Looking Back at 2025: What Drove BTC Price Through the "Four Seasons"?

Deng Tong,

As 2025 draws to a close, at this time of bidding farewell to the old and welcoming the new, we launch the "Looking Back at 2025" series of articles. Reviewing the progress of the crypto industry throughout the year, we also hope that the industry will see the end of winter and a bright future in the new year.

In 2025, the crypto market once shone brilliantly, reaching historic highs before returning to calm and entering a period of volatile consolidation. This article reviews the performance of the crypto market this year.

BTC Price Chart for 2025

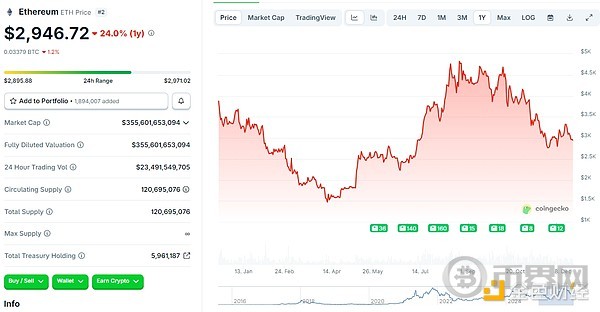

ETH Price Chart for 2025

I. January-February: Easing Signals + Trump Returns to the White House, Driving BTC Above $100,000

On January 1, 2025, BTC was priced at $93,507.88. The price then gradually increased, and by early February, BTC was mostly hovering above $100,000. BTC saw a strong start to the year, the entire industry was filled with optimism, and investors generally held a bullish outlook for the crypto market for the whole year.

The Federal Reserve kept interest rates unchanged at its meetings in January and February, but released signals of "cautious observation, easing expected," prompting the market to position itself early for liquidity benefits. From late January to early February, both meetings kept the federal funds rate target range stable at 4.25% to 4.5%. In terms of policy signals, the January statement removed the previous reference to "progress in bringing inflation back to the 2% target," and added concerns about "re-inflation risks." Fed Chair Powell made it clear that a rate cut would only be considered if there was "real progress on inflation or weakness in the labor market," but emphasized that "the threshold for reversing rate hikes is extremely high," ruling out the possibility of renewed rate hikes. The February meeting minutes further revealed that officials unanimously believed the current restrictive monetary policy allows time to assess the economy, while expressing concerns that Trump's tariff policies could push up inflation. However, most agreed that "rate cuts in 2025 remain the main direction." Based on this, institutions such as Goldman Sachs and Barclays predicted two 25-basis-point rate cuts within the year.

Additionally, former US President Trump returned to the White House on January 20, becoming the first "crypto president" in US history. This, combined with expectations of Fed easing, acted as a catalyst for the crypto market rally.

II. March-April: Tariff Threats + Slower Fed Easing Lead to BTC Pullback

Since Trump's return to the White House was confirmed, the market had been digesting expectations of his aggressive tariff policies.

At the end of February, Trump announced that the planned tariffs on Canada and Mexico would take effect as scheduled after a delay the following month—after giving both countries extra time to resolve border security issues, the tariffs would officially take effect after March 4.

With the US officially moving forward with tariffs on Canada and Mexico, the market began to reassess the global trade environment. The expectation that tariffs would take effect on March 4 sparked concerns about global trade friction, leading to increased risk aversion and a shift of funds from risk assets to the US dollar and cash equivalents.

On March 23, the Federal Reserve concluded its policy meeting, keeping rates unchanged but raising its inflation outlook, signaling that the pace of easing might slow down, breaking the market's previous optimism for rapid rate cuts. With multiple negative factors combined, the crypto market experienced a short-term wave of sell-offs.

III. May-October: Policy Tailwinds + Resumed Rate Cuts Help BTC Reach Double Peaks

US crypto regulatory policies and rate cuts truly brought a "crypto summer" to the market. As a result, BTC prices surged, reaching a historic high of $123,561 on August 14 and hitting another high of $124,774 on October 7.

From July 14-18, the US "Crypto Week" kicked off, with three major crypto regulatory bills passed.

On June 17, the US Senate passed the "Guiding and Establishing the National Innovation of Stablecoins Act" ("GENIUS Act"), advancing federal regulation of stablecoins and putting pressure on the House to plan the next phase of national digital asset regulation. On July 18, the bill was signed into law by Trump. The passage of this act marked the first time the US formally established a regulatory framework for digital stablecoins.

On July 17, the House passed the "Anti-CBDC Surveillance State Act" by a vote of 219 to 210.

On June 23, the House Financial Services Committee and Agriculture Committee submitted the "Digital Asset Market Clarity Act" ("CLARITY Act"), which defines digital commodities as digital assets whose value is "intrinsically linked" to the use of blockchain. The bill was passed by the House on July 17.

On September 18, the Federal Reserve announced a 25-basis-point rate cut, lowering the federal funds rate to 4%-4.25%, bringing back expectations of liquidity easing. At the same time, central banks in several countries began to include small amounts of BTC in their foreign exchange reserves for diversification. The Dutch central bank disclosed holdings of $1.5 billion in BTC assets, boosting market confidence.

On October 1, the US federal government entered a 43-day "shutdown" due to depleted funds, raising investor concerns about economic uncertainty and increasing demand for safe-haven assets. BTC became a favorite among both institutional and retail investors, and on October 7, it hit another all-time high. Although momentum faded afterward, BTC prices remained above $110,000 for most of October.

Additionally, events such as Circle's IPO on June 5, the implementation of Hong Kong's "Stablecoin Bill" on August 1, the WLFI transaction by the Trump family on September 1, and announcements by major companies regarding crypto reserves also occasionally acted as catalysts for market rallies.

While the market continued to climb, risks were lurking. After BTC's historic high of over $120,000 in October, it began to decline slowly, sparking widespread debate in the last two months of the year about whether the market had entered a bear phase.

IV. November-December: Concerns About the Future Economy Weaken BTC's Upward Momentum

On November 1, BTC was priced at $109,574, after which it began to decline. On November 23, BTC hit a low of $84,682, down 22.71% from the beginning of the month. Although it mostly fluctuated above $90,000 afterward, the upward trend was weak, leading to various speculations within the industry.

The US government shutdown led to a lack of key economic data, causing the market to worry about economic fundamentals and the future path of interest rates, which negatively affected the performance of risk assets.

Additionally, although there were already expectations that the Federal Reserve would continue to cut rates, before the cuts were implemented, the Fed sent cautious signals, leading to divided market expectations for future liquidity. On December 10, the Fed carried out its third rate cut of the year, but the market interpreted it as a "recessionary rate cut" in response to economic weakness, which further intensified pessimism. Investors are reassessing macro variables such as the global interest rate path and fiscal health, and are inclined toward more stable asset allocations amid uncertainty.

As the crypto market's downturn persisted, many DAT companies struggled to survive, and increased liquidations due to market volatility further pushed the market lower.

Currently, the market is looking forward to a "Christmas rally," which may be the "last hope for the whole village" this year.

Summary

The curtain of 2025 opened with an almost "certain" optimism, and Trump's rise to power filled the industry with anticipation. After experiencing tariff threats and a slowdown in Fed easing, the market exploded again after a period of dormancy: policy tailwinds, resumed rate cuts, IPOs by crypto companies such as Circle, hype around Trump family projects, and a surge of DAT companies all contributed to BTC breaking through the $120,000 mark twice. However, affected by macroeconomic expectations, BTC inevitably entered a period of volatile consolidation at the end of the year.

Looking at the crypto market's performance throughout the year, BTC's correlation with traditional financial markets has significantly increased, and the improvement of regulatory frameworks and the pace of Fed policy will likely continue to be key variables affecting BTC price trends in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano (ADA) Bagholders Switch Strategies As This Under $0.05 Token Offers Fresh Hope for Recovery Gains