Zcash Leads in Hype — But Monero (XMR) Is Quietly Dominating Where It Matters

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR). Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth. XMR Outperforms ZEC in Many

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR).

Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth.

XMR Outperforms ZEC in Many Aspects Despite Lacking the Spotlight

In terms of daily spot trading volume in December, ZEC performed exceptionally well.

ZEC maintains a daily trading volume of nearly $1 billion. This level surpasses XMR and DASH, thanks to strong liquidity on major exchanges like Binance.

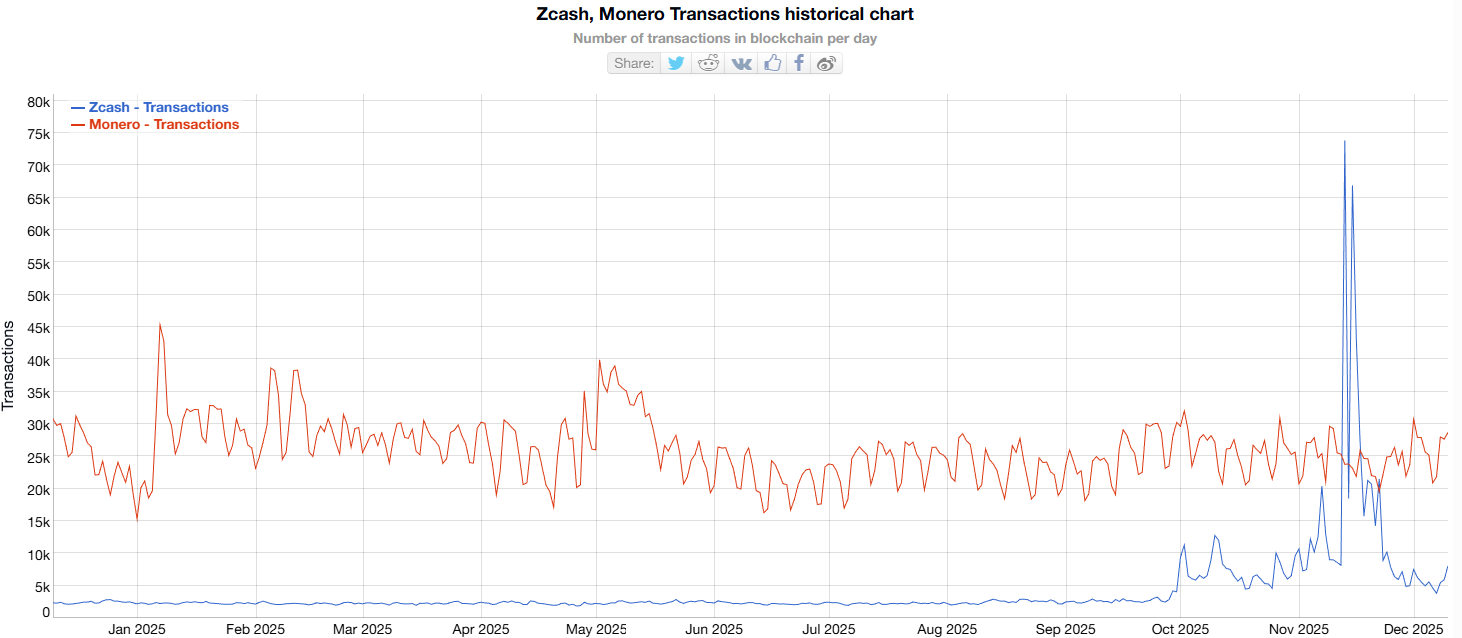

However, ZEC falls far behind in daily on-chain transactions. Data from BitInfoCharts shows XMR reaching an average of about 26,000 transactions per day. This figure is more than triple ZEC’s average of roughly 8,000 transactions per day.

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

The chart also indicates that XMR’s on-chain activity remains consistent over the long term. This trend reflects stable user behavior. In contrast, ZEC’s recent surge and sharp decline appear more like temporary excitement.

On-chain activity carries longer-term significance than spot volume. It reflects real usage patterns and user acceptance of XMR for anonymous transfers rather than short-term trading sentiment.

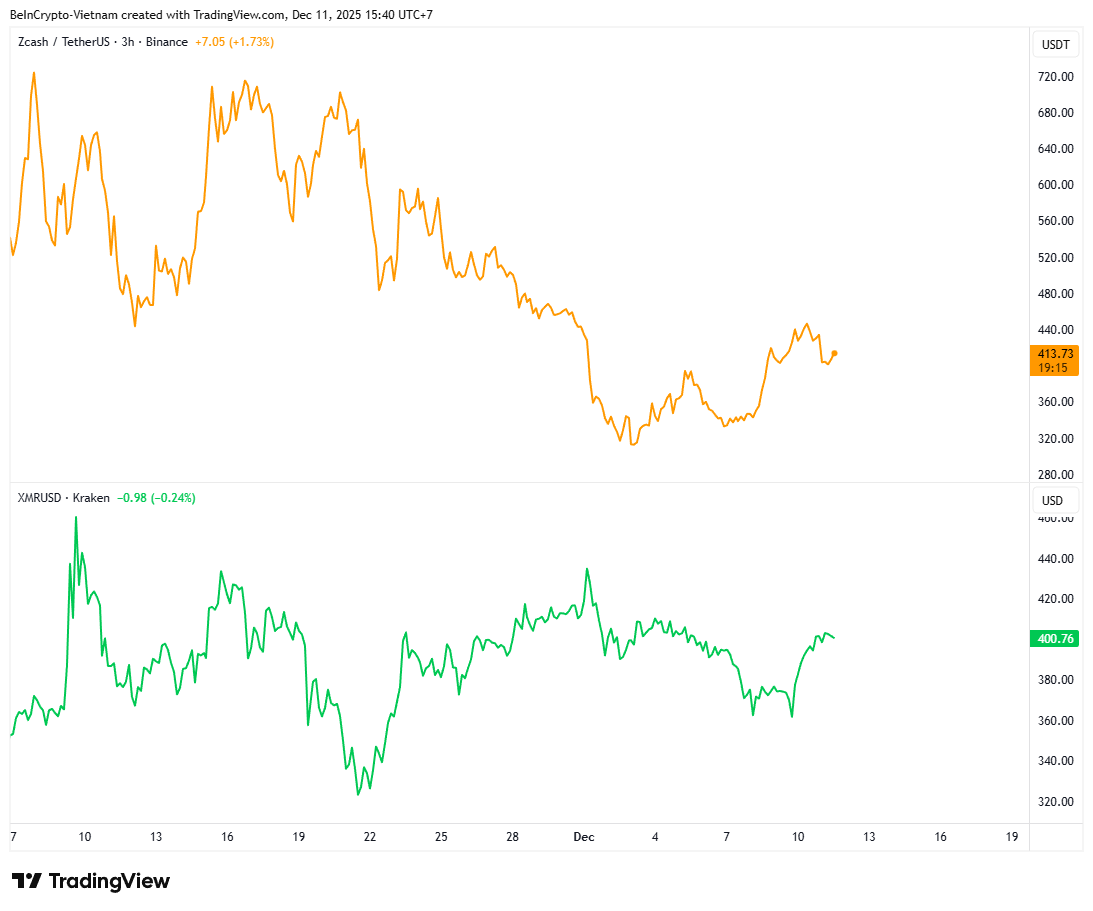

Additionally, ZEC’s price fluctuates due to increased volatility resulting from speculative trading. XMR’s price movement remains more stable.

TradingView data shows that ZEC has fallen by more than 40% over the past month. Many analysts now suggest the possibility of a bubble pattern. Meanwhile, XMR declined by roughly 12%.

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

From this perspective, ZEC suits traders who chase the privacy coin narrative and aim for quick profits during extreme FOMO cycles. The downside is deeper price drops and longer recovery periods.

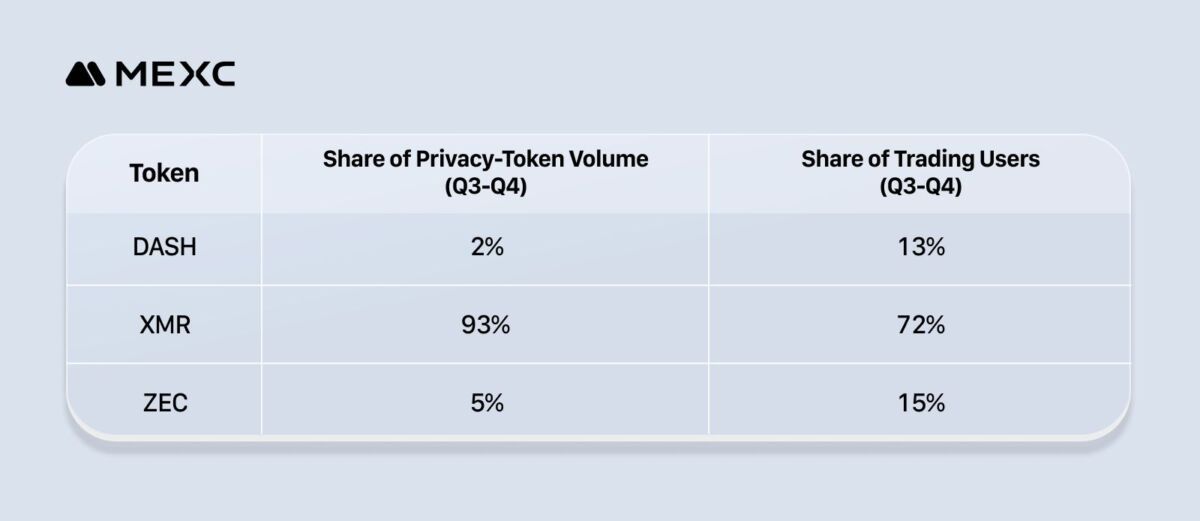

Furthermore, the latest report from MEXC Research reinforces XMR’s position. Over longer timeframes, XMR demonstrates superior trading volume and user activity compared to ZEC and DASH.

“Despite ZEC and DASH posting record-high trading volumes, Monero remains an asset of choice among privacy coin traders, accounting for 93% of total trading volume in Q3–Q4 and 72% of users in this segment,” MEXC Research reported.

The report also notes that growing interest in privacy assets reflects users’ increasing need for anonymity as regulators strengthen capital controls.

Therefore, regardless of holding ZEC or XMR, investors can continue to benefit next year. Experts predict privacy coins will remain a dominant market narrative in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving 2025: Impact on Cryptocurrency Market Trends

- Zcash's 2025 halving reduced block rewards to 1.5625 ZEC, triggering a 950% price surge to $589 amid ZIP 1015 scarcity mechanisms. - Institutional adoption accelerated, with Grayscale acquiring 5% supply and Cypherpunk committing $100M, mirroring Bitcoin's post-halving trends. - Speculative trading drove $1.11B in Zcash futures open interest, causing 24% 24-hour price swings as retail investors chased scarcity-driven gains. - Hybrid consensus and optional privacy features differentiate Zcash from Bitcoin

ICP Network's Rapid Expansion and Increasing Institutional Embrace: Key Strategic Considerations for Long-Term Investors in Web3 Infrastructure

- ICP's 2025 growth stems from Fission/Chain Fusion upgrades enabling Bitcoin-Ethereum interoperability and Caffeine AI's no-code dApp platform attracting 2,000+ developers. - Institutional adoption surged with $1.14B TVL, Microsoft-Google partnerships, and first ICP ETP via Copper-DFINITY collaboration expanding institutional access. - Despite $4.71 price peak in November 2025, 10%+ volatility highlights risks, though 11,500 TPS capacity and $357M daily trading volume signal infrastructure strength. - Lon

New Prospects in STEM Learning and Career Advancement: Sustained Institutional Commitment to Academic Initiatives Fueling Tomorrow’s Innovation

- Global STEM education is accelerating as AI and engineering drive economic transformation, with 2025 government initiatives expanding AI-focused programs and workforce development. - U.S. universities report 114.4% growth in AI bachelor's enrollments, supported by corporate partnerships and $25M+ in tech industry investments for AI labs and teacher training. - EdTech's AI-powered platforms, valued at $5.3B in 2025, are projected to reach $98.1B by 2034, with startups like MagicSchool AI securing $45M in

ICP Caffeine AI: Leading the Way in AI-Powered Investment Prospects within the Web3 Landscape

- ICP Caffeine AI, developed by DFINITY Foundation, merges AI and blockchain to enable no-code app development via natural language prompts. - Its "chain-of-chains" architecture and Chain Fusion technology enhance scalability and cross-chain interoperability for AI-native applications. - With $237B TVL and partnerships with Microsoft/Google Cloud, ICP faces competition from TAO and RNDR but aims to rival AWS with on-chain AI solutions. - Institutional adoption in finance and energy, plus regulatory alignme