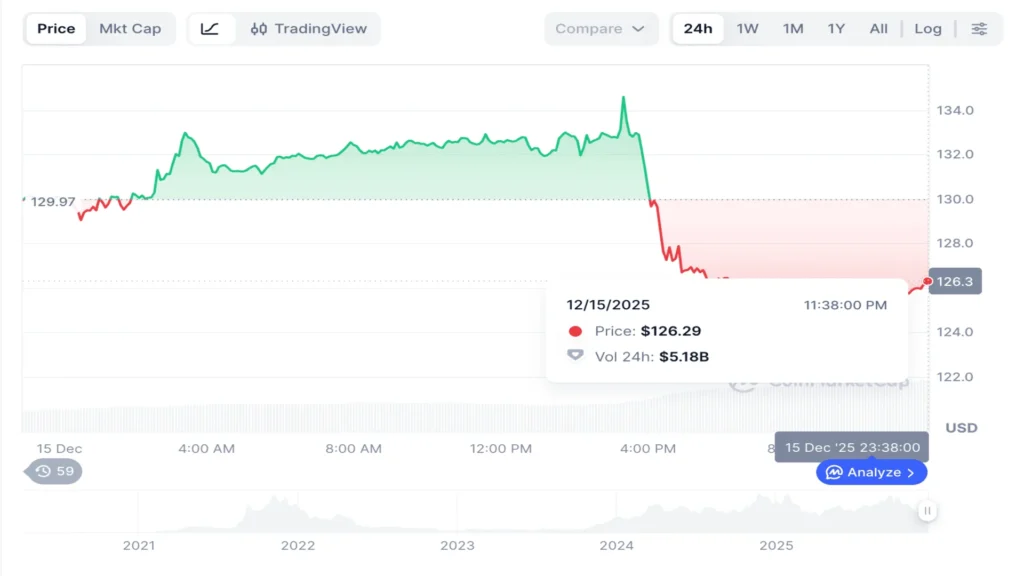

Solana’s recent move toward the $126 level shows the market is moving away from memecoins and now a rotation towards stablecoins and consumer payments is beginning. As capital shifts away from pure speculation, investors assessing the best crypto to buy now are increasingly paying attention to networks and platforms tied to real-world use.

Among those gaining attention is Digitap ($TAP), an omni-banking platform. As Solana’s price recovery highlights renewed interest in payments, traders are discussing whether early-stage platforms like Digitap could capture more upside heading into 2026.

Solana’s Price Recovery Highlights Payments and Alt Coins to Watch

Solana’s recent dip to $126 follows the larger trend of consolidation across major layer-1 networks. While price action has remained volatile, on-chain activity tied to payments and stablecoins has been relatively steady.

Market data shows Solana continuing to process high volumes of low-cost transactions, reinforcing its role as a settlement layer rather than a purely speculative asset. Analysts note that while trends like memecoins and high-risk DeFi rotate quickly, payment rails tend to persist through quieter market phases.

That persistence is drawing attention back to use cases. As volatility compresses, traders often shift focus from short-term price swings to infrastructure that supports everyday activity, such as transfers, spending, and stablecoin settlement.

At the same time, Solana’s size comes into play. With a market capitalization already in the tens of billions, future upside is increasingly tied to broader adoption rather than exponential multiple expansion. For many investors, that reality is prompting a familiar search for earlier-stage opportunities connected to the same payments narrative.

From Networks to Use Cases: Why Payments Are Back in Focus

Source: CoinMarketCap

This distinction is becoming more visible as the market matures. Networks like Solana compete on speed and cost. Application-layer platforms compete on how easy they are to use and how well they work in everyday life.

Digitap operates in this application layer. Rather than trying to be another blockchain, Digitap focuses on making crypto simpler for everyday users. The platform combines fiat accounts, crypto, and stablecoins into one app, designed for spending and transfers.

The app, already live on iOS and Android, allows users to hold multiple currencies, convert between crypto and fiat instantly, and spend funds globally via a Visa card. For users paid in stablecoins or crypto, this removes common pain points like slow withdrawals, conversion delays, and extra fees.

As payments regain relevance, platforms that make crypto usable outside of trading screens are drawing more attention.

Comparing Scale and Trajectory: Solana vs. Digitap

Solana and Digitap occupy very different positions in the market. Solana represents a large, established network whose future gains depend on continued ecosystem growth and adoption. Digitap represents an early-stage application aiming to capture value from how crypto is used day to day.

This is not a zero-sum comparison. Increased payment activity benefits Solana as a network. Platforms like Digitap benefit by making that activity accessible to end users.

For investors, the distinction matters. Solana offers exposure to network-level adoption. Digitap offers exposure to how users actually spend and move money at a much earlier stage than larger networks.

As payment narratives strengthen, many traders are choosing to balance exposure between mature infrastructure and emerging platforms built on top of it.

Looking Ahead to 2026: SOL or $TAP, Which is the Best Crypto to Buy Now?

Solana’s recent recovery around the $120-$130 range has helped reframe the market conversation around payments and real-world usage. It suggests the cycle may be shifting away from pure speculation toward applications that persist across market conditions.

The project already has a live product and is nearing completion. Nearly 150 million tokens have been sold, supported by an active Christmas campaign. As a result, Digitap is increasingly discussed as a payments-focused crypto to consider, not just a short-term trade.

For traders assessing the best crypto to buy now, the takeaway is clear. Large networks often signal direction. Early-stage platforms often capture acceleration. As the payments narrative strengthens, Digitap is emerging as one of the more closely watched altcoins heading into 2026.