Aster DEX on the Rise: The Transformation of Institutional Crypto Market Access Through Decentralized Exchanges

- Aster DEX's 19.3% perpetual market share and $11.94B 24-hour volume highlight its role as a key gateway for institutional crypto capital in 2025. - Its hybrid AMM-CEX model with 1001x leverage and hidden orders addresses liquidity fragmentation, attracting $5.7B in institutional buy volume. - Strategic partnerships and MiCA-compliant custody solutions bolster institutional trust, while CZ's $2M ASTER purchase signaled market validation. - Privacy features and 40.2% Q3 TVL growth position Aster to capture

Aster DEX: Pioneering Institutional Adoption in Decentralized Exchanges

In 2025, Aster DEX has rapidly emerged as a leading force in the decentralized exchange sector, signaling a significant evolution in the cryptocurrency industry. No longer limited to individual traders, DEXs like Aster are now attracting substantial institutional investment. By merging advanced technology, robust compliance measures, and inventive product offerings, Aster has secured 19.3% of the perpetual DEX market share, surpassing competitors such as Hyperliquid and achieving an unprecedented $11.94 billion in daily trading volume, as highlighted in recent reports. This momentum marks a turning point, with institutions increasingly leveraging DEXs to access crypto markets efficiently and in line with regulatory standards.

Aster’s Hybrid Approach: Bridging AMM and CEX for Institutions

Central to Aster’s success is its unique hybrid model, which blends automated market maker (AMM) protocols with features typically found on centralized exchanges (CEXs), such as hidden order types and up to 1001x leverage. This innovative structure directly addresses the challenge of fragmented liquidity that often deters institutional players. By offering on-chain transactions with the speed and clarity of a CEX, Aster has drawn in $5.7 billion in institutional buy volume—far outpacing its growth among retail users.

Strategic alliances have further strengthened institutional trust in Aster. The integration of real-world assets (RWAs) such as gold and equities, in line with broader industry trends, has expanded the platform’s utility beyond speculative trading. Notably, Binance founder Changpeng Zhao’s $2 million purchase of ASTER tokens sparked an 800% surge in trading activity, reinforcing confidence in Aster’s tokenomics and governance framework.

Compliance and Privacy: Uniting Traditional Finance and DeFi

For decentralized exchanges to gain traction with institutional investors, they must balance decentralization with regulatory compliance. Aster addresses this challenge through a comprehensive compliance strategy, including the implementation of MiCA-compliant custody solutions and zero-knowledge proofs (ZKPs) to safeguard transaction privacy while meeting EU regulatory requirements. These initiatives are essential for satisfying anti-money laundering (AML) and know-your-customer (KYC) standards, which have historically limited institutional involvement in DeFi.

The proprietary Aster Chain Layer 1 blockchain further enhances the platform’s appeal to institutions by reducing dependence on external networks like BNB Chain. This advancement improves transaction speed and scalability, resolving operational hurdles that can impede large-scale investors. Additionally, the introduction of 80% margin trading and a 5% fee reduction for ASTER token holders has optimized capital efficiency, a crucial factor for institutional liquidity providers.

Future Prospects: Privacy Enhancements, Strategic Partnerships, and Expanding Market Share

Aster’s development roadmap includes privacy-focused features such as Shield Mode, designed to protect high-leverage trades from front-running, as detailed in recent reports. With a 40.2% increase in total value locked (TVL) during Q3 2025 and a reported $27.7 billion in daily trading volume as of October 2025, Aster is well-positioned to capture an even greater share of the market. The upcoming launch of institutional-grade custody and ZKP integration, anticipated in early 2026, will further reinforce Aster’s role as a bridge between traditional finance and decentralized finance.

This evolution has far-reaching implications for the broader crypto ecosystem. As platforms like Aster demonstrate that decentralization and institutional compliance can coexist, they are reshaping liquidity flows and cross-chain functionality. This trend challenges the dominance of centralized exchanges and points toward a future where institutional capital moves seamlessly into decentralized markets, propelled by innovation rather than regulatory loopholes.

Conclusion

The remarkable growth of Aster DEX is a reflection of DeFi’s maturation into a credible infrastructure for institutional engagement. By seamlessly integrating technological advancements with stringent regulatory practices, Aster has not only transformed its own trajectory but also accelerated the institutional adoption of decentralized exchanges. For investors, the platform’s impressive milestones—including tripling its user base to 3 million and achieving a 10% share in perpetual futures trading—highlight its enduring potential as a foundational player in the evolving crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

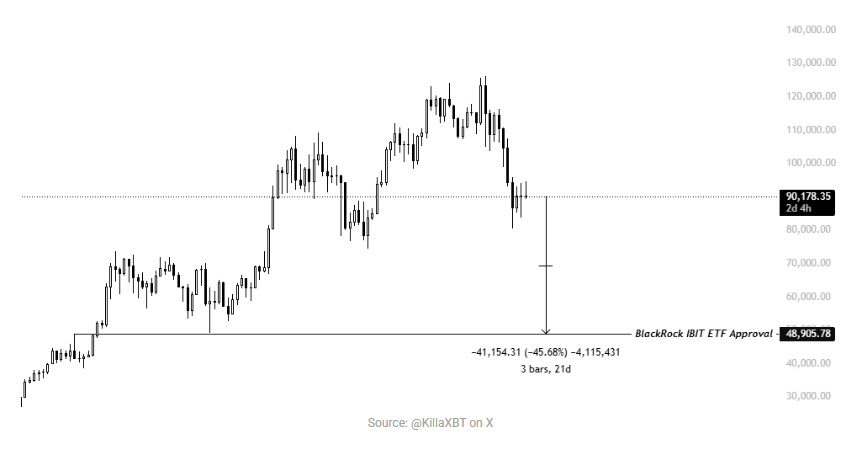

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why