Mercuryo wins the 2025 Cryptonomist Award for "Best Crypto On-Ramp and Payment Solution"

This has been a milestone year, marked by growth, product innovation, and global collaboration.

2025 is a breakthrough year. The development of Mercuryo is characterized by its scale, execution, and continuous efforts to enable global users to use cryptocurrency more quickly, conveniently, and familiarly. As the industry continues to shift toward real-world applications, Mercuryo has expanded its infrastructure layer to help wallets, exchanges, and Web3 applications easily onboard users and empower them to trade confidently across markets.

Expanding Simple and Secure On/Off-Ramp Infrastructure Globally

Mercuryo has strengthened its role as a unified infrastructure provider, expanding on-ramp, off-ramp, and payment channels to help partners improve user onboarding success rates, increase conversion rates, and build user trust.

This end-to-end solution combines localized payment options, seamless fiat-to-crypto conversion, and advanced compliance and anti-fraud systems, enabling partners to serve users across different regulatory and payment environments. Over the past year, Mercuryo has continued to deepen its presence in exchanges, wallets, DeFi applications, and fintech, providing payment support to more than 500 global partners.

Extending Mastercard Crypto Credentials to Self-Custody Wallets

A key milestone in 2025, Mercuryo is collaborating with Mastercard and Polygon Labs to extend crypto credentials to user self-custody wallets. The initiative introduces alias-based verified identifiers designed to replace lengthy wallet addresses, allowing users to receive digital assets using familiar usernames. Mercuryo is responsible for user onboarding, verification, and alias issuance, and users can also choose to mint a Soul Bound token on Polygon to indicate their verified status and enable compliance checks. This collaboration marks an important step toward making Web3 interactions as intuitive and user-friendly as traditional finance, while maintaining user self-custody.

Providing On-Ramp Access in Telegram Wallet

Mercuryo has integrated its on-ramp service into the Telegram Wallet, marking a significant step in bringing cryptocurrency payments to the mass market. By enabling seamless fiat-to-crypto conversion within one of the world’s most widely used instant messaging platforms, Mercuryo transforms a familiar daily environment into a convenient gateway for purchasing and using digital assets.

Through the Telegram Wallet, users can access Bitcoin, Toncoin, stablecoins, and Jettons, and top up their wallets with various fiat currencies using Mercuryo’s infrastructure. Built on the TON blockchain, the wallet combines scalability, simplicity, and high performance, reflecting Mercuryo’s strategic goal to reduce friction and expand the real-world adoption of digital payments.

Spending in Ledger Live

Notably, Mercuryo has integrated the Mastercard crypto debit card Spend into its system via Ledger Live, the “best companion app” for securely managing cryptocurrencies and NFTs. Ledger users can now use the Spend debit card to shop securely and seamlessly wherever Mastercard is accepted, and convert crypto to fiat with funds topped up directly from their Ledger devices.

The Spend card can be activated instantly and for free via Ledger Live, enabling Ledger’s more than 7 million users to pay for everyday purchases in fiat at around 150 million merchant locations (including physical and online merchants) within the Mastercard network using cryptocurrency.

Accelerating Stablecoin Adoption in Web3

In 2025, stablecoins continue to evolve from crypto-native tools into everyday financial channels, and Mercuryo has invested heavily to make stablecoin access cheaper, smoother, and more widely available on mainstream platforms.

This year, Mercuryo expanded retail user access to stablecoins through USDC partnerships and promotional campaigns with major wallets and networks. This includes a collaboration with Coinbase to lower USDC deposit fees for MetaMask users on Coinbase, boosting stablecoin adoption as mainstream user numbers grow.

Mercuryo has also integrated with Bitget Wallet, launching a USDC discount campaign, while Mercuryo’s wallet on-ramp feature has been activated. In addition, the company partnered with LOBSTR to launch a USDC cashback program on the Stellar network, and continues its collaboration with Ledger to enable millions of self-custody users to purchase digital assets directly within the hardware wallet interface.

These initiatives collectively reinforce Mercuryo’s role in strengthening the stablecoin economy, supporting cost-effective, user-friendly, and blockchain-agnostic payment options within the Web3 ecosystem.

Research-Based Insights on Wallet Adoption

In addition to product launches and expanded integrations, Mercuryo is also committed to understanding how real users adopt cryptocurrency at scale. To this end, Mercuryo partnered with Web3 research firm Protocol Theory to conduct a nationwide study on how Americans use crypto wallets.

The research shows that about 12% of Americans use crypto wallets daily, with high-income individuals more likely to be frequent users. However, concerns about complexity, lack of education, and fear of irreversible loss remain the main barriers to broader adoption.

These insights will continue to inform Mercuryo’s product development, integration priorities, and policy engagement as the company strives to support more convenient and intuitive pathways to the digital asset economy.

Gaining Growing Global Recognition

Mercuryo co-founder and CEO Petr Kozyakov said, “This year, Mercuryo once again achieved impressive growth and successfully secured partnerships with renowned companies including Ledger and Mastercard. Outstanding user experience (UX) and a robust platform experience are key elements for Web3 to achieve mass adoption. In 2025, we have maintained the highest standards of excellence in these areas through a series of successful collaborations.”

Looking Ahead

As the digital asset industry continues to shift toward real-world payments and everyday use, Mercuryo’s development trajectory points to a clear theme: infrastructure is critical.

Through compliant rails, better user experience, deeper stablecoin utility, and strategic partnerships, Mercuryo is helping cryptocurrency become less like a technological leap and more like a familiar financial activity, laying the foundation for the next stage of global digital payments.

Today, Mercuryo supports users in 148 countries and regions, with over 12.5 million registered users (including 1.3 million green KYC wallets), and a global team of more than 300 employees across 30+ countries. With a 2024 customer satisfaction score of 80, the company continues to strengthen the most important elements of large-scale operations: reliability, trust, and user experience—making users barely notice the presence of “cryptocurrency.”

[End]

About Mercuryo

MercuryoMercuryo is a leading payment infrastructure platform in the digital token space. With its intuitive and powerful solutions, Mercuryo stands out in the decentralized ecosystem, powering the next generation of Web3 payment services by enhancing payment use case growth and on-chain integration. Mercuryo’s innovative payment products, such as Spend, bridge the gap between TradFi, Web2, and Web3. Mercuryo is honored to partner with leading digital token economy companies such as Ledger, MetaMask, Trust Wallet, and Revolut. Driven by a continuously evolving product suite, Mercuryo is further expanding and continuously innovating through a diversified portfolio of payment services.

Learn more:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

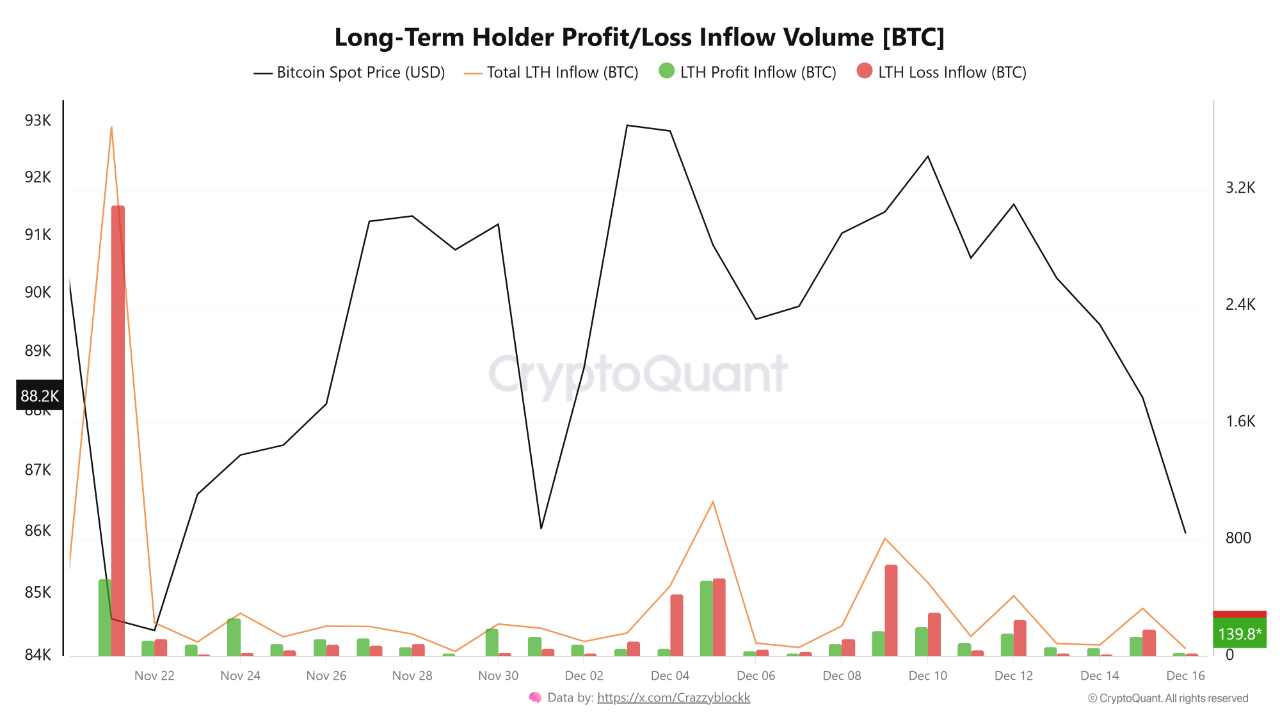

Who are the real dip sellers? On-chain data reveals the true sellers of bitcoin

Ethereum Faces Pressure After Failing to Hold $3,400—What Happens Next?

Elizabeth Warren Sounds Alarm on Trump's Crypto Dealings, PancakeSwap

Why is the Bank of Japan so important to Bitcoin?