Just after Federal Reserve Chairman Powell announced a 25 basis point rate cut, silver prices broke historical records and surged above $61, U.S. Treasury yields rose instead of falling, gold experienced slight fluctuations, and bitcoin unexpectedly plunged.

In the early hours of December 11, 2025, the Federal Reserve announced a 25 basis point cut in the federal funds rate target range to 3.5%-3.75%, marking the third rate cut of the year.

The policy statement noted that U.S. economic activity is expanding moderately, but job growth has slowed and inflation remains somewhat elevated. This widely anticipated rate cut triggered a series of unconventional market reactions.

I. Policy Turning Point

At its final policy meeting of 2025, the Federal Reserve announced a 25 basis point rate cut as expected. Since the start of this rate-cutting cycle in September 2024, this marks the sixth cut.

● The policy statement pointed out that weak signals from the labor market were the main reason for this rate cut. Bai Xue, Senior Deputy Director of the Research and Development Department at Dongfang Jincheng, believes this is a preemptive, risk-management policy adjustment aimed at preventing labor market weakness from spreading to consumption and economic growth.

● Unlike previous meetings, this meeting saw three dissenting votes, the highest number since September 2019. One member advocated for a 50 basis point cut, while two others favored keeping rates unchanged.

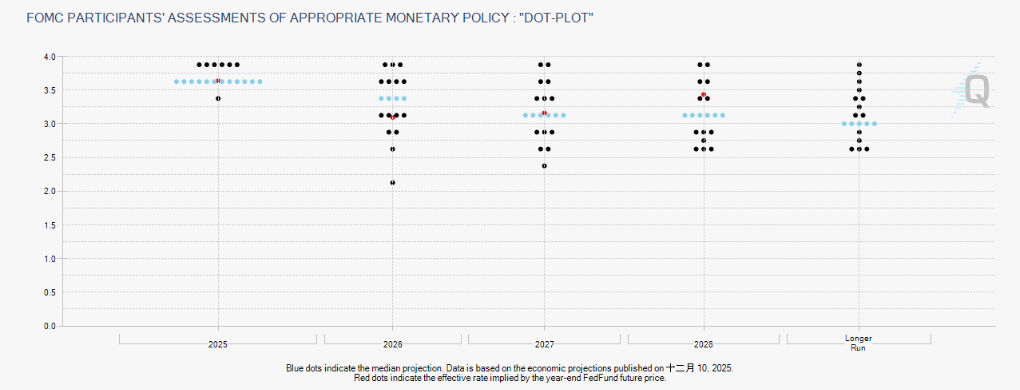

● The dot plot shows that Federal Reserve officials expect only one more rate cut in 2026. However, Wen Bin, Chief Economist at Minsheng Bank, pointed out that if the new Fed chair adopts a more dovish stance, the actual rate cut next year may exceed the dot plot's forecast.

II. Anomalies in U.S. Treasuries

● Against the backdrop of the Fed's rate cut, the U.S. Treasury market experienced its first anomalous trend in nearly thirty years—yields rose instead of falling. Since the Fed began easing monetary policy, the 10-year Treasury yield has risen by nearly half a percentage point.

● As of December 9, the 10-year Treasury yield climbed to 4.17%, the highest since September; the 30-year Treasury yield also rose to a recent high of about 4.82%. This trend is completely contrary to what is typically seen during a rate-cutting cycle.

● There are three main interpretations of this anomaly: Optimists believe it shows market confidence that the economy will not fall into recession; neutrals see it as a return of Treasury yields to pre-2008 norms; pessimists worry that "bond vigilantes" are punishing the U.S. for fiscal disorder.

● JPMorgan's Global Head of Rates Strategy, Barry, pointed out two key factors: First, the market had already priced in easing expectations; second, the Fed chose to cut rates aggressively while inflation remains high, sustaining economic expansion rather than ending it.

III. Silver Frenzy

● In stark contrast to the caution in the Treasury market, the silver market is experiencing a historic rally. On December 12, spot silver broke through $64/ounce, hitting a record high. So far this year, silver has surged an astonishing 112%, nearly double the gain of gold.

● There are multiple factors driving silver's rise. Fed rate cut expectations have lowered the opportunity cost of holding non-yielding assets. At the same time, silver has been included in the U.S. critical minerals list, sparking concerns about potential trade restrictions.

● More fundamentally, the silver market has faced a supply deficit for the fifth consecutive year. According to the Silver Institute, the global silver supply deficit in 2025 is expected to be between 100 million and 118 million ounces.

● Industrial demand is a long-term support for the silver market, especially as silver use in the photovoltaic industry is expected to account for 55% of global silver demand. The International Energy Agency predicts that by 2030, solar energy alone will drive annual silver demand up by nearly 150 million ounces.

IV. Gold Fluctuations

By contrast, the gold market's reaction to the Fed's rate cut was relatively mild. After the Fed's announcement, COMEX gold futures rose slightly by 0.52% to $4,258.30/ounce.

● Gold ETF holdings also showed subtle changes. As of December 12, the world's largest gold ETF—SPDR—held about 1,049.11 tons of gold, slightly down from the October peak but still up 20.5% year-on-year.

● Central bank gold purchases provide long-term support for gold. In Q3 2025, global central bank gold purchases reached 220 tons, up 28% from the previous quarter. The People's Bank of China has increased its gold reserves for 13 consecutive months.

● Market analysis indicates that short-term gold price fluctuations are mainly driven by two opposing forces: on the one hand, support from Fed rate cuts; on the other, pressure from potential easing of geopolitical tensions and declining investment demand.

V. Bitcoin's Cold Reception

● While traditional assets reacted in various ways to the Fed's rate cut, the cryptocurrency market remained unusually calm. After the Fed's decision, bitcoin briefly surged to $94,500 before quickly plunging to around $92,000.

● Within 24 hours, the total amount of liquidated contracts across the crypto market exceeded $300 million, with 114,600 traders liquidated. This reaction was in stark contrast to the usual expectation of bitcoin as a risk asset.

● Analysts point out that bitcoin is currently in a clear state of decoupling. Despite continued purchases by companies like MicroStrategy, structural selling pressure in the market remains strong.

● Standard Chartered recently sharply lowered its bitcoin forecast, adjusting its year-end 2025 target from $200,000 to around $100,000. The bank believes that large-scale bitcoin buying may have "run its course."

VI. The Logic Behind Market Divergence

The vastly different reactions of various asset classes to the same monetary policy event reflect deep market logic. Uncertainty over the Fed's policy path is one of the core factors.

● According to the latest Summary of Economic Projections, the median forecasts for U.S. economic growth from 2025 to 2028 by Fed officials have all been raised, with the 2026 growth forecast increasing from 1.8% to 2.3%.

● However, internal divisions within the Fed over future policy paths are widening. Cecilia Cui, Senior U.S. Economist at Pictet Wealth Management, pointed out: "The Fed's dot plot for 2026 rate forecasts shows significant divergence, and the 3.375% median forecast is very unstable."

● On the other hand, concerns over the Fed's independence are mounting. U.S. President Trump has repeatedly expressed dissatisfaction with the Fed's pace of rate cuts, calling the latest cut "too small, should be doubled."

● Trump's standard for the next Fed chair is "whether they are willing to cut rates immediately." If a chair perceived as more "compliant" takes office, it could further undermine market confidence in the Fed's independence.

● Within 24 hours of the Fed's rate cut announcement, COMEX silver futures had risen 109% year-to-date, while the 10-year Treasury yield climbed to a three-month high of 4.17%.

When the Fed's rate cut—a signal traditionally seen as boosting risk assets—triggers a series of unconventional reactions across different markets, the market is sending a clear message: monetary policy alone can no longer dictate the complex logic of asset prices.

With the Fed chair transition approaching and economic data fluctuating, the market in 2026 may face more "abnormal" tests. Investors who can identify the core drivers of different assets may find new balance amid this divergence.