Date: Sun, Dec 14, 2025 | 12:30 PM GMT

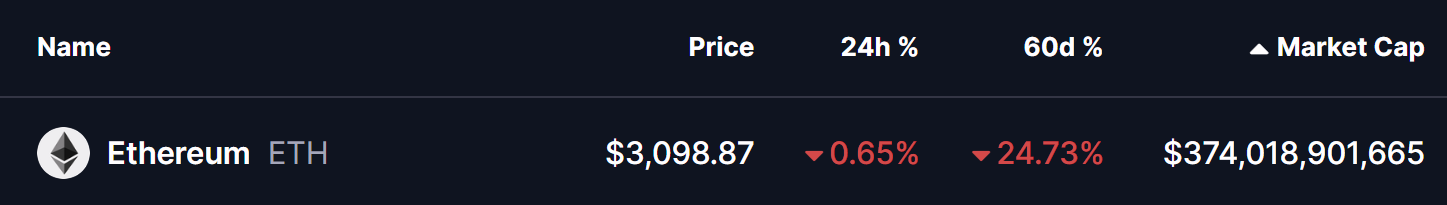

The broader altcoin market has remained volatile over the past few weeks, with sharp intraday swings keeping traders cautious. Amid this uncertainty, Ethereum (ETH) is beginning to flash a technically significant signal. While recent price action may look indecisive at first glance, the underlying structure on the 4-hour chart suggests ETH is currently retesting a critical breakout zone — a phase that often determines whether a trend reversal can firmly take hold or lose momentum.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Bump-and-Run Reversal (BARR) Breakout

On the 4-hour timeframe, Ethereum is carving out a Bump-and-Run Reversal (BARR) pattern, a well-known structure that frequently signals a transition from bearish control to bullish dominance.

The formation begins with a steady decline during the Lead-in phase, where price respects a descending trendline. This is followed by the Bump phase, characterized by an accelerated selloff that briefly pushes price below the trend’s natural slope. In ETH’s case, this capitulation phase marked the exhaustion of selling pressure, setting the stage for a sharp reversal.

The breakout occurred when ETH decisively reclaimed the descending trendline near the $3,130 level, signaling a potential shift in short-term trend direction. Following this move, price rallied swiftly toward $3,447 before facing mild profit-taking, which pulled ETH back toward the former resistance area.

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

At present, ETH is undergoing a classic throwback to the breakout trendline, hovering near the $3,100 zone. This retest is technically significant, as successful support confirmation here often strengthens the probability of a sustained Run phase higher.

What’s Next for ETH?

If buyers continue to defend and prevent a breakdown below the reclaimed trendline, it would validate the BARR structure and reinforce bullish momentum. A decisive move back above $3,447, which marks the recent local high, could act as confirmation that Ethereum is ready to resume its upward trajectory.

Based on the pattern’s measured projection, the BARR setup suggests a potential upside target near $4,763, implying a substantial recovery move if bullish conditions persist.

On the downside, failure to hold above the breakout support could weaken the reversal narrative. A sustained close below the trendline may open the door for further consolidation, delaying the bullish continuation and keeping ETH range-bound in the near term.

For now, Ethereum remains at a critical technical crossroads, with the coming sessions likely to determine whether this pullback serves as a launchpad for higher prices or a pause before further sideways movement.