Investment company Matrixport has drawn attention to the liquidity problem in the cryptocurrency market! Here are the details.

Matrixport shared a noteworthy assessment regarding liquidity conditions in the cryptocurrency markets. In a statement made on social media, the company emphasized that while the absolute supply of stablecoins continues to increase, the rate of growth has slowed significantly.

According to Matrixport, the cumulative growth rate in stablecoin supply over the past 12 months peaked at the end of October and has since declined.

The company stated that there was a simultaneous weakening not only on the supply side, but also in stablecoin inflows and new liquidity flows into the crypto market.

This situation is said to be a contributing factor to the failure of cryptocurrency prices to gain the expected momentum, especially in recent months. Matrixport argued that the current trend in the markets indicates a more cautious liquidity environment compared to previous periods.

The statement noted that the Federal Reserve's (FED) shift to a more cautious stance in monetary policy was also a significant reason for this weakening.

The Federal Reserve's more cautious signals regarding interest rate cuts are limiting global risk appetite and slowing the flow of capital into the cryptocurrency market. Matrixport notes that this situation is directly reflected in the growth dynamics of stablecoins.

While the company acknowledges that the absolute increase in stablecoin supply is still significant, it warned that the overall liquidity environment may be weaker than previously anticipated. This could lead investors to be more selective in the short term and increase market volatility.

Analysts point out that stablecoin growth is a key indicator of liquidity for the cryptocurrency market, and that any slowdown in growth should be closely monitored for its impact on the overall health of the market. Matrixport's assessment suggests that a cautious outlook may prevail in the cryptocurrency markets in the coming period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: Bad News from ETFs

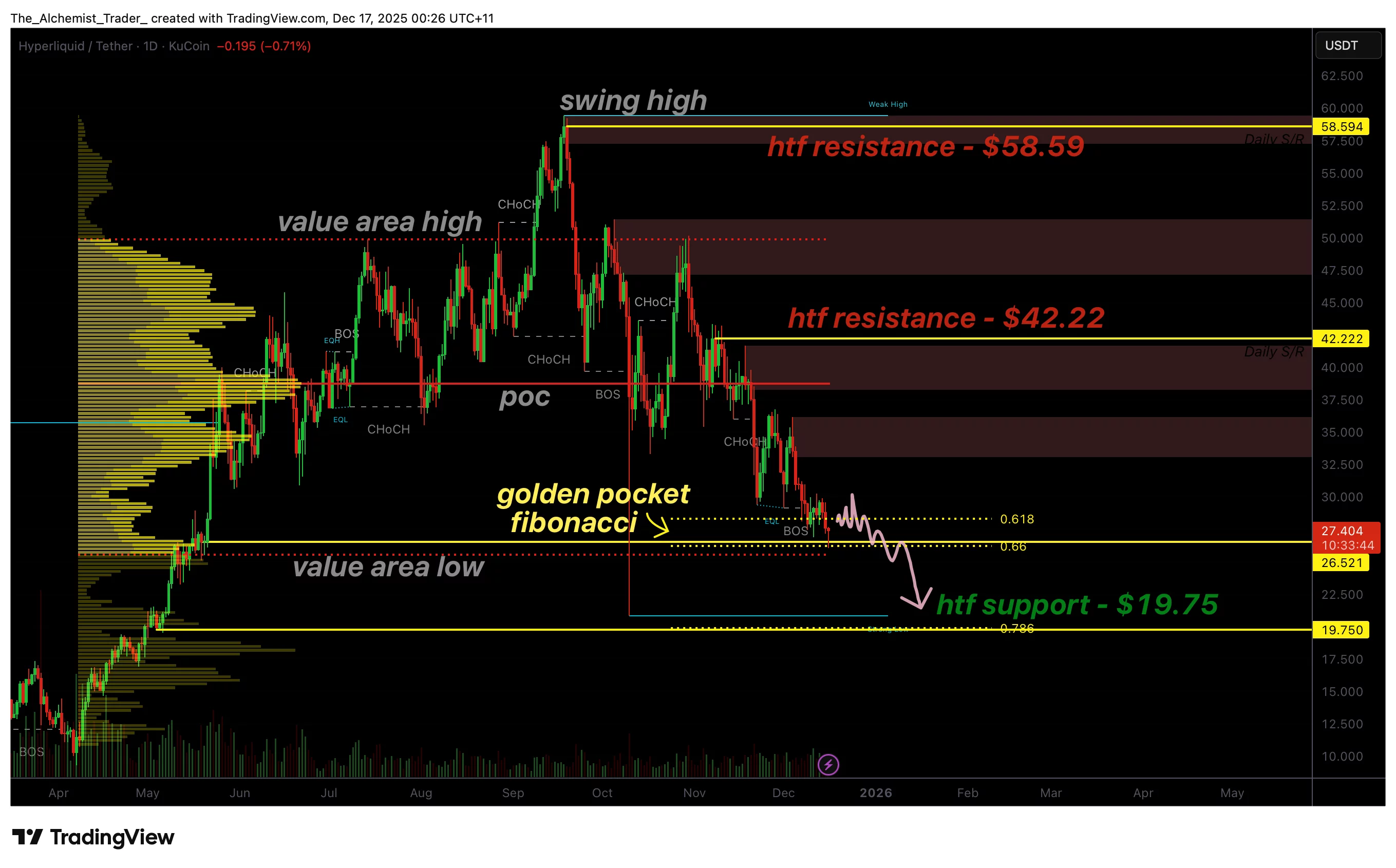

HyperLiquid price bounces at golden pocket, but downside risk remains

DEX users keep full custody as smart contracts replace exchange middlemen