Peter Schiff criticizes MSTR's bitcoin strategy, accusing it of betting $50 billion on bitcoin

Why MSTR's Bitcoin Strategy Is Being Tested During the Cryptocurrency Market Crash

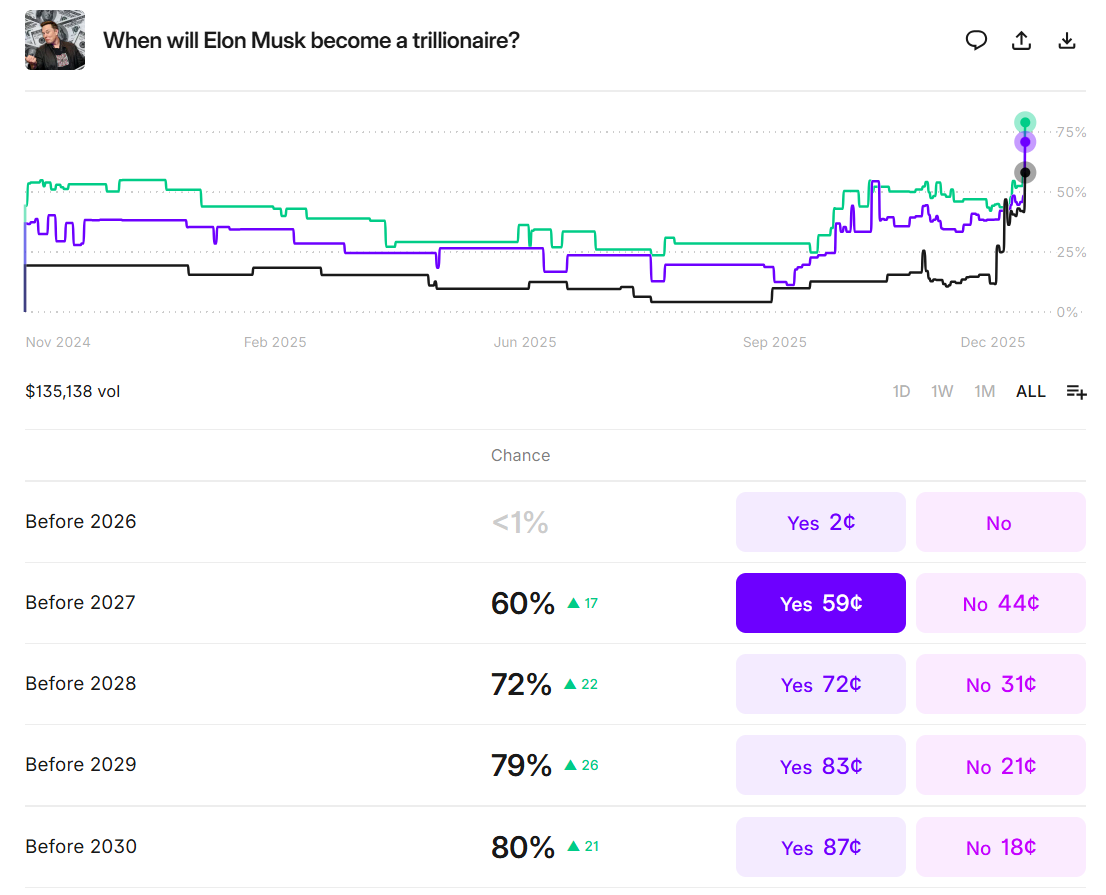

Will MicroStrategy's massive bet on Bitcoin ultimately face a real test? As cryptocurrencies surgeand Bitcoin's price drops to around $85,555, with the overall crypto market down nearly 4%, economist Peter Schiff's sharp criticism has once again sparked debate about the MSTR Bitcoin strategy. Schiff argues that over the past five years, MSTR has invested more than $5 billion in Bitcoin, but with gold and silver prices soaring, its returns are surprisingly low.

Peter Schiff vs. MSTR's Bitcoin Strategy

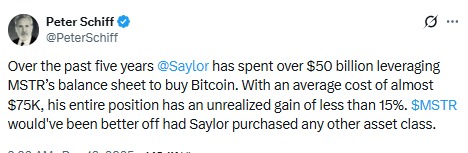

Peter Schiff questioned Michael Saylor's long-term MicroStrategy (MSTR) Bitcoin accumulation strategy on the X platform. Schiff pointed out that MicroStrategy has spent over $4.8 to $5 billion buying Bitcoin, with an average cost close to $75,000.

Source: X (formerly Twitter)

Despite Bitcoin's long-term rise, he claims that MSTR's overall unrealized gains are less than 15%. His argument is simple: for such a massive capital investment, the returns seem negligible.

When asked how it would have performed if invested in gold instead, he said the profit would have..."at least doubled, if not more." The timing of this post is significant. It was published during a crypto market crash, when leverage-driven liquidations led to over $600 million in positions lost in a single day.

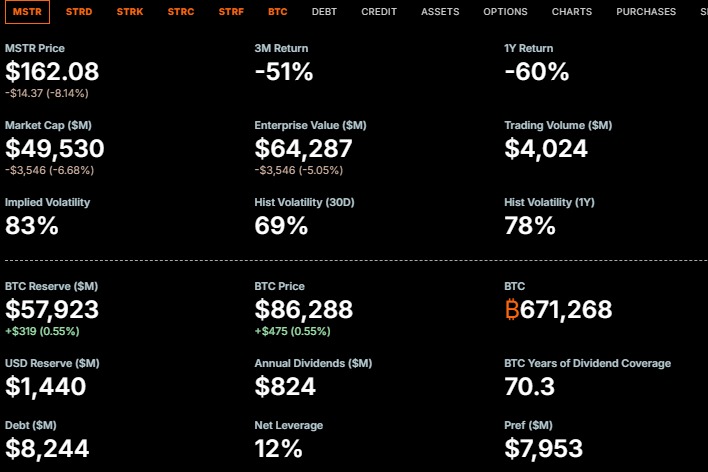

MicroStrategy Financial Details

Market data shows that MicroStrategy's stock is under pressure. Over the past year, MSTR's share price has dropped by more than 60%, and volatility remains extremely high. Nevertheless, the company currently holds about 671,268 tokens, with a total value of around $5.03 billion. At current prices, close to $86,000.Bitcoin's declinehas led to a reduction in unrealized gains, making Schiff's criticism more pronounced during economic downturns.

Source: Strategy website

Nevertheless, Saylor remains steadfast. In a recent update, he confirmed that Strategy acquired 10,645 Bitcoins at a price of about $980 million, with an average price close to $92,098. He also emphasized that Bitcoin's year-to-date return is 24.9%, indicating his continued confidence in Michael Saylor's investment strategy.

Bitcoin vs. Gold Under Market Pressure

The debate becomes even more intense when comparing Bitcoin to gold. XAU/USD prices have climbed to around $4,350, less than 1% away from their all-time high. According to TradingView data, gold has risen about 131% over the past five years. In contrast, Bitcoin has risen about 344% over the same period, but with greater volatility.

In times of economic uncertainty, gold benefits from falling yields and a weakening dollar. Digital assets, on the other hand, behave more like risk assets in the short term. This explains why Schiff focuses more on unrealized gains rather than long-term charts. The volatility of digital assets means timing is more critical.

Silver Joins the Safe Haven Rally

The rise in silver prices adds a new dimension to this argument. After a strong breakout, silver prices have recently remained near historic highs of around $64. Supported by ETF inflows and demand for hard assets, silver prices are expected to rise by more than 100% in 2025.The silver-Bitcoin ratiohas collapsed, indicating that funds are shifting from cryptocurrencies to precious metals.

Why Did Saylor Choose Crypto Assets?

Critics question why Saylor chose Bitcoin over stocks, bonds, or precious metals. Supporters argue that the MSTR Bitcoin strategy is based on long-term scarcity rather than short-term stability. Saylor believes Bitcoin is a digital asset, not just a trade. Schiff disagrees, arguing that corporate balance sheets require lower volatility and more stable returns.

While there is no evidence that Saylor "knows some secret," his conviction sets MicroStrategy apart from traditional companies. This strategy amplifies gains in bull markets and magnifies losses during crashes.

Conclusion

MicroStrategy's strategy is not a failure, but it is undergoing a stress test. Over the past five years, crypto assets have outperformed gold, but short-term crashes shrink unrealized gains and spark criticism. In 2025, gold and silver are expected to shine, while cryptocurrencies will remain volatile. The real question is whether investors will judge MicroStrategy based on short-term fluctuations or long-term confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FTC Compels Nomad Operator to Repay Users After $186M Crypto Bridge Hack in 2022