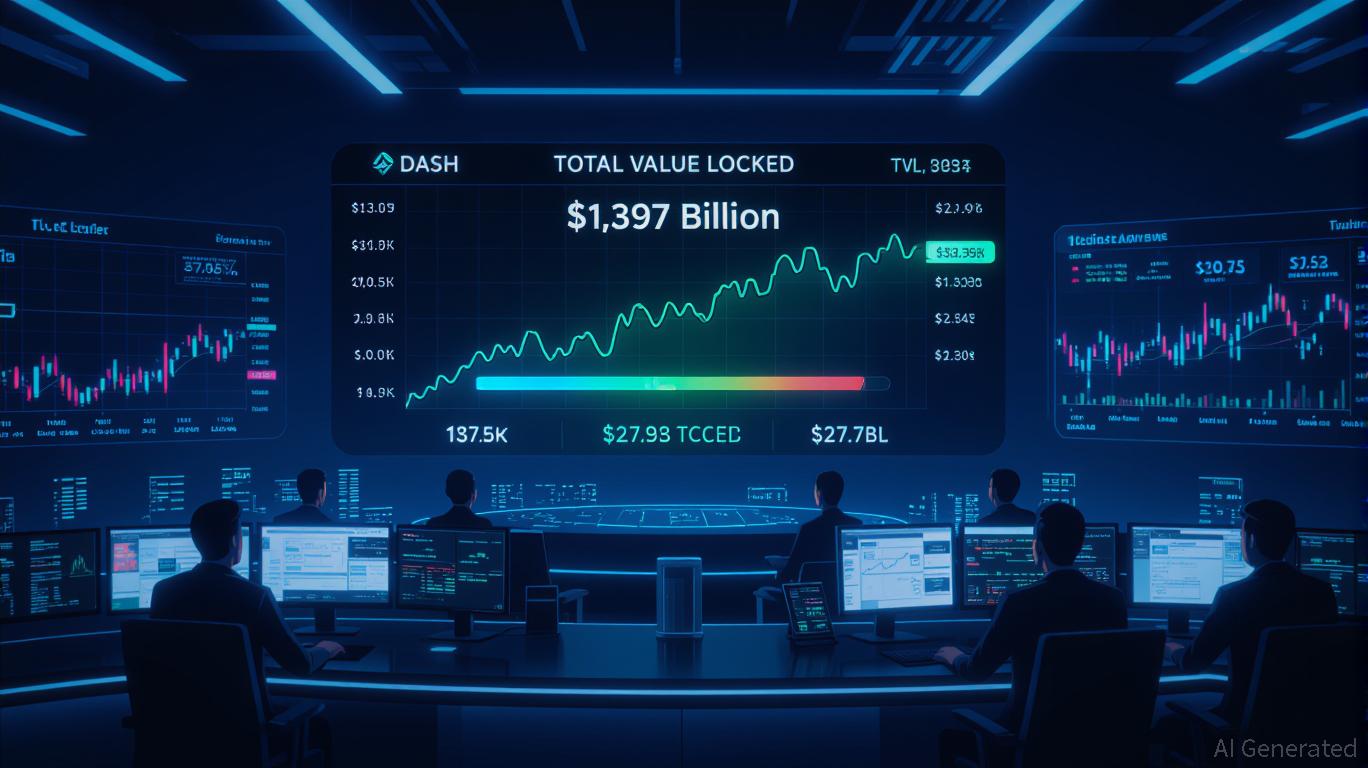

Aster DEX’s unique blend of AMM and CEX functionalities tackles two major challenges in DeFi: fragmented liquidity and slow transaction execution. By merging the transparency of AMMs with the rapid trade processing of CEXs, the platform has achieved a 40% reduction in slippage compared to conventional AMMs. These advancements are reflected in its performance metrics: by the third quarter of 2025, Aster DEX reached a total value locked (TVL) of $1.399 billion and saw daily trading volumes surpass $27.7 billion. The addition of DASH to perpetual futures trading, with leverage up to 5x, significantly boosted its market visibility, leading to a remarkable 1,650% increase in ASTER token value following its token generation event.

The success of this hybrid model lies in its ability to serve a wide range of users. Retail participants benefit from efficient price discovery similar to AMMs, while institutions can execute large trades using CEX-style order books. Notably, Aster DEX supports 10,000 transactions per second and ensures that 77% of trades are protected by zero-knowledge proofs (ZKP), which helped the platform attract 2 million daily active users by the end of 2025.

Cross-Chain Connectivity and Enhanced Liquidity

Aster DEX’s focus on interoperability across multiple blockchains has been instrumental in its rapid growth. By enabling seamless trading across BNB Chain, Ethereum, Solana, and Arbitrum, the platform removes liquidity barriers and allows users to access global markets without the need for asset conversions. This strategy aligns with the evolution of DeFi 2.0, where cross-chain solutions reduce fragmentation and improve capital efficiency. For example, DASH’s trading volume on Aster DEX increased by 114.5% year-over-year, reaching $781.43 million in the fourth quarter of 2025, highlighting its expanding influence as a cross-chain asset.

When compared to other DeFi platforms, Aster DEX stands out. While Uniswap leads in liquidity and brand presence, Aster DEX’s adaptive fee structures and deep liquidity pools help minimize slippage during volatile periods. Its multi-route execution also surpasses Curve’s stablecoin-centric approach in turbulent markets. In contrast to Apex Omni, Aster DEX’s focus on privacy—through features like hidden orders and MEV-aware routing—meets the needs of institutions seeking confidential trading environments.

Strategic Collaborations and Institutional Growth

The expansion of Aster DEX has been accelerated by key partnerships with Binance and YZi Labs, which have strengthened its tokenomics and enhanced its reputation among institutional players. These collaborations have paved the way for the integration of real-world assets (RWAs) such as gold and stocks, making the platform more appealing to traditional investors. Additionally, innovative features like Shield Mode and TWAP orders address concerns about market impact and privacy, enabling institutions to execute large trades discreetly and efficiently.

The platform’s economic model, which includes mechanisms like token burns and staking rewards, encourages long-term user participation and value creation. Initiatives such as a $10 million trading competition and a Stage Four airdrop in late 2025 further fueled ecosystem growth, resulting in the creation of 330,000 new wallets after the token generation event.

Market Position and Future Outlook

By the end of 2025, Aster DEX had captured a 19.3% share of the perpetual DEX market. Nonetheless, the platform faces ongoing challenges, including regulatory scrutiny over unusual trading patterns and a temporary removal from DefiLlama. Despite these obstacles, Aster DEX’s 2026 roadmap—which includes the launch of its own Layer-1 Aster Chain, integration of fiat gateways, and the introduction of AI-powered risk management—positions it to attract even more traditional capital.

Market forecasts for the ASTER token remain optimistic but cautious. Projections for 2025 suggest the token could reach $1.73 (with an average of $1.33), while 2026 estimates point to a potential high of $2.87, driven by greater institutional involvement and the addition of real-world assets. These predictions, however, depend on regulatory developments and ongoing innovation in asset tokenization.

Summary

The listing of DASH on Aster DEX demonstrates how next-generation DeFi platforms are bridging the divide between decentralized and traditional finance. By tackling key issues such as liquidity, privacy, and scalability through hybrid and cross-chain solutions, Aster DEX has set new standards for the industry. As the platform pursues its ambitious 2026 plans, investors must balance its technological advancements with regulatory risks, making Aster DEX a noteworthy example of the complexities and opportunities in the evolving world of decentralized trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum (MMT) Gaining Traction Through Key Alliances and Growing Attention from Institutions

- Momentum (MMT) gains traction in 2025 via strategic partnerships with Sui , Coinbase , and OKX, boosting institutional adoption. - A $10M HashKey Capital funding round and regulatory clarity underpin MMT's cross-chain DEX launch and RWA tokenization efforts. - Ve(3,3) governance and buybacks drive deflationary dynamics, with TVL exceeding $600M and $1.1B daily trading volumes. - Technical indicators signal potential bullish reversal at $0.52–$0.54, despite 70% post-TGE price correction and volatile forec

ALGO Falls by 3.33% Amidst Market Developments and Announced Restructuring Plans

- ALGO drops 3.33% in 24 hours, part of a broader 61.02% annual decline amid volatile market conditions. - Upcoming Swiss rate decisions, U.S. jobless claims, and bond auctions may intensify market uncertainty affecting crypto assets. - Argo Blockchain's approved restructuring plan, including new mining equipment, could indirectly impact ALGO supply/demand dynamics. - Market participants monitor macroeconomic indicators and blockchain sector developments to gauge ALGO's future trajectory.

LUNA Value Increases by 10.29% Over 24 Hours as Network Upgrade and Growing Inflows Drive Momentum

- LUNA surged 10.29% in 24 hours, driven by a network upgrade and rising on-chain inflows. - The terrad v3.6.1 upgrade aims to resolve legacy contract issues and enhance blockchain security ahead of December 18 implementation. - Derivatives open interest in LUNC futures rose to $25.55M, signaling renewed investor confidence linked to the upgrade. - Technical indicators show LUNA trading above 50-week EMA with RSI at 56, suggesting sustained upward momentum. - Analysts project continued gains if the upgrade

KITE Stock Performance After Listing: Understanding Investor Reactions and Institutional Ambiguity in Initial Tech IPO Phases

- KITE's stock plummeted 63% post-IPO despite strong retail occupancy and NOI growth, highlighting market uncertainty in early-stage tech. - Analyst ratings diverged (Buy at $30 vs. Neutral at $24), reflecting skepticism about KITE's ability to compete with AI-driven disruptors. - Institutional positions split sharply, with COHEN & STEERS boosting stakes while JPMorgan/Vanguard cut holdings, revealing sector risk fragmentation. - KITE trades at a 35.17 P/E (vs. 27.1x retail REIT average) but lags high-grow