Brazil’s Largest Private Bank Advises 3% Bitcoin Allocation For Clients

Itau argues that Bitcoin’s low correlation with traditional assets and its global nature can improve diversification without materially increasing portfolio risk.

Itaú Unibanco Holding SA, Latin America’s largest private bank, has advised clients to allocate up to 3% of their portfolios to Bitcoin for 2026.

The bank framed the cryptocurrency not as a speculative asset, but as a hedge against the erosion of the Brazilian real.

Why Itau Wants Clients’ Funds in Bitcoin

In a strategy note, analysts at the Sao Paulo-based lender said investors face a dual challenge from global price uncertainty and domestic currency fluctuations. They argued that these conditions necessitate a new approach to portfolio construction.

The bank recommends a Bitcoin weight of 1% to 3% to capture returns uncorrelated with domestic cycles.

“Bitcoin [is] an asset distinct from fixed income, traditional stocks, or domestic markets, with its own dynamics, return potential, and — due to its global and decentralized nature — a currency hedging function,” the bank wrote.

Itau emphasized that Bitcoin should not become a core holding. Instead, the bank framed the asset as a complementary allocation calibrated to an investor’s risk profile.

The objective is to capture returns that are not closely tied to domestic economic cycles and to provide partial protection against currency depreciation. It also aims to preserve exposure to long-term appreciation.

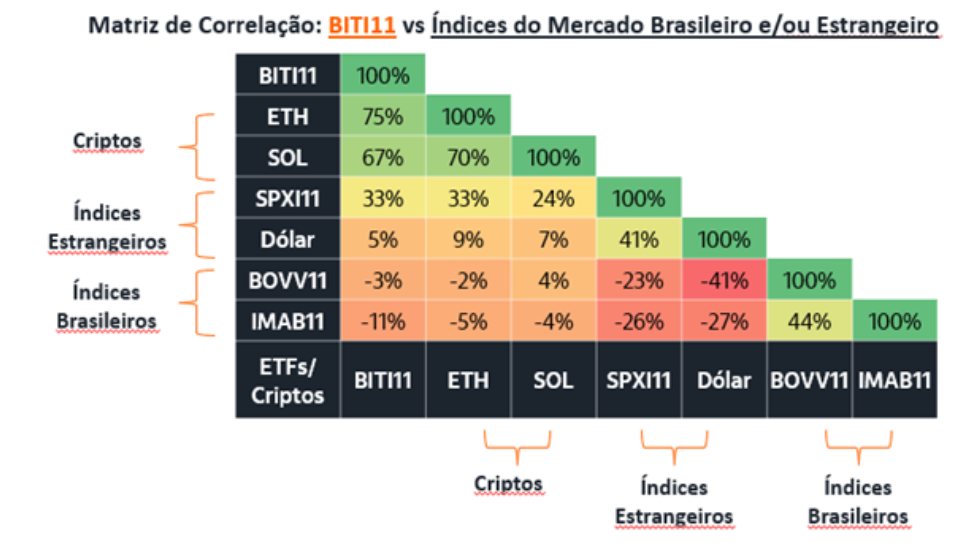

The bank pointed to the relatively low correlation between Bitcoin and traditional asset classes. It argued that an allocation of 1% to 3% can enhance diversification without overwhelming overall portfolio risk.

Bitcoin Performance vs Traditional Assets. Source:

Itau

Bitcoin Performance vs Traditional Assets. Source:

Itau

The approach, the note said, requires moderation, discipline, and a long-term horizon, rather than reactions to short-term price swings.

“Attempting ‘perfect timing’ in assets like Bitcoin or other international markets is risky — and often counterproductive,” the bank warned.

Itaú’s 3% ceiling places it squarely in line with the most forward-looking global guidance, narrowing the gap with US counterparts.

Notably, major US banks such as Morgan Stanley and Bank of America have recommended that their clients allocate up to 4% of their assets to the flagship digital asset.

For Brazilian investors, however, the stakes are different.

Itaú said that in a world of shortening economic cycles and more frequent external shocks, Bitcoin’s “hybrid character” sets it apart from traditional assets.

The bank described the flagship cryptocurrency as part high-risk asset and part global store of value. It argued that this combination offers a form of resilience that fixed income can no longer guarantee.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations

Clean Energy Market Fluidity and the Emergence of REsurety's CleanTrade Solution

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a regulatory breakthrough for clean energy trading infrastructure. - The platform addresses $16B+ in pent-up demand by providing liquidity, transparency, and institutional-grade safeguards for VPPAs, PPAs, and RECs. - CleanTrade's integration of carbon tracking analytics and ESG alignment tools enables institutional investors to quantify environmental impact alongside financial returns. - By resolving counterparty risks and enabling cross-asset