- Hyperliquid (HYPE) is hovering around $26.

- Market sentiment shows weak to neutral momentum.

As the bearish sentiment clutches the crypto market tight, the majority of the digital assets are charted in red. Bitcoin (BTC) and Ethereum (ETH) are stalled at resistance, currently trading at $86.8K and $2.9K. With the fear lingering, Hyperliquid (HYPE) is seeking to escape from the downside track to land in a bullish zone.

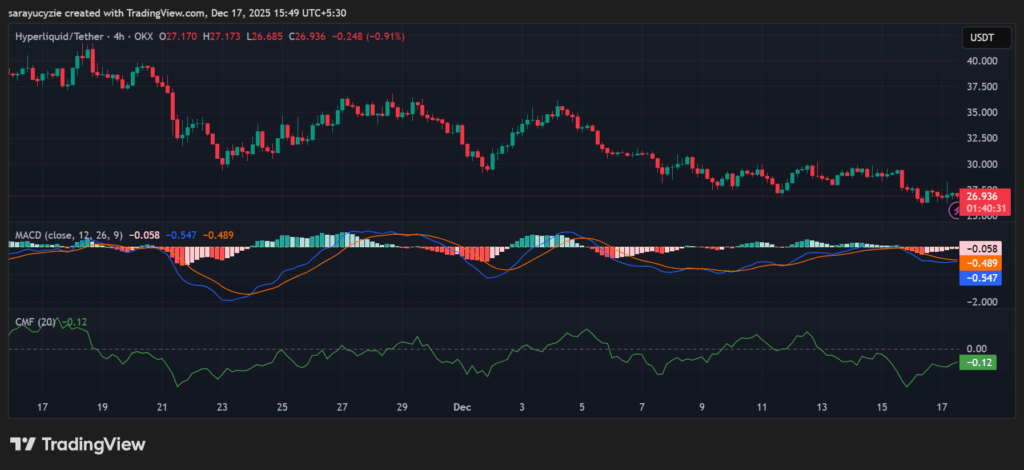

With a brief spike, HYPE’s lowest trading range as of December 17 is marked at $26.26. Similarly, the asset’s highest level is recorded at around $28.02. If the bullish pressure gains more power to move upwards, the price action would likely display a shift in momentum.

At press time, Hyperliquid traded at around $26.90, with its market cap touching $9.29 billion. Additionally, the daily trading volume of the asset has dropped to the $367.83 million mark. As per Coinglass data, the market has seen a 24-hour liquidation of $882.74K worth of HYPE.

Can Hyperliquid Bounce, or Is More Pain Coming?

Assuming the active downside momentum gains more traction, Hyperliquid might fall to the $26.78 support range. If the market turns highly bearish, the death cross could take place, driving the price to its former low of around $26.66. In defiance, if the uptrend catches up, the asset could instantly climb to its resistance at the $27.02 level. With a strong upside correction, the golden cross might unfold, likely pushing the asset to a high above $27.14.

HYPE chart (Source: TradingView)

HYPE chart (Source: TradingView)

The Moving Average Convergence Divergence (MACD) line and signal line of Hyperliquid are stationed below the zero line. It implies a bearish trend, and the short-term momentum is weaker than the longer-term. Moreover, the Chaikin Money Flow (CMF) indicator found at -0.12 hints at selling pressure in the HYPE market. The capital is flowing out of the asset rather than into it. A move back above zero needs to confirm renewed buying.

The Bull Bear Power (BBP) value at -0.874 indicates strong bearish dominance of HYPE. As the magnitude is larger, the bears are exerting significant pressure, not just mild weakness. Furthermore, the daily Relative Strength Index (RSI) of 40.27 suggests weak to neutral momentum. As it is not oversold, below 30, there is still room for downside or consolidation. Upon the Hyperliquid crossing above 50, the bullish strength improves.

Top Updated Crypto News