Small-cap tokens fall to a four-year low—Is the "altcoin bull run" completely hopeless?

Despite having a correlation as high as 0.9 with major crypto tokens, small-cap tokens have failed to provide any diversification value.

Despite a correlation as high as 0.9 with major crypto tokens, small-cap tokens have failed to provide any diversification value.

Written by: Gino Matos

Translated by: Luffy, Foresight News

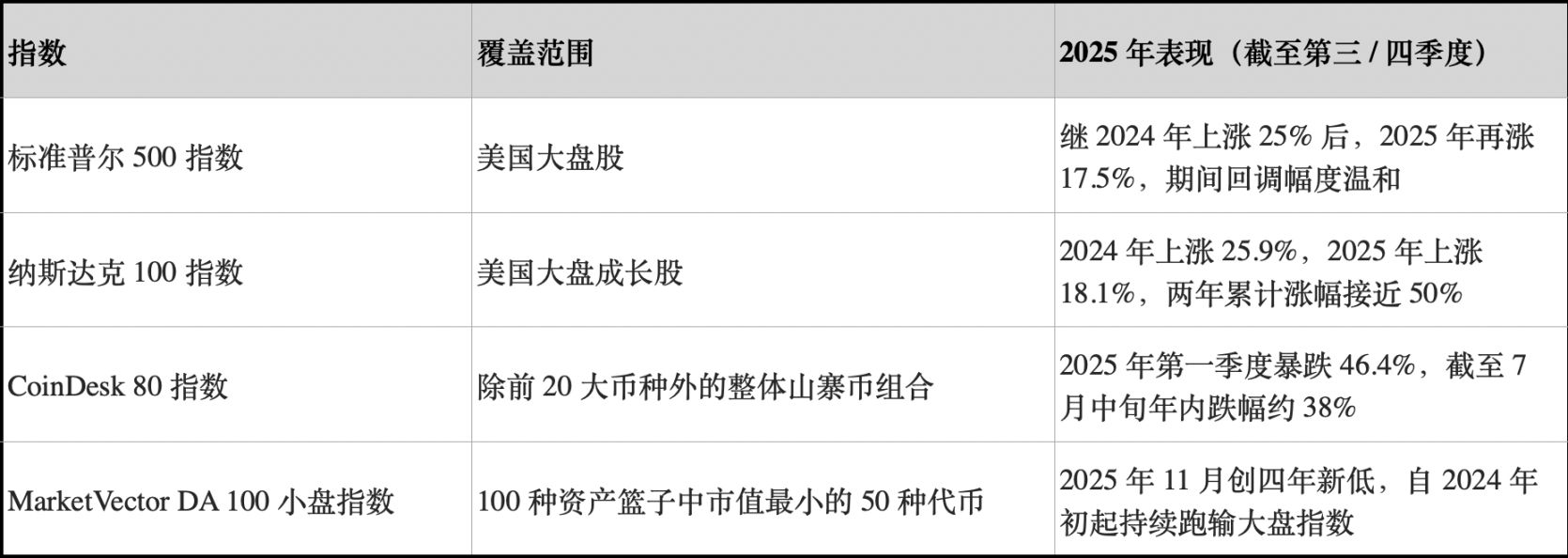

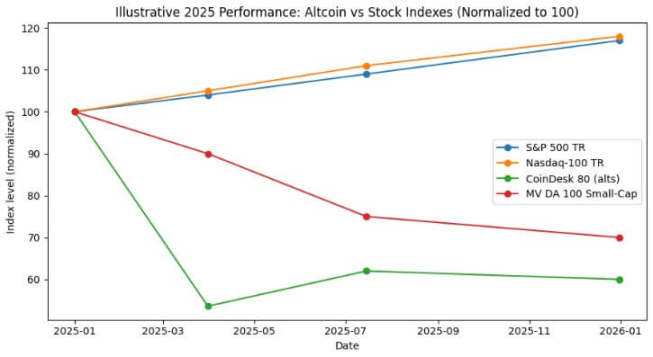

Since January 2024, a comparison of the performance between cryptocurrencies and stocks shows that the so-called new "altcoin trading" is essentially just an alternative to stock trading.

In 2024, the S&P 500 returned about 25%, and in 2025, 17.5%, with a cumulative two-year increase of about 47%. Over the same period, the Nasdaq 100 rose by 25.9% and 18.1%, with a cumulative increase close to 49%.

The CoinDesk 80 Index, which tracks 80 assets outside the top 20 cryptocurrencies by market cap, plummeted 46.4% in just the first quarter of 2025, and as of mid-July, had fallen about 38% year-to-date.

By the end of 2025, the MarketVector Digital Assets 100 Small Cap Index had dropped to its lowest level since November 2020, causing the total crypto market cap to evaporate by more than 1 trillion USD.

This divergence in performance is by no means a statistical anomaly. The overall altcoin portfolio not only delivered negative returns, but its volatility was comparable to or even higher than that of stocks; in contrast, major US stock indices achieved double-digit growth with controlled drawdowns.

For bitcoin investors, the core question is: can allocating to small-cap tokens actually bring risk-adjusted returns? Or does such an allocation simply maintain a similar correlation to stocks while taking on additional risk exposure with a negative Sharpe ratio? (Note: The Sharpe ratio is a key metric for measuring risk-adjusted returns of a portfolio, calculated as: portfolio annualized return - annualized risk-free rate / portfolio annualized volatility.)

Selecting a Reliable Altcoin Index

For analysis, CryptoSlate tracked three altcoin indices.

The first is the CoinDesk 80 Index, launched in January 2025, which covers 80 assets outside the CoinDesk 20 Index, providing a diversified investment portfolio beyond bitcoin, ethereum, and other leading tokens.

The second is the MarketVector Digital Assets 100 Small Cap Index, which selects the 50 smallest market cap tokens from a basket of 100 assets, serving as a barometer for the market's "junk assets."

The third is the small-cap index launched by Kaiko, a research product rather than a tradable benchmark, offering a clear sell-side quantitative perspective for analyzing small-cap assets.

These three indices depict the market landscape from different dimensions: the overall altcoin portfolio, high-beta small-cap tokens, and a quantitative research perspective, yet all point to highly consistent conclusions.

In contrast, the benchmark performance of the stock market presents a completely opposite trend.

In 2024, US large-cap indices achieved gains of around 25%, and in 2025, double-digit growth as well, with relatively limited drawdowns during the period. The S&P 500's maximum drawdown for the year was only in the mid-to-high single digits, while the Nasdaq 100 maintained a strong upward trend throughout.

Both major indices achieved annual compounded returns without significant profit givebacks.

In stark contrast, the overall altcoin indices performed very differently. According to reports from CoinDesk Indices, the CoinDesk 80 Index plummeted 46.4% in just the first quarter, while the CoinDesk 20 Index, which tracks large caps, fell 23.2% over the same period.

As of mid-July 2025, the CoinDesk 80 Index had fallen 38% year-to-date, while the CoinDesk 5 Index, which tracks bitcoin, ethereum, and three other major coins, rose by 12% to 13% over the same period.

Andrew Baehr of CoinDesk Indices described this phenomenon in an interview with ETF.com as "identical correlation, vastly different profit and loss performance."

The correlation between the CoinDesk 5 Index and the CoinDesk 80 Index is as high as 0.9, meaning their trends are almost identical, but the former achieved modest double-digit growth while the latter plummeted nearly 40%.

In reality, the diversification benefits of holding small-cap altcoins are negligible, while the performance cost is extremely severe.

The performance of the small-cap asset sector is even worse. According to Bloomberg, as of November 2025, the MarketVector Digital Assets 100 Small Cap Index had fallen to its lowest level since November 2020.

Over the past five years, this small-cap index returned about -8%, while the corresponding large-cap index soared by about 380%. Institutional funds clearly favor large-cap assets and avoid tail risks.

Looking at the performance of altcoins in 2024, the Kaiko Small Cap Index fell more than 30% for the year, and mid-cap tokens also struggled to keep up with bitcoin's gains.

Market winners are highly concentrated in a few leading tokens, such as SOL and XRP. Although the total trading volume share of altcoins once rebounded to the 2021 peak in 2024, 64% of trading volume was concentrated in the top ten altcoins.

Liquidity in the crypto market has not disappeared, but has shifted to high-value assets.

Sharpe Ratio and Drawdown

When comparing risk-adjusted returns, the gap widens further. The CoinDesk 80 Index and various small-cap altcoin indices not only have deeply negative returns, but their volatility is comparable to or even higher than that of stocks.

The CoinDesk 80 Index plummeted 46.4% in a single quarter; after another round of declines, the MarketVector Small Cap Index fell to pandemic-era lows in November.

The overall altcoin indices have repeatedly experienced index-level halving drawdowns: in 2024, the Kaiko Small Cap Index fell more than 30%; in the first quarter of 2025, the CoinDesk 80 Index plummeted 46%; and by the end of 2025, the small-cap index fell again to 2020 lows.

In contrast, the S&P 500 and Nasdaq 100 achieved cumulative returns of 25% and 17% over two years, with maximum drawdowns only in the mid-to-high single digits. While the US stock market is volatile, it remains overall controllable; crypto indices, on the other hand, are highly destructive in their volatility.

Even if the high volatility of altcoins is considered a structural feature, their unit risk-adjusted returns from 2024 to 2025 are still far below those of holding major US stock indices.

From 2024 to 2025, the overall altcoin indices had negative Sharpe ratios; meanwhile, the S&P and Nasdaq indices already performed strongly even without volatility adjustment. After adjusting for volatility, the gap between the two widened further.

Bitcoin Investors and Crypto Liquidity

The first insight from the above data is the trend of liquidity concentration and migration to high-value assets. Both Bloomberg and Whalebook's reports on the MarketVector Small Cap Index point out that since early 2024, small-cap altcoins have consistently underperformed, with institutional funds flowing into bitcoin and ethereum ETFs.

Combined with Kaiko's observations, although the total trading volume share of altcoins rebounded to 2021 levels, funds are concentrated in the top ten altcoins. The market trend is clear: liquidity has not completely left the crypto market, but has shifted to high-value assets.

The previous altcoin bull market was essentially just a basis trading strategy, not a structural outperformance of the assets. In December 2024, the CryptoRank Altcoin Bull Market Index once soared to 88 points, then plummeted to 16 points in April 2025, giving back all its gains.

The 2024 altcoin bull market ultimately turned into a classic bubble burst; by mid-2025, the overall altcoin portfolio had almost given back all its gains, while the S&P and Nasdaq indices continued to compound.

For financial advisors and asset allocators considering diversification beyond bitcoin and ethereum, CoinDesk's data provides a clear case reference.

As of mid-July 2025, the CoinDesk 5 Index, which tracks large caps, achieved modest double-digit growth for the year, while the diversified altcoin index CoinDesk 80 plummeted nearly 40%, yet the correlation between the two was as high as 0.9.

Investors allocating to small-cap altcoins did not gain substantial diversification benefits, but instead suffered losses in returns and drawdown risks far higher than those of bitcoin, ethereum, and US stocks, while still being exposed to the same macro drivers.

Currently, capital regards most altcoins as tactical trading targets rather than strategic allocation assets. From 2024 to 2025, the risk-adjusted returns of spot bitcoin and ethereum ETFs were significantly better, and US stocks also performed well.

Liquidity in the altcoin market is increasingly concentrating in a few "institutional-grade tokens," such as SOL, XRP, and a handful of others with independent positive factors or clear regulatory prospects. Asset diversity at the index level is being squeezed by the market.

In 2025, the S&P 500 and Nasdaq 100 rose about 17%, while the CoinDesk 80 crypto index fell 40% and small-cap cryptocurrencies fell 30%

What Does This Mean for Liquidity in the Next Market Cycle?

The market performance from 2024 to 2025 tested whether altcoins could deliver diversification value or outperform the majors in an environment of rising macro risk appetite. During this period, US stocks achieved double-digit growth for two consecutive years with controllable drawdowns.

Bitcoin and ethereum gained institutional recognition through spot ETFs and benefited from a more relaxed regulatory environment.

In contrast, the overall altcoin indices not only had negative returns and larger drawdowns, but also maintained high correlations with major crypto tokens and stocks, yet failed to compensate investors for the additional risk taken.

Institutional funds have always chased performance. The MarketVector Small Cap Index had a five-year return of -8%, while the corresponding large-cap index rose 380%. This gap reflects capital's ongoing migration to assets with clear regulation, ample derivatives market liquidity, and robust custody infrastructure.

The CoinDesk 80 Index plummeted 46% in the first quarter and recorded a 38% year-to-date decline by mid-July, indicating that the trend of capital migration to high-value assets is not reversing, but accelerating.

For bitcoin and ethereum investors evaluating whether to allocate to small-cap crypto tokens, the data from 2024 to 2025 provides a clear answer: the absolute returns of the overall altcoin portfolio underperformed US stocks, and risk-adjusted returns lagged behind bitcoin and ethereum; despite a correlation as high as 0.9 with major crypto tokens, they failed to provide any diversification value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP sinks below $2 despite $1B in ETF inflows: How low can price go?

Beyond Trading: A Look at Star New Projects and Major Updates in the Solana Ecosystem

The Solana Breakpoint 2025 conference was truly spectacular.

Quick Look at the 33 Winning Projects of the Solana Breakpoint 2025 Hackathon

Over 9,000 participants formed teams and submitted 1,576 projects, with a total of 33 projects winning awards. All of them are top industry seed projects selected from hundreds.

WEEX Labs: The Next Chapter for Memecoin, the Era of Flash Trends

In the era of rapid trends, memecoins have begun to shift from being a "joke" to becoming a "cultural index."