Countdown to Bank of Japan rate hike: Will the crypto market repeat its downturn?

Since 2024, each interest rate hike by the Bank of Japan has been accompanied by a drop of more than 20% in the price of bitcoin.

Since 2024, every rate hike by the Bank of Japan has been accompanied by a more than 20% drop in the price of bitcoin.

Written by: 1912212.eth, Foresight News

After the dust settled on the Federal Reserve’s 25 basis point rate cut, another major macro event is worth watching. The Bank of Japan (BOJ) is set to hold a policy meeting on December 18-19, and market expectations for a rate hike have reached their peak.

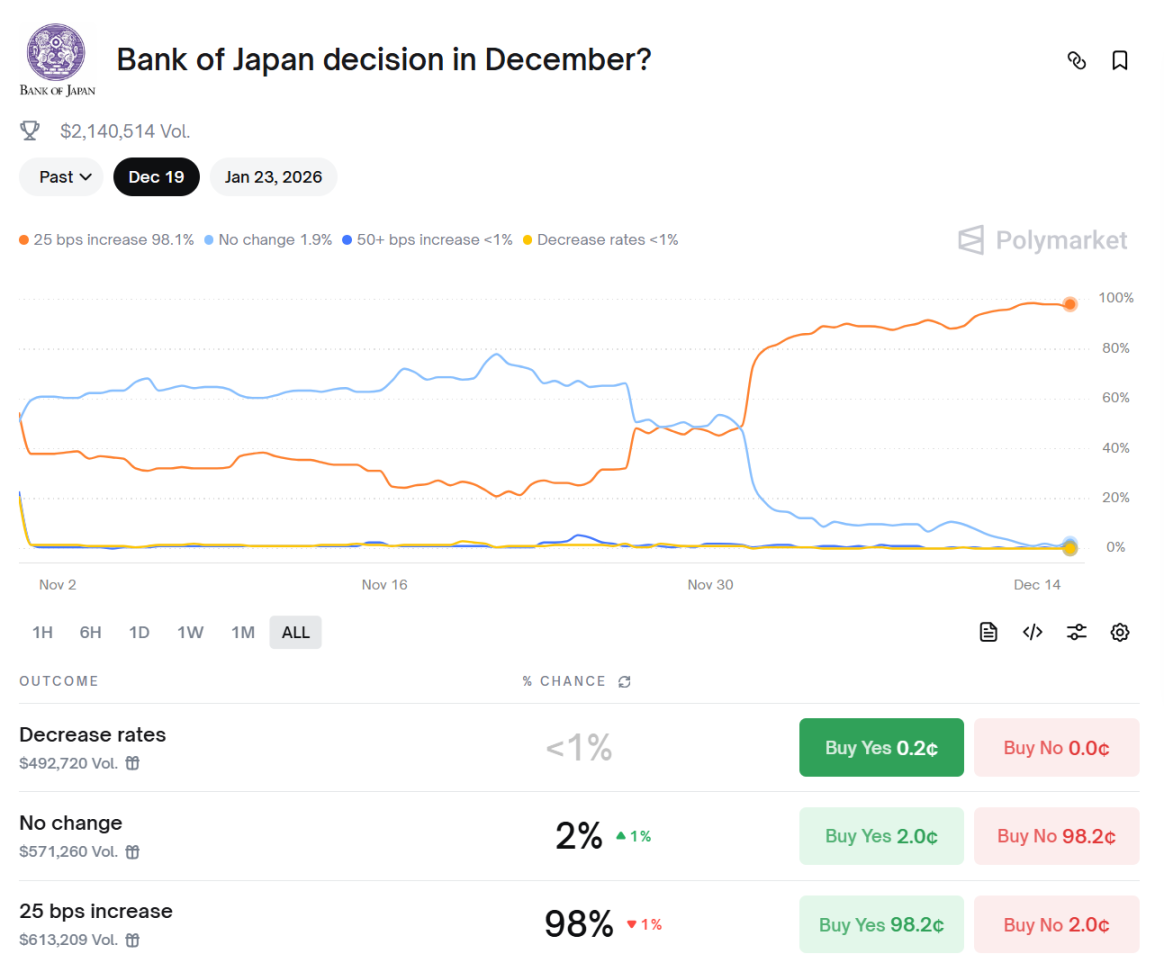

According to the latest data from prediction market platform Polymarket, there is a 98% probability that the BOJ will raise its benchmark interest rate by 25 basis points at this meeting, while the probability of keeping rates unchanged is only 2%. The chances of a rate cut or a larger rate hike are both less than 1%. This data echoes a Reuters poll, which showed that 90% of economists (63 out of 70) expect the BOJ to raise short-term interest rates from the current 0.5% to 0.75%.

These indicators reflect the market consensus on Japan’s economic recovery and inflationary pressures: Japan’s core CPI in November rose 2.5% year-on-year, well above the BOJ’s 2% target, while the yen has recently hovered around 150 against the US dollar, prompting the central bank to take action to curb further depreciation of the yen.

Since 2024, Japan has raised interest rates three times. In March 2024, the BOJ ended its negative interest rate policy for the first time, raising rates from -0.1% to 0-0.1%, marking the end of Japan’s 17-year era of ultra-loose monetary policy. In July 2024, the BOJ further raised rates to 0.25%, triggering sharp volatility in global stock and crypto markets. In January 2025, rates rose to 0.5%, again putting pressure on risk asset prices. Now, market pricing shows that this rate hike is almost a certainty, but its potential impact goes far beyond Japan itself, spreading to global liquidity through complex transmission mechanisms, especially affecting the cryptocurrency market.

Transmission Mechanism of BOJ Rate Hikes on Global Markets

The reason why the Bank of Japan’s monetary policy can influence the world is mainly due to the massive scale of the “yen carry trade.” The core of this strategy is that investors borrow low-interest yen and invest in high-yield assets such as US Treasuries, stocks, or cryptocurrencies. According to data from the Bank for International Settlements (BIS), the global scale of yen carry trades exceeds 1 trillion US dollars, with some of these funds flowing directly into the crypto market. When the BOJ raises rates, the cost of borrowing yen rises, causing the yen to appreciate (the USD/JPY exchange rate falls), and investors are forced to unwind carry positions, selling high-risk assets to repay yen debt. This triggers a tightening of global liquidity, similar to “reverse quantitative easing.”

Historically, this mechanism has amplified market volatility multiple times. After the July 2024 rate hike, the yen appreciated against the dollar from 160 to below 140, triggering a trillion-dollar global asset sell-off. The crypto market was hit first: bitcoin plunged from a high of $65,000 to $50,000, a drop of 26%; the entire crypto market capitalization evaporated by $60 billions. These events are not isolated, but rather a chain reaction caused by yen appreciation: carry trade funds exit, pushing the VIX index (fear index) higher and amplifying leveraged liquidations.

In the current environment, this impact may be even more complex. Although the Federal Reserve (Fed) has cut rates three times in 2025, bringing the federal funds rate down to 4.25%-4.5% and providing global liquidity support, the BOJ’s reverse tightening may offset some of these effects. Japan’s 10-year government bond yield has risen to 1.95%, well above the expected policy rate, indicating that the market has already priced in the rate hike. However, if the yen further appreciates below 140, global risk assets will face repricing.

As a high beta asset, bitcoin is highly sensitive to changes in liquidity. In 2025, bitcoin’s price has fallen from a high of $120,000 to around $90,000, and during periods of liquidity tightening, it is often the first to be sold off in the short term.

Glassnode co-founder Negentropic wrote, “The market is not afraid of tightening (rate hikes), but of uncertainty. The normalization of the Bank of Japan’s policy brings clear expectations to the global financing environment, even if leverage will be under pressure in the short term. Yen carry trades have clearly contracted, and volatility means opportunity. Bitcoin often strengthens after policy pressure is released, not before. Less chaos, stronger signals. This looks like preparation for asymmetric upside risk.”

Analyst AndrewBTC, based on historical data, analyzed that since 2024, every rate hike by the Bank of Japan has been accompanied by a more than 20% drop in the price of bitcoin. For example, in March 2024, bitcoin fell by about 23%, in July 2024 by about 26%, and in January 2025 by about 31%. If the Bank of Japan raises rates next week, similar downside risks may occur again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP sinks below $2 despite $1B in ETF inflows: How low can price go?

Beyond Trading: A Look at Star New Projects and Major Updates in the Solana Ecosystem

The Solana Breakpoint 2025 conference was truly spectacular.

Quick Look at the 33 Winning Projects of the Solana Breakpoint 2025 Hackathon

Over 9,000 participants formed teams and submitted 1,576 projects, with a total of 33 projects winning awards. All of them are top industry seed projects selected from hundreds.

WEEX Labs: The Next Chapter for Memecoin, the Era of Flash Trends

In the era of rapid trends, memecoins have begun to shift from being a "joke" to becoming a "cultural index."