350 Million XRP Changes Hands as Bigger Whales Take Over Amid Price Downtrend

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts. Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure. XRP Supply Changes Hands Whale activity shows a notable redistribution of XRP supply between major

XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts.

Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure.

XRP Supply Changes Hands

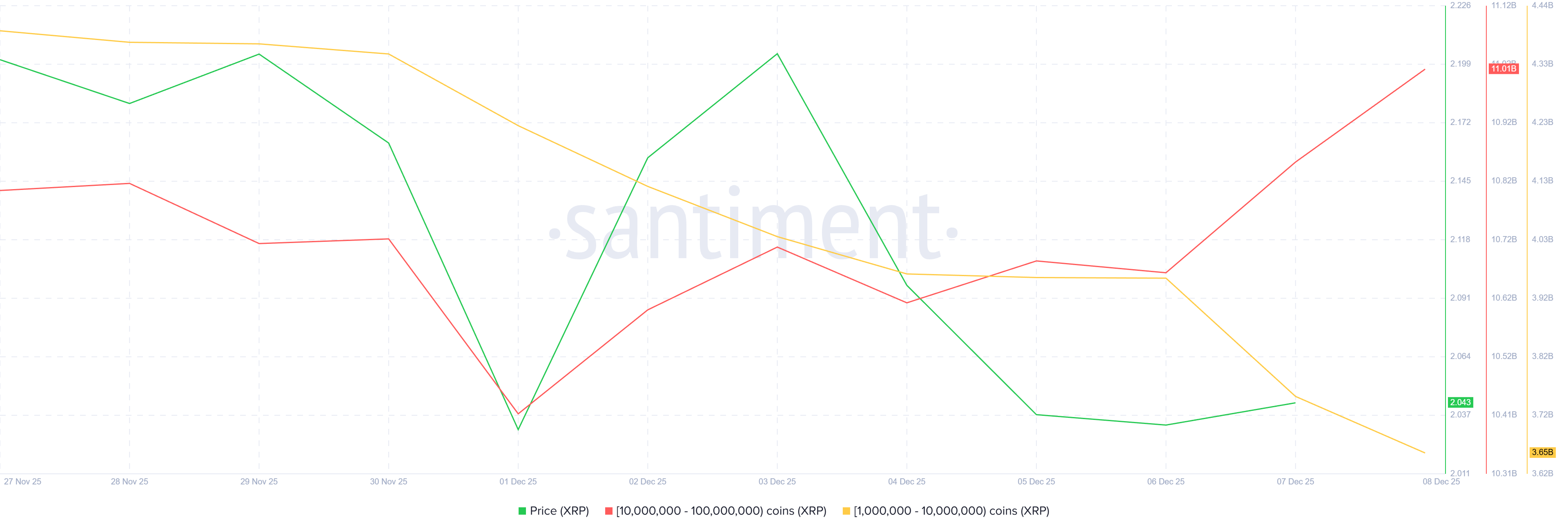

Whale activity shows a notable redistribution of XRP supply between major cohorts. Addresses holding 1 million to 10 million XRP offloaded more than 330 million XRP in the past four days, reflecting skepticism among mid-sized whales. Their selling pressure, however, did not send supply to exchanges or retail holders.

Instead, larger wallets holding 10 million to 100 million XRP absorbed this supply. Their combined holdings climbed by 350 million XRP during the same period, worth more than $729 million. This accumulation signals confidence from deeper-pocketed investors who often act as stabilizing forces when market sentiment weakens.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Whale Holding. Source:

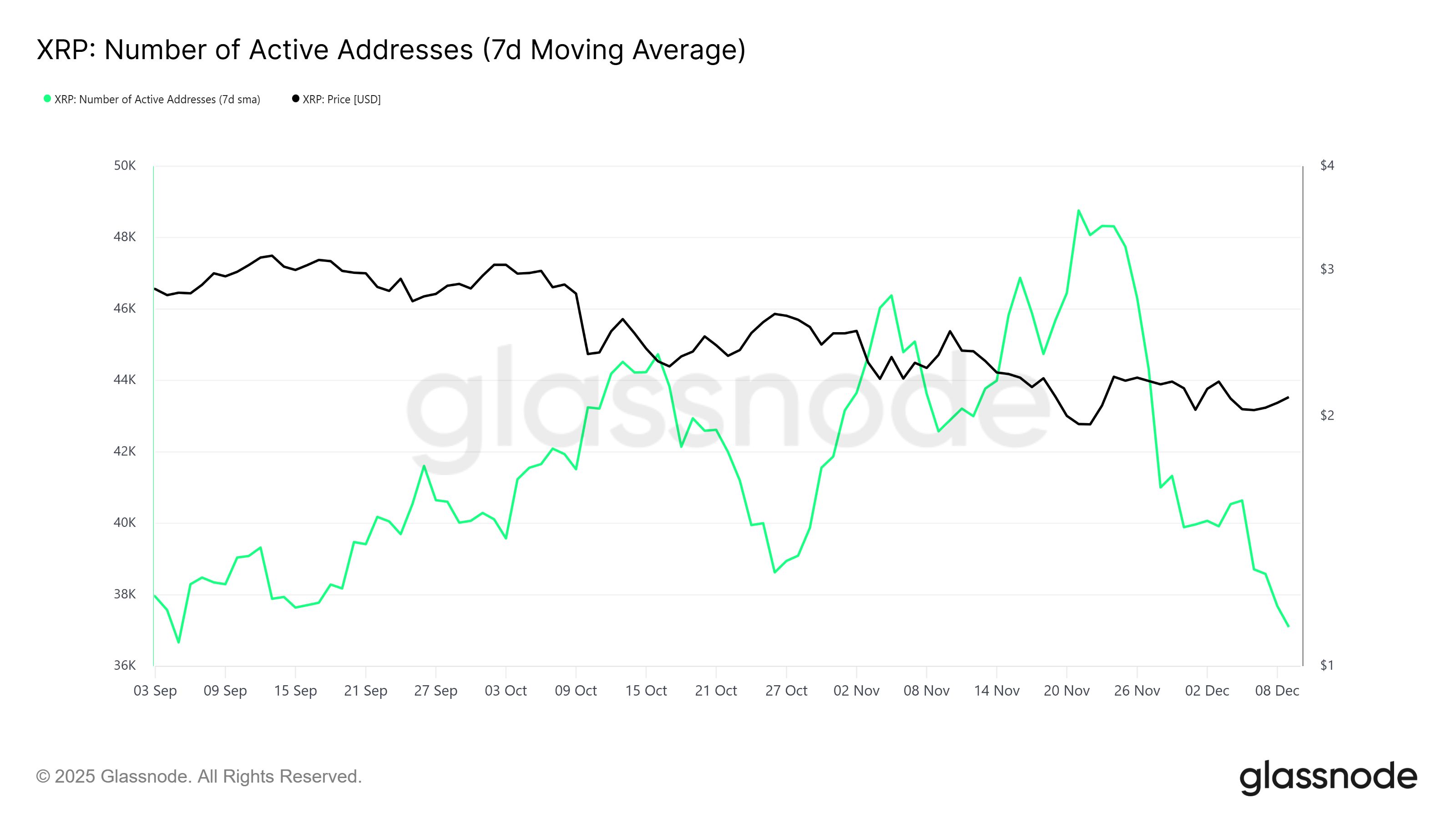

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

XRP Whale Holding. Source:

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

Reduced participation also impacts liquidity, making it harder for XRP to stage a strong recovery even when large holders are accumulating. With fewer users initiating transactions, demand remains muted, slowing down the pace at which XRP can escape its downtrend.

XRP Active Addresses. Source:

XRP Active Addresses. Source:

XRP Price Could Remain Rangebound

XRP is trading at $2.08 at the time of writing, extending a nearly month-long downtrend. For several days, the altcoin has oscillated within the narrow range between $2.20 and $2.02. This highlights the ongoing struggle to generate momentum.

The mixed signals from whales and weak network activity suggest that XRP may continue consolidating within this band. If broader market conditions improve, a break above $2.20 could allow XRP to target $2.36. This would mark its first meaningful recovery attempt in weeks.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If bullish sentiment fails to develop, XRP faces the risk of another downturn. Losing the $2.02 support level would send the price below $2.00. This would invalidate the bullish thesis, exposing the altcoin to deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin