Aave founder charts 'master plan' to trillion-dollar scale as DAO tensions mount, SEC ends 4-year probe

Aave founder Stani Kulechov has published a sweeping, multi-decade roadmap outlining how DeFi’s largest lending protocol plans to scale into what he described as the "foundational credit layer" of the onchain economy — even as the Aave DAO weathers a contentious governance debate.

Kulechov is also the CEO of Avara, the parent company of Aave Labs, which is the primary development company contributing to the Aave protocol.

The plan, shared late Tuesday on X, laid out a strategy centered on three pillars: Aave V4, Horizon, and the Aave App. In the post, Kulechov wrapped Aave’s future around institutional adoption, unified liquidity, and mass-market onboarding. He also said the protocol is entering a phase aimed at moving the next trillion dollars in assets and the next several million users onchain.

Aave is currently the dominant lender among decentralized finance platforms and one of the most profitable onchain venues.

Kulechov pointed to this scale, stating the protocol has processed $3.33 trillion in deposits, originated nearly $1 trillion in loans, generated $885 million in fees this year, and commands 59% of the DeFi lending market.

"Aave will win," he said, stating his belief that the protocol is "still on day zero compared to what lies ahead."

Aave V4: Unified liquidity and institutional scale

At the center of the roadmap is Aave V4, a complete architectural redesign introducing a hub-and-spoke liquidity model. Rather than fragmented pools across networks, V4 would consolidate liquidity into hubs while enabling specialized markets, or "spokes", tailored for different asset types.

Kulechov said this design would allow Aave to support trillions of dollars in assets, making it the default liquidity venue for institutions, fintechs, and global credit markets. A new developer toolkit would accompany the rollout to accelerate integrations and product deployments on top of Aave, according to the so-called "master plan."

Horizon and Aave App

Aave’s Horizon market — launched earlier this year — serves as a compliance-aligned venue for institutions to use tokenized Treasurys and other credit instruments as collateral.

The Dec. 16 post touted Horizon as the bridge for the "next trillion dollars," targeting $1 billion in deposits in 2026 as the team expands partnerships with Circle, Ripple, Franklin Templeton, VanEck, and others.

Horizon has already grown to $550 million in net deposits and, according to Kulechov, is the fastest-growing RWA-backed lending venue in DeFi.

The third pillar, the Aave App, is designed as a consumer gateway for DeFi. The app integrates Push, a zero-fee fiat stablecoin on/off-ramp covering more than 70% of global capital markets, per details shared publicly on Tuesday.

Kulechov pitched the app as a competitor to mainstream fintech products, arguing that DeFi can offer vastly superior savings and cash-management features. A full rollout is planned for early 2026, with a stated goal of onboarding the protocol’s "first million users."

Escalating governance tension and shuttered SEC investigation

Kulechov’s announcement comes during an intense governance dispute between Aave Labs and segments of the Aave DAO, centered on who should steer the protocol’s long-term direction and who is entitled to capture its revenue streams.

The debate began after a delegate raised concerns about Aave Labs’ integration of CoW Swap into the Aave interface — replacing Paraswap — and the redirection of swap-related fees away from the Aave DAO treasury.

A broader examination of the perceived "stealth privatization" of DAO value flows and the boundaries between Aave Labs’ products and DAO-owned assets followed shortly thereafter.

That has now culminated in a proposal from an AAVE token holder calling for a "poison pill" mechanism, which would empower the DAO to absorb Aave Labs if alleged misalignment escalates. The Block reported that the measure aims to give the DAO leverage in any future dispute over protocol revenues, brand rights, and core development stewardship.

In response to concerns raised by some DAO participants about alignment between Aave Labs and token holders, Kulechov stated that he and his team are among the largest AAVE holders and have shipped more protocol upgrades and products than any other contributor.

"I’ve seen a lot of the discourse within the DAO forum. Let me be very clear, no one cares about Aave more than I do," he wrote. "Open debate is a feature of DeFi governance and is not a symptom of misalignment."

The master plan also follows a notable regulatory milestone, after Kulechov revealed the U.S. Securities and Exchange Commission ended its years-long probe into Aave without taking enforcement action. Kulechov called the outcome validation of DeFi’s staying power, declaring that "DeFi will win."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Who Accurately Forecasted XRP Price Crash to $1.88 Sets Next Price Target

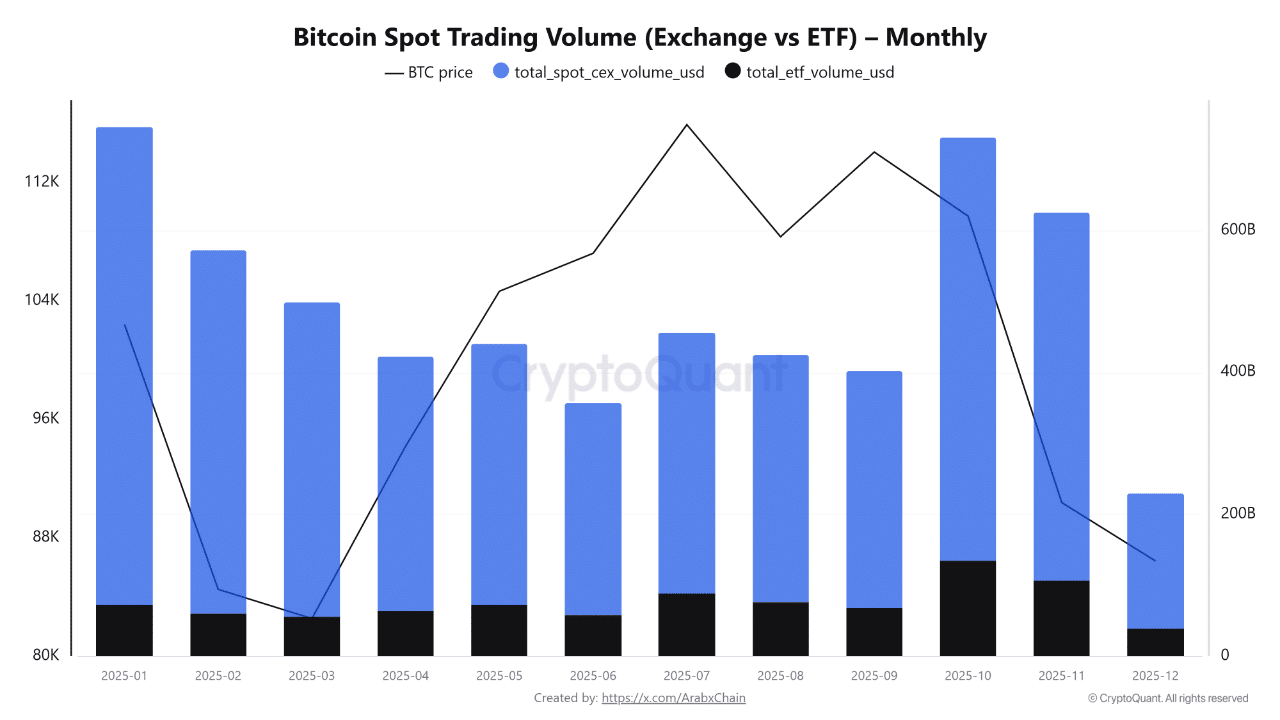

Mapping Bitcoin’s year-end slowdown as leverage exits the market

Two Key Reasons Why Bitcoin Has Entered a Bear Market: Wall Street Veteran

Bitcoin bears scramble to retreat as BTC surges