How A Token Sale Gone Wrong Turned Into a 100% Rally For HumidiFi (WET)

HumidiFi (WET) has emerged as the top daily gainer in the cryptocurrency market today, rising over 100% in the past 24 hours. The Solana-based token’s surge coincides with its latest market debut, which has drawn significant interest from the crypto community. Why is HumidiFi (WET) Token’s Price Surging? BeInCrypto Markets data showed that WET’s value

HumidiFi (WET) has emerged as the top daily gainer in the cryptocurrency market today, rising over 100% in the past 24 hours.

The Solana-based token’s surge coincides with its latest market debut, which has drawn significant interest from the crypto community.

Why is HumidiFi (WET) Token’s Price Surging?

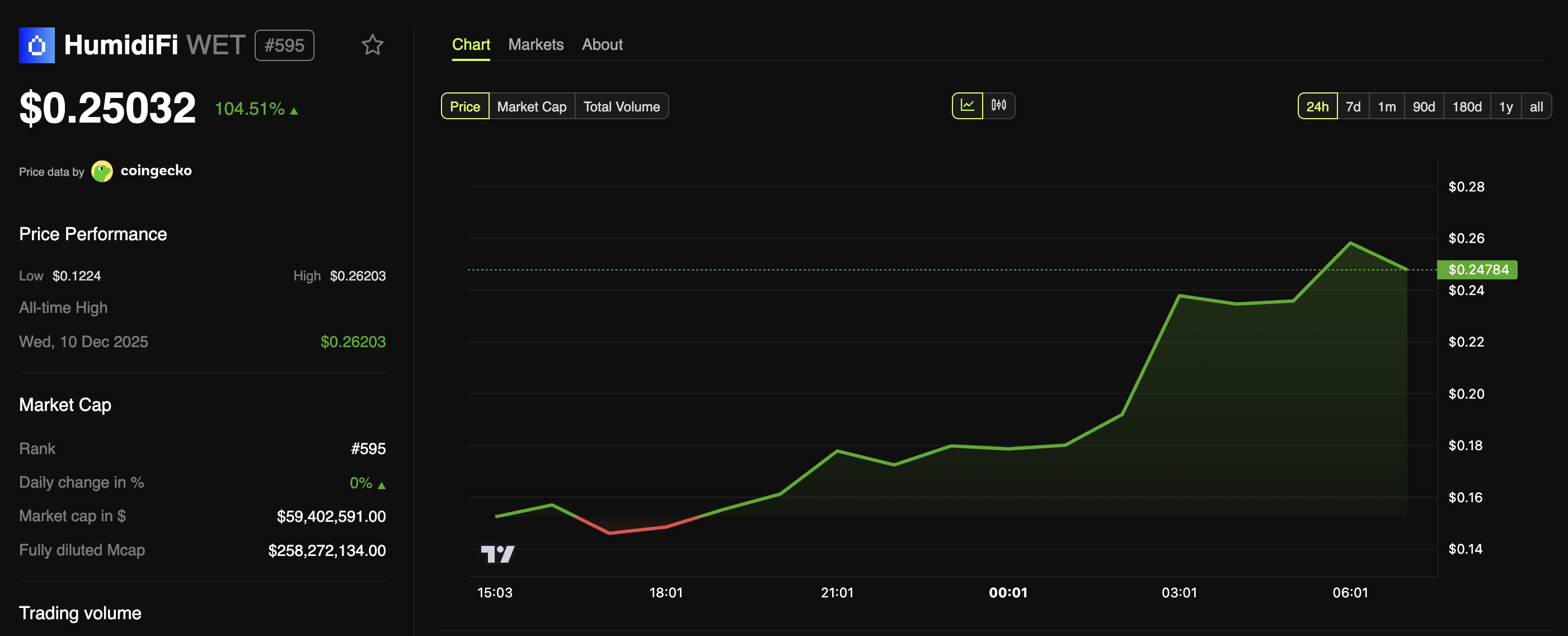

BeInCrypto Markets data showed that WET’s value has increased by 104.5% in the past 24 hours. At the time of writing, the altcoin was trading at $0.25.

WET’s market capitalization has also exceeded $50 million. Moroever, trading activity remains strong, with daily volume surpassing $150 million.

HumidiFi (WET) Price Performance. Source:

BeInCrypto Markets

HumidiFi (WET) Price Performance. Source:

BeInCrypto Markets

The token’s rise has sparked notable community buzz, earning it the top spot on CoinGecko’s trending lists. Sentiment data indicates an 80% bullish and 20% bearish outlook among traders.

But what exactly is HumidiFi, and what’s causing this hype? HumidiFi operates as a proprietary automated market maker (prop AMM) on Solana.

According to its litepaper, HumidiFi is Solana’s largest decentralized exchange, handling over $1 billion volume per day and accounting for more than 35% of Solana’s spot DEX activity. Furthermore, the protocol is integrated with Jupiter, DFlow, Titan, and OKX Router, serving as a key liquidity layer in the network.

WET is the platform’s native token. It is the first token launched via Jupiter’s Decentralized Token Formation (DTF) platform.

Yet, the launch was disrupted. On December 5, blockchain analytics firm Bubblemaps revealed that a single entity “Ramarxyz” used over 1,000 wallets to claim 70% of the initial offering. HumidiFi and Jupiter acknolwdged the incident swiftly.

“They set up thousands of wallets, each having 1000 USDC. For each wallet, there was an instruction created, that triggered the deposit of funds into the DTF smart contract. This is like a button that says put 1000 USDC into DTF to buy WET. Then a transaction was made that pressed 6 of these buttons at the same time. Per bundle sent (a lot of bundles were sent), 4 transactions were executed. 4 transactions that triggered 6 instructions each, for a total of 24,000 USDC or ~350,000 WET for each bundle,” HumidiFi explained.

In response, the team announced a complete relaunch with a new token. This move showed a clear commitment to fair access and a community-driven process over opportunistic trading.

“As the currently deployed WET tokens are in the completed initial offering vaults and cannot be retrieved, a new token will be minted to facilitate the relaunch of the public sale. The current WET token (WETcX1wAahwVbuJ9HihE8Uwf3dwmJBojGphAZPSVpJP) is VOIDED, and WILL NOT be the official token of HumidiFi,” Jupiter added.

Relaunch Success With Anti-Bot Mechanisms

The public relaunch went live on December 8 at 10:00 a.m. EST, with anti-sniping features. These included permissioned signing through the DTF frontend and Cloudflare, increased compute units per deposit, and mechanisms to disable revert protection.

These strategies worked. The relaunch raised 2.07 million USDC from genuine buyers, with 60,000 visitors on the DTF platform. HumidiFi’s analysis showed that 20% of depositors contributed less than the maximum $500 cap, signaling real user participation rather than automated scripts.

“Each of the 4000+ users that managed to purchase WET had to go through the DTF application’s front-end. Based on initial wallet-age analysis, we are very confident that legitimate users at their battle stations (with rapid refresh and fast fingers) won today and only about 5% were from potentially suspicious addresses,” Jupiter posted.

The successful relaunch helped restore community confidence after the initial manipulation. In addition, the WET token secured listings on major exchanges including Coinbase, OKX, Bybit, and Gate. These listings substantially enhance its visibility, deepen liquidity, and open the door to a much broader investor base.

Thus, these developments have fueled WET’s sharp upward momentum and solidified its position as one of the market’s standout performers today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum (MMT) Gaining Traction Through Key Alliances and Growing Attention from Institutions

- Momentum (MMT) gains traction in 2025 via strategic partnerships with Sui , Coinbase , and OKX, boosting institutional adoption. - A $10M HashKey Capital funding round and regulatory clarity underpin MMT's cross-chain DEX launch and RWA tokenization efforts. - Ve(3,3) governance and buybacks drive deflationary dynamics, with TVL exceeding $600M and $1.1B daily trading volumes. - Technical indicators signal potential bullish reversal at $0.52–$0.54, despite 70% post-TGE price correction and volatile forec

ALGO Falls by 3.33% Amidst Market Developments and Announced Restructuring Plans

- ALGO drops 3.33% in 24 hours, part of a broader 61.02% annual decline amid volatile market conditions. - Upcoming Swiss rate decisions, U.S. jobless claims, and bond auctions may intensify market uncertainty affecting crypto assets. - Argo Blockchain's approved restructuring plan, including new mining equipment, could indirectly impact ALGO supply/demand dynamics. - Market participants monitor macroeconomic indicators and blockchain sector developments to gauge ALGO's future trajectory.

LUNA Value Increases by 10.29% Over 24 Hours as Network Upgrade and Growing Inflows Drive Momentum

- LUNA surged 10.29% in 24 hours, driven by a network upgrade and rising on-chain inflows. - The terrad v3.6.1 upgrade aims to resolve legacy contract issues and enhance blockchain security ahead of December 18 implementation. - Derivatives open interest in LUNC futures rose to $25.55M, signaling renewed investor confidence linked to the upgrade. - Technical indicators show LUNA trading above 50-week EMA with RSI at 56, suggesting sustained upward momentum. - Analysts project continued gains if the upgrade

KITE Stock Performance After Listing: Understanding Investor Reactions and Institutional Ambiguity in Initial Tech IPO Phases

- KITE's stock plummeted 63% post-IPO despite strong retail occupancy and NOI growth, highlighting market uncertainty in early-stage tech. - Analyst ratings diverged (Buy at $30 vs. Neutral at $24), reflecting skepticism about KITE's ability to compete with AI-driven disruptors. - Institutional positions split sharply, with COHEN & STEERS boosting stakes while JPMorgan/Vanguard cut holdings, revealing sector risk fragmentation. - KITE trades at a 35.17 P/E (vs. 27.1x retail REIT average) but lags high-grow