The FDIC just dropped a major proposal that could let US banks issue stablecoins under the GENIUS Act, giving them a regulated path into crypto.

Published this week, the framework outlines how FDIC-supervised banks can issue payment stablecoins through subsidiaries, with strict requirements on reserves, redemption, and governance.

If passed, it would mark a turning point in US crypto regulation and open the door for traditional banks to enter the $300B stablecoin market.

FDIC proposes framework for US banks to issue stablecoins

US banks may soon be able to issue their own stablecoins under a new proposal from the Federal Deposit Insurance Corp, marking a major regulatory step in implementing the GENIUS Act.

The proposed rule, published this week, outlines how banks supervised by the FDIC can apply to issue payment stablecoins through subsidiaries, subject to strict oversight.

Banks would need to meet a set of standards laid out in the GENIUS Act, including one-to-one reserve backing, sound financial health, and strong governance.

If approved, the FDIC would act as the primary regulator of the issuing subsidiary. The proposal is currently open for public comment before moving to the next phase.

This rulemaking follows the GENIUS Act’s passage in June and its signing into law by President Donald Trump in July. The law is seen as a turning point in US crypto regulation, giving banks a clear path to participate in the $300 billion global stablecoin market.

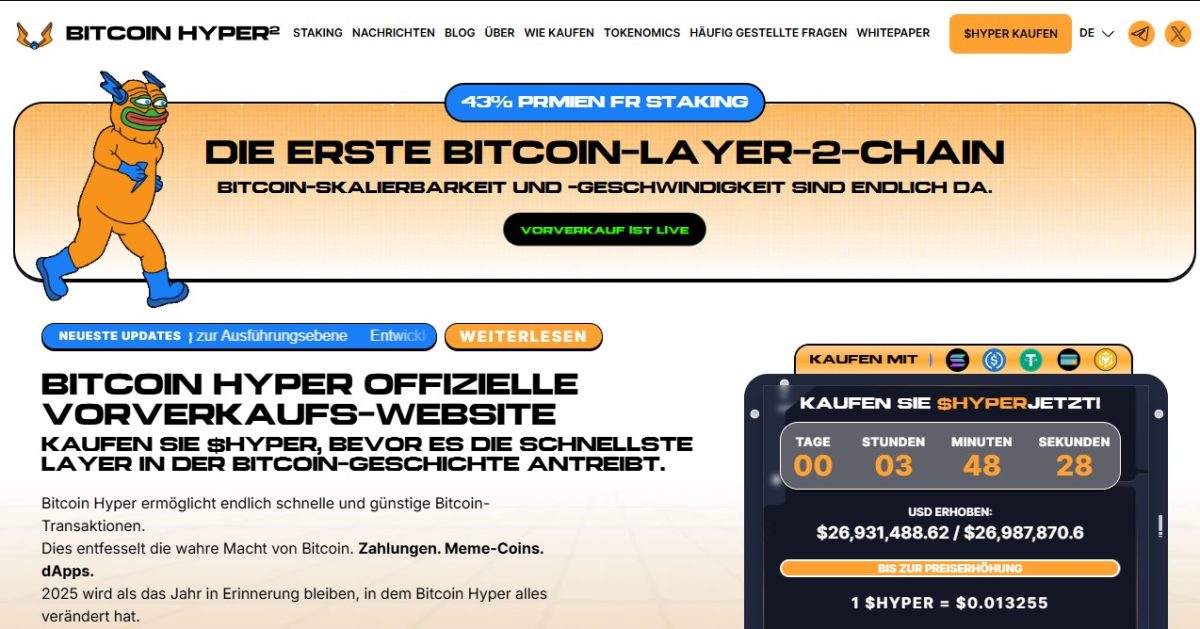

Bitcoin Hyper

Bitcoin Hyper is aiming to fix Bitcoin’s biggest problem: speed and scalability. Bitcoin itself only handles around 7 transactions per second and struggles with high fees, making it unfit for DeFi or fast dApps.

That’s where Bitcoin Hyper steps in. It plugs Solana’s Virtual Machine into the Bitcoin network, unlocking smart contracts and fast execution while staying secured by Bitcoin’s Proof-of-Work.

Its modular design splits the work: Bitcoin handles settlement, while a fast Layer 2 powered by Proof-of-Stake handles the rest. Users can lock BTC on the main chain and mint wrapped tokens instantly through the Canonical Bridge.

The tech is strong. But the presale has already raised $30M, which lowers the upside. A 2–3x return is still possible, but 100x is unlikely. Earlier-stage projects like DeepSnitch AI may now present new opportunities in the space.

Nexchain

Nexchain is developing an AI-powered blockchain designed to offer up to 400,000 transactions per second and fees under $0.001. Its hybrid consensus and sharding system add both speed and stability, making it stand out from typical early-stage projects.

Testnet 2.0 just launched, and developers are already testing tools like wallet reputation scores and predictive behavior s. These features aim to make dApps smarter and safer from day one.

NEX token holders get daily rewards: 10% of gas fees shared back to the community. As the network grows, so does the payout. Now in Stage 29 of presale, Nexchain is eyeing a $0.30 listing, but the upside is highly limited. The space crawls with tens of blockchains that can offer similar TPS today, without a presale. Take TON, or Solana, for example.

That’s why many investors are now shifting to DeepSnitch AI, the protocol that offers a unique utility that nobody else in the space does.

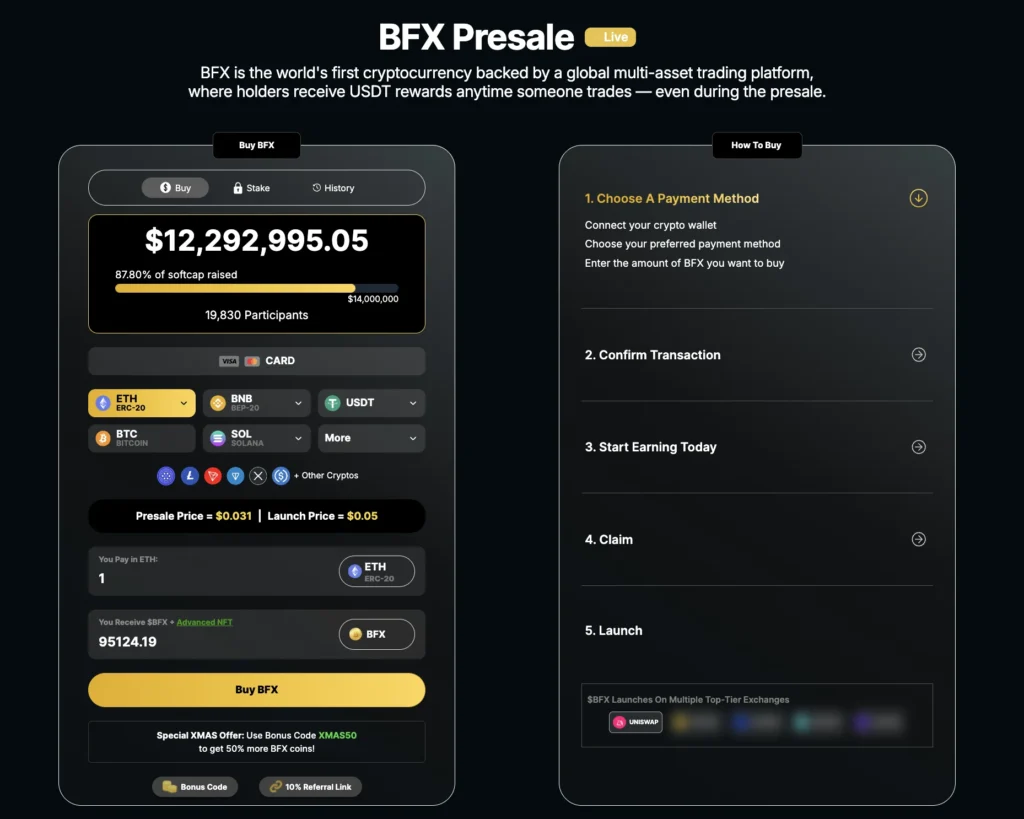

BlockchainFX

BlockchainFX is focusing on what traders actually need. It offers a real solution for an increasing problem: one regulated platform for all types of assets. Traders get access to over 500 tradable securities, from crypto to stocks, through a single account.

The presale has raised over $12 million. Current price sits at $0.03, with a public listing planned at $0.05. Still, the competition is fierce. Giants like Revolut and Robinhood already own the cross-asset trading space, backed by massive funding and brand loyalty. That’s a tough wall to break through.

Some investors are now eyeing DeepSnitch AI instead. It’s reaching to a 100M+ user base with an AI dashboard that delivers live market signals. Three agents are already active. Unlike BlockchainFX, DeepSnitch builds a new narrative that could change the trading game forever.

Ozak AI

Ozak AI scans markets in real time, notifies users to changes, and offers tools to react fast. The $OZ token powers everything: from analytics to premium features. Traders don’t just buy it, they use it constantly.

The platform is already live. Tokens spent or staked feed straight back into the system, keeping value locked in. This makes $OZ more than a passive asset. It’s part of the action.

Tokenomics focus on long-term growth. Most of the supply supports staking, rewards, and new features. Cross-chain support and governance are coming next.

Still, with $5 million raised, Ozak’s early gains may be behind it. DeepSnitch AI, priced at $0.02846, could offer much higher upside for risk-tolerant investors.

The bottom line

While all five projects show long-term promise, only one stands out for investors hunting that perfect blend of low risk and high reward.

Bitcoin Hyper has powerful tech, but is already too big for a true 100x. BlockchainFX faces stiff competition from giants. And the other two simply don’t have the narrative strength or user funnel to explode in 2026.

DeepSnitch AI does. With just a $0.02846 entry point and a market that loves early utility, DSNT has earned attention among investors in December 2025.