Is XRP Price Hinting at a Bounce? 3 Clues Say This One Could Finally Hold

XRP price has tested patience for weeks. The coin is down about 18% over the last month and nearly 4% in the past 24 hours. It has spent most of its time stuck inside a tight range, making the past few weeks feel flat and frustrating. But the latest move shows something that the earlier

XRP price has tested patience for weeks. The coin is down about 18% over the last month and nearly 4% in the past 24 hours. It has spent most of its time stuck inside a tight range, making the past few weeks feel flat and frustrating.

But the latest move shows something that the earlier attempts did not. A chart signal and a shift in holder behavior now point to a bounce that might finally have enough support to hold.

A New Signal Shows That Buyers Might Be Returning

XRP has been trading between $2.28 and $1.98 since late November. This range shows that buyers and sellers have been evenly matched. But the lower side of this range recently produced something new. The price touched the bottom trend line of a symmetrical triangle. A symmetrical triangle forms when buyers and sellers slow down at the same pace, which often signals an aggresive move.

The first strong clue comes from the volume trend. Between December 6 and December 11, the price made a lower low, but the On-Balance Volume (OBV) made a higher low.

Divergence Hints At XRP Rebound:

Divergence Hints At XRP Rebound:

OBV measures whether volume is flowing in or out of a coin. When price drops but OBV rises, it shows hidden accumulation. This usually means someone is buying the dips even while the chart looks weak. That is the first sign that a bounce attempt might surface.

This combination of the triangle support and the OBV divergence hints that early buying pressure is returning.

Why This Bounce Could Finally Hold If Selling Pressure Keeps Fading

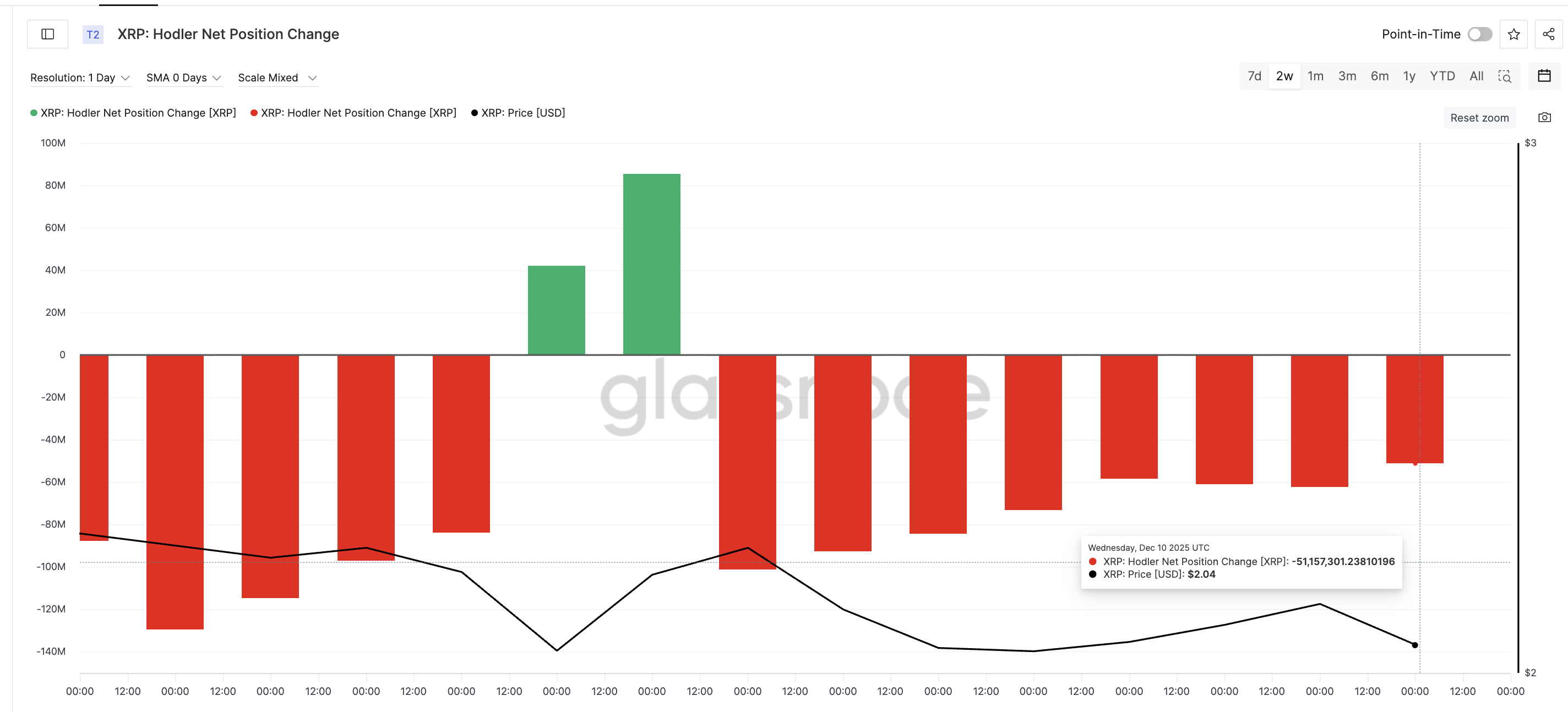

A clean bounce, if it happens, also needs lower selling pressure. Long-term holders, often the strongest group in any coin, have reduced their selling sharply. On December 3, they were moving out 101,083,156 XRP. By December 10, that number dropped to 51,157,301 XRP. That is about a 49% reduction. They are still net sellers, but the selling pressure is softening at a noticeable pace.

HODLers Selling Fewer Coins:

HODLers Selling Fewer Coins:

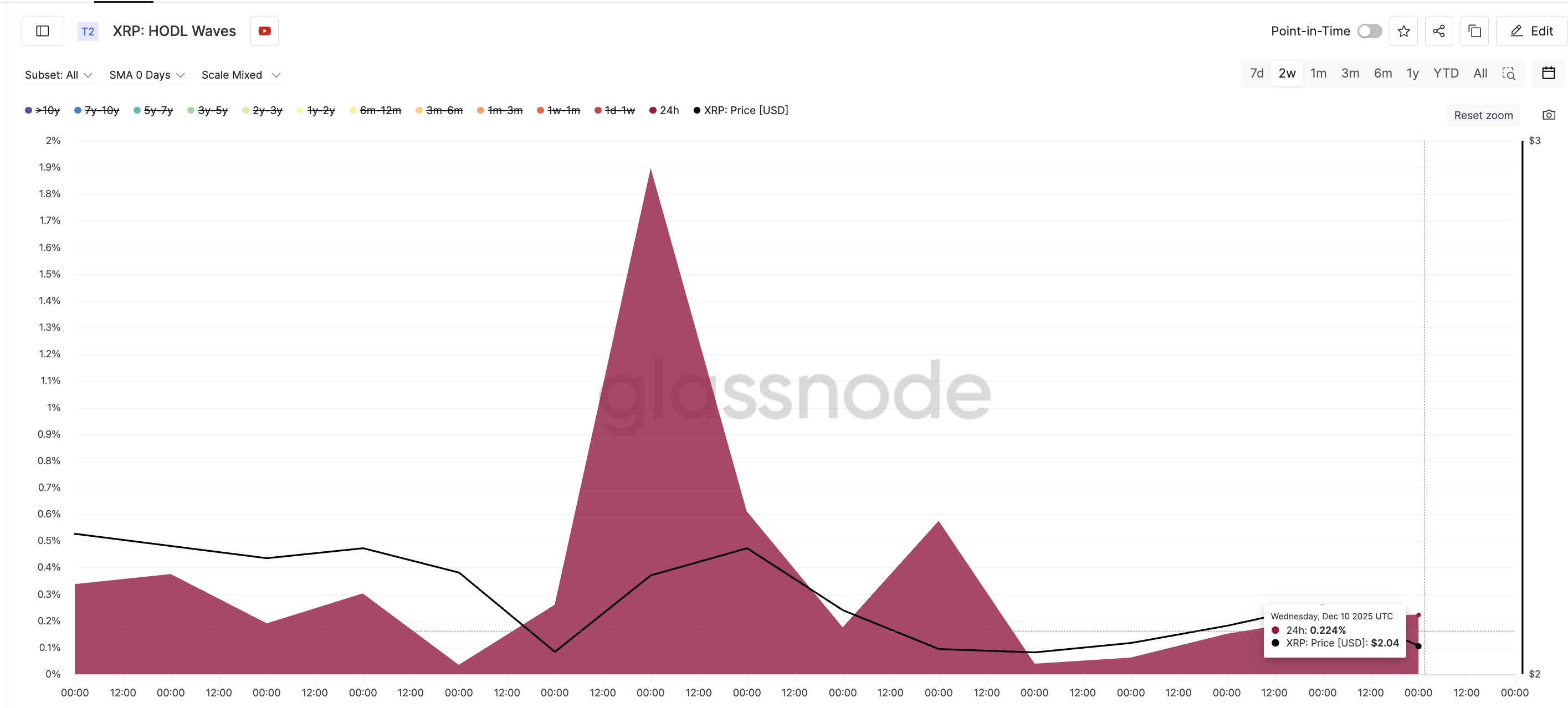

The most interesting, third clue, comes from the fastest-moving wallets. These short-term XRP holders often sell into every bounce and kill momentum. But this time, they are cutting the supply. That is evident via the HODL waves metric, which shows supply held based on cohort age.

The 24-hour cohort held 1.89% of the supply on December 2. By December 10, that had dropped to just 0.22%.

24-Hour XRP Wallets Dumping:

24-Hour XRP Wallets Dumping:

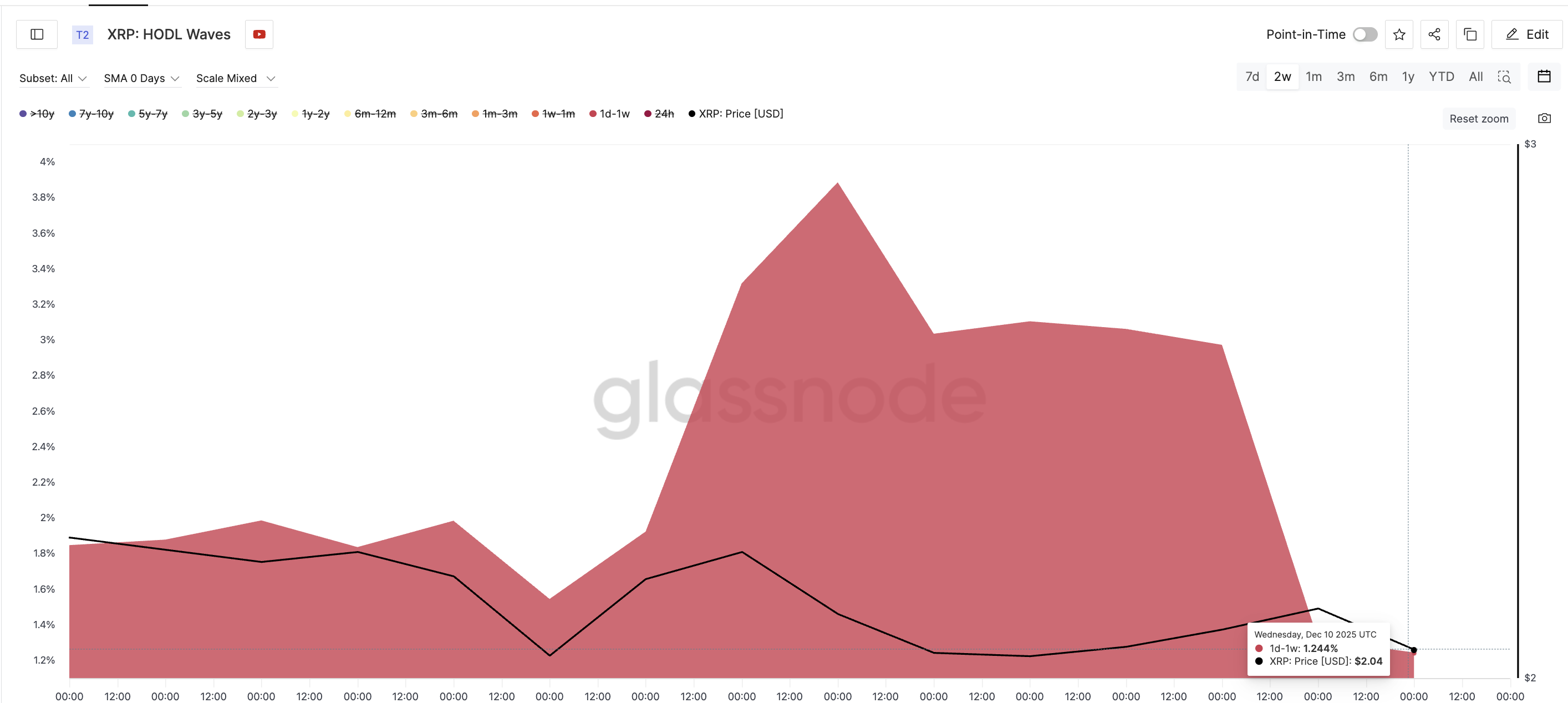

The one-day to one-week cohort peaked at 3.88% on December 4 and has dropped to 1.24% as of December 10. This removes the speculative pressure that usually weakens rebounds.

Short-Term Cohort Leaving:

Short-Term Cohort Leaving:

When long-term holders sell less and very short-term holders (speculative money) exit the market, it allows price bounces to sustain.

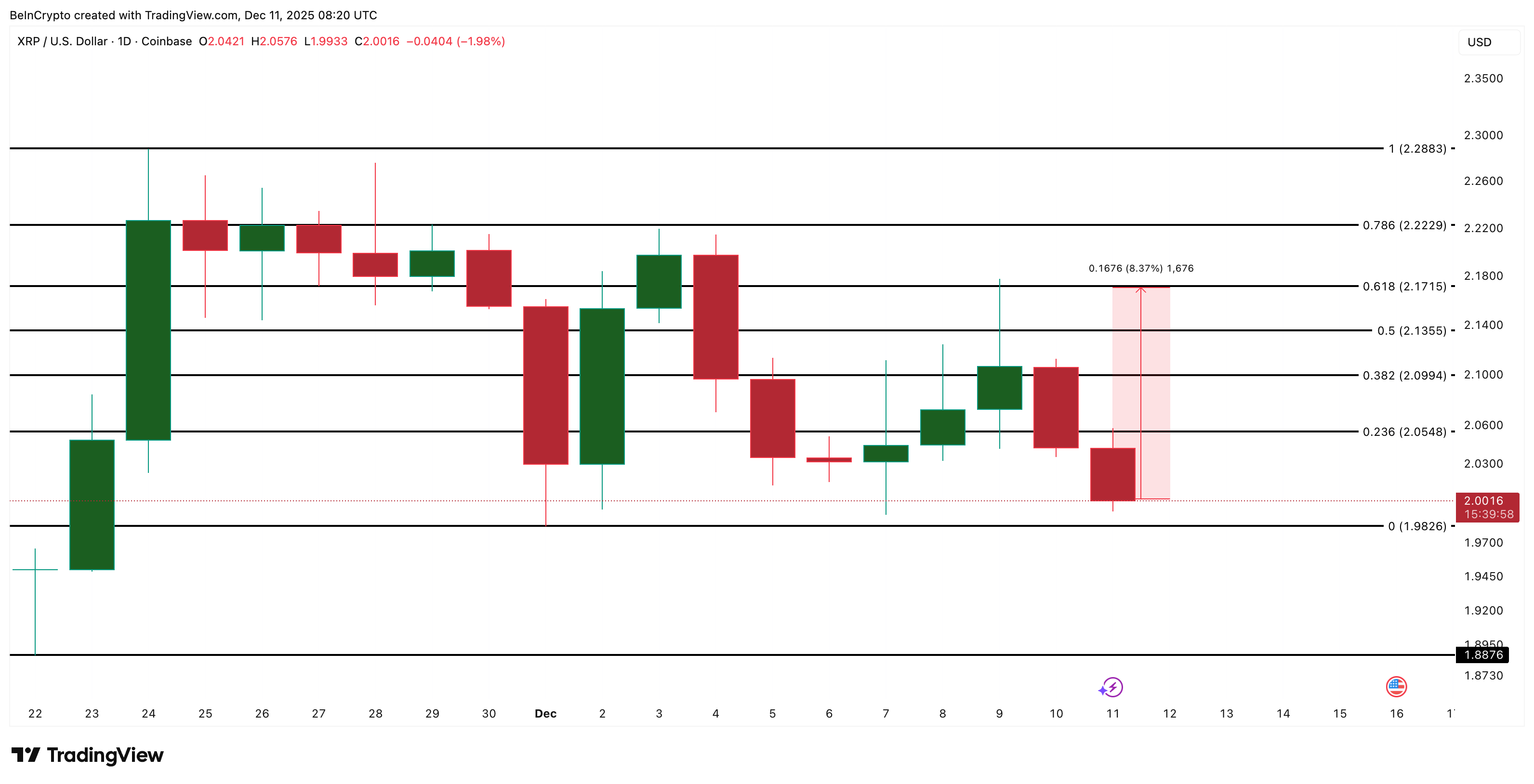

XRP Price Levels That Will Confirm or Break the XRP Bounce

XRP trades near $2.00 and is still inside the broader $2.28 to $1.98 range. For the bounce to gain strength, XRP needs to clear $2.17 first. That level, about 8.37% higher, is the checkpoint that decides the next push. A daily close above it improves the odds of testing the top of the range.

A move above $2.28 would confirm a range break. That would allow the XRP price to aim higher, finally.

XRP Price Analysis:

XRP Price Analysis:

On the downside, the risk is close. A daily candle close under $1.98 weakens the entire bullish setup. If that breaks, the chart opens a path toward $1.88. That is the next major support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin