Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

A divided Federal Reserve approved a 0.25% rate cut, but concerns over inflation and economic growth, as well as the BTC "fragile zone" highlighted by Glassnode, may continue to keep it below $100,000.

On Wednesday, the Federal Reserve approved a 25 basis point rate cut, marking the third cut this year and aligning with market expectations. Consistent with price action before previous FOMC meetings, Bitcoin surged past $94,000 on Monday, but the media's "hawkish" interpretation of this rate cut reflects ongoing divisions within the Fed regarding U.S. monetary policy and economic outlook.

Given that this week's rate cut has been labeled "hawkish," Bitcoin's price may experience a "sell the news" reaction and continue to consolidate within a range until new momentum emerges.

According to CNBC, the Fed passed the rate cut with a 9-to-3 vote, indicating that members remain concerned about persistent inflation and believe that future economic growth and the pace of rate cuts may slow down by 2026.

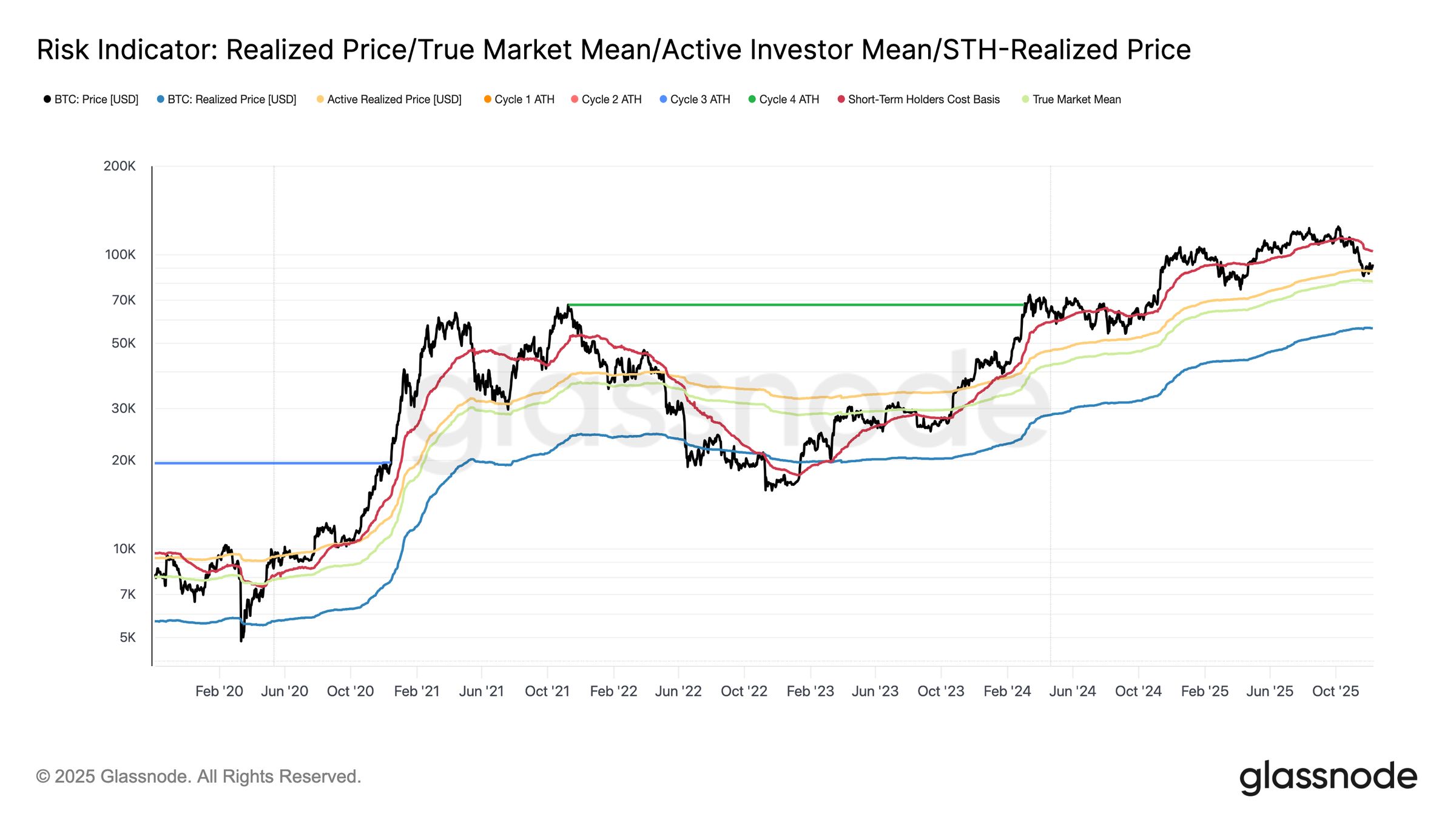

According to Glassnode data, Bitcoin BTC$92,626 remains trapped in a structurally fragile zone below $100,000, with its price action constrained between the short-term cost basis of $102,700 and the "true market mean" of $81,300.

Glassnode data also shows that in an environment of weakening on-chain conditions, reduced futures demand, and ongoing selling pressure, Bitcoin continues to be suppressed below $100,000.

Key Points:

- Bitcoin's structurally fragile zone has stalled the market below $100,000, with unrealized losses continuing to expand.

- Realized losses have soared to $555 million per day, the highest since the FTX collapse in 2022.

- Massive profit-taking by holders of over one year, along with capitulation by top buyers, has prevented Bitcoin from reclaiming the STH (short-term holder) cost basis.

- The Fed's rate cut may not significantly boost Bitcoin in the short term.

Time Is Running Out for Bitcoin to Return to $100,000

According to Glassnode, Bitcoin's inability to break through $100,000 reflects mounting structural pressure: time is working against the bulls. The longer the price remains trapped in this fragile zone, the more unrealized losses accumulate, increasing the likelihood of forced selling.

Realized price and true market mean for Bitcoin. Source: Glassnode

The 30-day simple moving average (SMA) of relative unrealized losses has risen to 4.4%, ending a two-year period below 2% and signaling the market's entry into a higher-pressure environment. Although Bitcoin rebounded from its November 22 low to around $92,700, entity-adjusted realized losses have continued to climb, reaching $555 million per day, matching levels seen during the FTX capitulation period.

Meanwhile, long-term holders (those holding for over a year) are realizing over $1 billion in profits per day, with a record peak of $1.3 billion. Capitulation by top buyers and large-scale distribution by long-term holders may keep BTC suppressed below key cost bases, preventing it from reclaiming the $95,000–$102,000 resistance zone, which marks the upper limit of the fragile range.

Realized profit by age. Source: Glassnode

Spot-Led Rally Meets Shrinking Futures Market

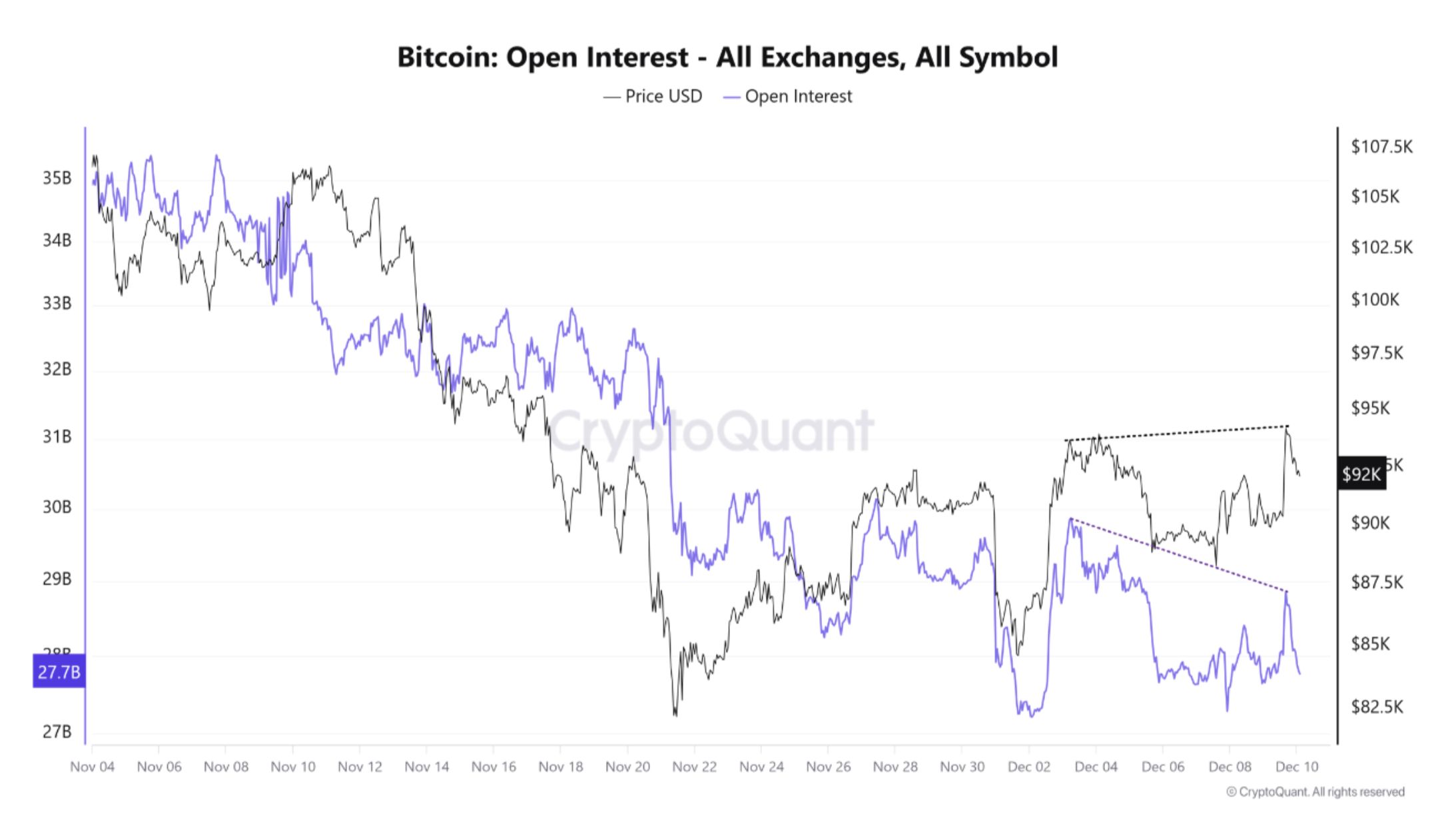

According to CryptoQuant data, the crypto market typically rallies ahead of FOMC meetings, but a significant divergence has recently emerged: Bitcoin's price is rising while open interest (OI) continues to decline.

Bitcoin price versus open interest divergence. Source: CryptoQuant

During the pullback since October, OI has been declining, and even as Bitcoin's price rose after bottoming on November 21, OI continued to drop. This suggests that the current rally is mainly driven by spot demand rather than leveraged speculation.

CryptoQuant adds that while spot-driven rallies are generally healthier, sustained bull market momentum historically requires an increase in leveraged positions. Given that derivatives trading volume structurally dominates, with spot trading volume currently accounting for only 10% of derivatives activity, this spot-led strength may be difficult to maintain if market expectations for future rate cuts weaken ahead of the meeting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.

JPMorgan Chase issues Galaxy short-term bonds on Solana network

The three giants collectively bet on Abu Dhabi, making it the "crypto capital"

As stablecoin giants and the world's largest exchange simultaneously secure ADGM licenses, Abu Dhabi is rapidly emerging from a Middle Eastern financial hub into a new global center for institutional-grade crypto settlement and regulation.