Polymarket trading figures are being ‘double-counted ’: Paradigm

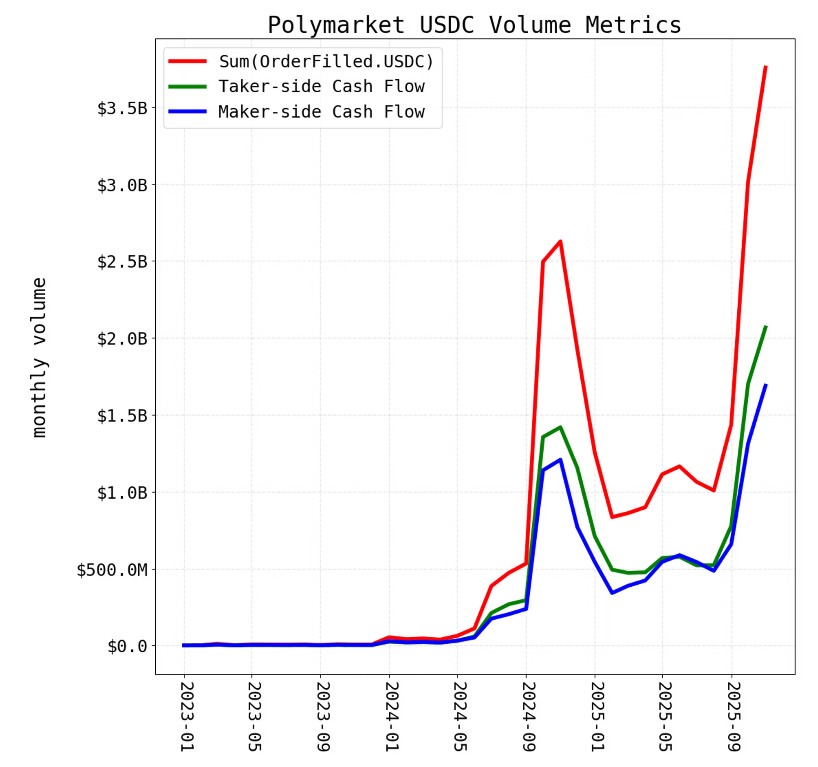

Some of the reported trading activity and volume of prediction market platform Polymarket may be significantly higher than actual reality due to a “data bug,” according to a researcher at Paradigm.

“It turns out almost every major dashboard has been double-counting Polymarket volume not related to wash trading,” said Storm, a researcher at the venture capital firm.

Storm explained that this was because “Polymarket’s onchain data contains redundant representations of each trade.”

“Polymarket’s onchain data is quite complex, and this has led to widespread adoption of flawed accounting methods.”

When trades occur on Polymarket, the system emits multiple “OrderFilled” events: one set for makers, who have existing orders, and another for takers, who execute the trade.

These events describe the same trade from different perspectives, not separate trades. However, many major dashboards have been combining them, counting the same volume twice.

Polymarket has been seen as a rare crypto success recently, as spot and derivatives markets have been in turmoil. The discovery that its headline metric may be incorrect across many dashboards could dent some of its perceived success.

Polymarket’s complex blockchain data

The researcher went on to explain that the accounting bug “inflates both types of volume metrics commonly used for prediction markets, notional volume and cashflow volume.”

“Polymarket’s data has been notoriously confusing for crypto data analysts … the data has too many layers of interacting complexity to untangle using just a block explorer.”

Related: Polymarket plans to use in-house market maker to trade against users: Report

This complexity arises because Polymarket trades can be simple swaps or they can be “splits” and “merges” where both parties exchange cash for opposing positions.

The smart contracts emit redundant events for tracking purposes, and standard blockchain explorers don’t make this distinction clear, the researcher stated.

Cointelegraph contacted Polymarket for comment, but did not receive an immediate response.

Polymarket is valued at $9 billion

The Intercontinental Exchange (ICE) valued the prediction platform at $9 billion this week, according to reports, citing $25 billion in trading volume, which could now be in question.

In September, it was reported that Polymarket was preparing for a US launch at a $10 billion valuation. In October, Bloomberg reported that it was looking to raise funds at a valuation between $12 billion and $15 billion.

Meanwhile, Dune Analytics reported that the platform achieved a monthly record of $3.7 billion in trading volume in November, but this may be double the actual figure if Paradigm’s research is correct.

“DefiLlama, Allium, Blockworks and many Dune dashboards were double-counting,” said the researcher.

Prediction markets are rapidly evolving into a critical financial sector, “and as the category matures, the industry should converge on consistent, transparent, and objective reporting standards,” the researcher concluded.

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Influence of Artificial Intelligence on Universities and Preparing Tomorrow’s Workforce

- AI integration in higher education drives academic program expansion, with 2.5% undergraduate and 3% graduate enrollment growth in 2024. - Universities invest $33.9B in generative AI to modernize curricula and partner with industries , addressing 58% workforce readiness gaps. - AI-driven tools boost student retention (52% adoption) and project 1.5% U.S. GDP growth by 2035 through automation in key sectors. - Challenges persist: 71% academic integrity concerns and 52% training gaps highlight risks in AI a

The CFTC-Sanctioned Transformation in Clean Energy Trading

- CFTC's 2025 withdrawal of carbon credit derivatives guidance creates regulatory uncertainty but sparks innovation in blockchain/AI solutions. - OBBBA's 2026 construction deadline accelerates solar/wind project cancellations while preserving tax credit transferability mechanisms. - Battery storage, geothermal, and hydrogen emerge as resilient sectors amid market shifts, supported by IRA tax credits and OZ modernization. - Investors prioritizing domestic supply chains and third-party certified projects gai

Aligning university programs with new technology sectors to pinpoint areas with strong investment potential

- Higher education is redefining curricula to align with AI, quantum computing, green energy, and biotech sectors, addressing urgent talent gaps. - Green energy apprenticeships (e.g., ACE Network) and biotech-AI hybrid training programs are scaling rapidly to meet workforce demands. - Quantum computing initiatives like Connecticut's $1B QuantumCT plan highlight trillion-dollar investment potential in talent development and infrastructure. - AI ethics integration and edtech platforms for real-time labor mar

Tight Range Emerges: PEPE Trades at $0.054368 With 4.1% Weekly Decline and Key Levels in Focus