How “Diamond Hands” in Solana Meme Coins Struggle to Recover Their Investments

The Solana meme coin ecosystem is attractive, but it is also filled with risks. Many investors plan to trade in the short term. Yet rapid price swings forced them to become “diamond hands” unwillingly. Can they recover their losses? The following reasons show why this is difficult. Why Solana Meme Coin Investors Face Slim Chances

The Solana meme coin ecosystem is attractive, but it is also filled with risks. Many investors plan to trade in the short term. Yet rapid price swings forced them to become “diamond hands” unwillingly.

Can they recover their losses? The following reasons show why this is difficult.

Why Solana Meme Coin Investors Face Slim Chances of Breaking Even

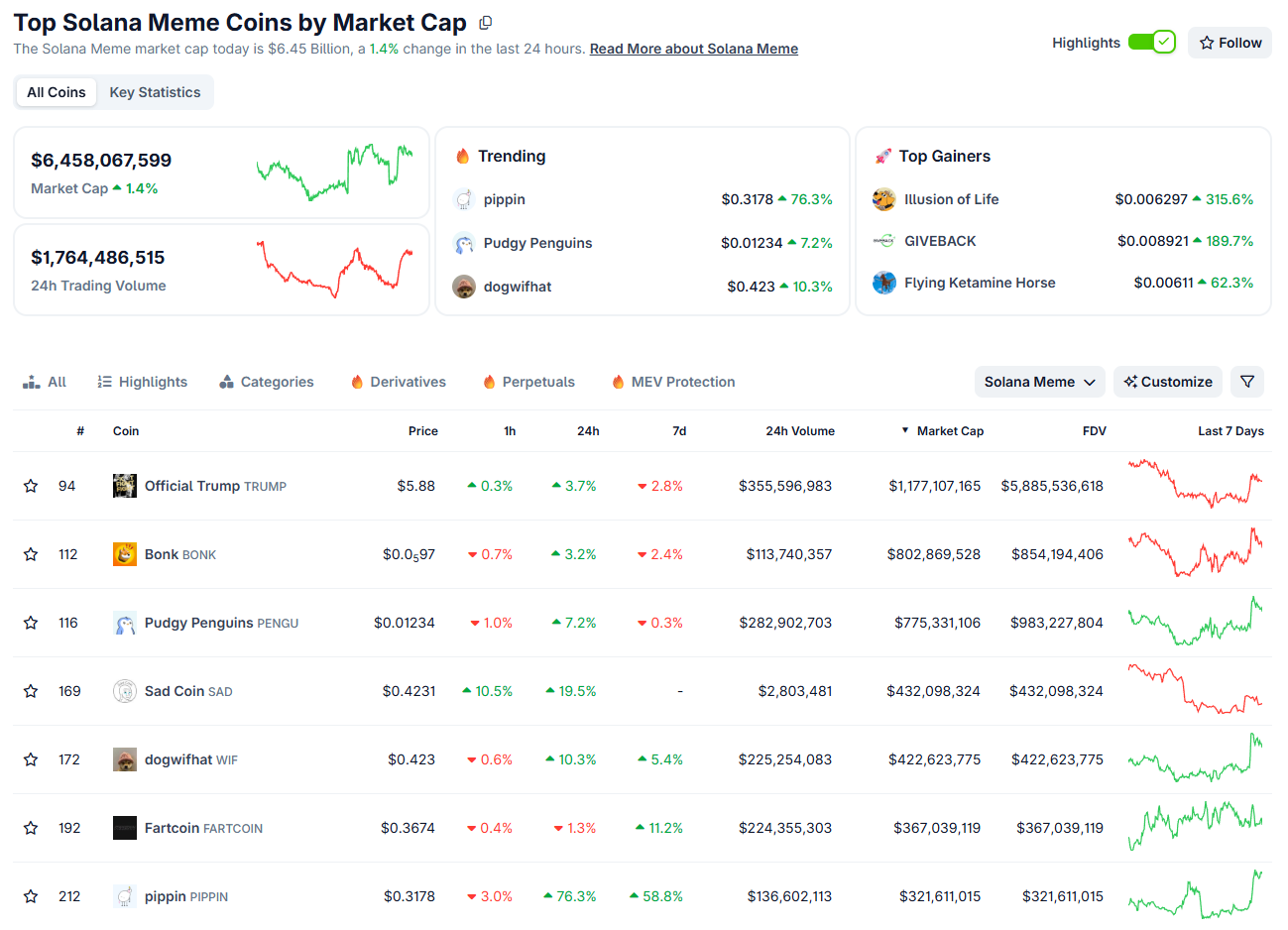

CoinGecko reports that the total market capitalization of Solana meme coins is approximately $6.45 billion, with a daily trading volume of over $1.7 billion.

However, the seven leading meme coins — TRUMP, BONK, PENGU, WIF, FARTCOIN, and PIPPIN — account for about 70% of the total market cap. Their combined daily volume covers 75% of the sector’s liquidity.

Top Solana Meme Coins by Market Cap. Source:

CoinGecko

Top Solana Meme Coins by Market Cap. Source:

CoinGecko

This liquidity concentration keeps most remaining meme tokens stuck with low trading volume. Their ability to recover becomes limited.

A report from Stalkchain shows that major ecosystem tokens such as PUMP, MELANIA, PENGU, SOL, and TRUMP all have unlock schedules in December. These dilution events cause large-cap tokens to bleed and drag down the entire sector.

The situation worsens as scams spread. Thesis.io analyzed 109 newly issued Solana tokens last week. 68.8% quickly became scams, and only 18.3% showed “potential.” Even within the potential group, 39.1% of individuals fell victim to scams within seven days.

Furry market analyst @ThesisDog brings the alpha. We’re dissecting the daily Solana action to reveal exactly where Meme Flow is heading in the first week of December.▸ Out of 109 alerts, 68.8% degraded into Scam, while only 18.3% maintained genuine Potential.→ This yields a… pic.twitter.com/Cmt4XZfSRw

— Thesis.io (@thesis_io) December 8, 2025

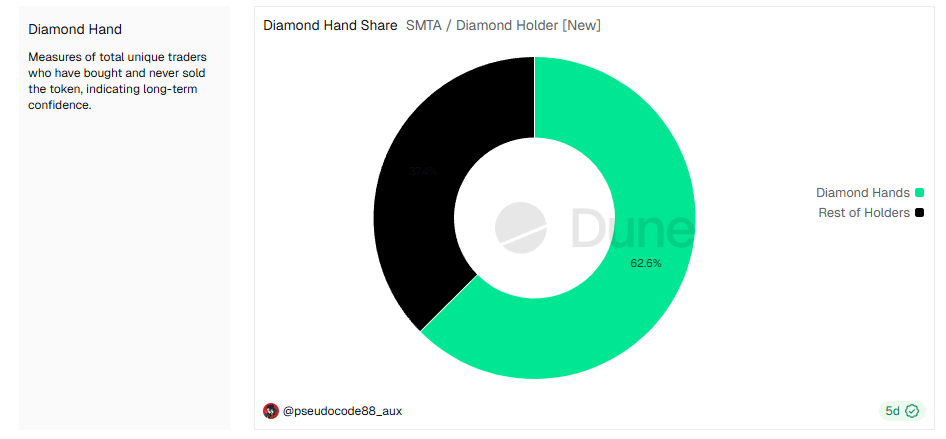

Dune data shows that more than 62% of Solana meme coin holders qualify as “diamond hands,” meaning they bought tokens and have never sold any.

Solana Meme Token Holders. Source:

Dune

Solana Meme Token Holders. Source:

Dune

Whether they became holders by accident or by long-term conviction, their chances of breaking even shrink for the reasons above.

Is There Any Hope?

A small positive signal exists. The meme coin market has shown early signs of recovery, although the momentum remains weak.

The most optimistic scenario would be fresh capital flowing into the entire ecosystem. This could lift both large meme coins and smaller low-cap tokens.

If no new capital enters, capital may shift from large-cap to small-cap stocks. This rotation could give underwater holders a chance to exit.

“PUMP, TRUMP, BONK, WIF, PENGU, FARTCOIN and USELESS hold most of the memecoin liquidity on Solana. So when money moves out of them, it has to go somewhere, and that’s when small caps and new tokens start pumping,” Stalkchain predicts.

However, searching for opportunities in meme coins remains a high-risk bet. Proper portfolio allocation is necessary so that the entire portfolio does not become overly dependent on these tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov