Things to know: Bitcoin's early rebound on Wednesday now seems like a distant memory, as the price has fallen back to this week's lows. Precious metals continue to be in demand, with silver hitting new highs again and gold approaching its all-time high. An analyst warns that due to year-end position adjustments and tax considerations, the current price action of Bitcoin should not be overinterpreted.

After experiencing the daunting "Bart Simpson pattern", Bitcoin has fallen back to this week's low of $85,500. This pattern is characterized by a rapid price surge, a few minutes of stability, and then a quick return to the previous level. The shape formed on the chart resembles the head of the famous cartoon character.

The crypto market seems to be stuck in a troublesome situation again: when stocks rise, there is no correlation at all, but when things go south, it correlates 1:1 with stocks.

In fact, this morning's sharp rebound collapsed along with the Nasdaq, which began to fall as enthusiasm for AI trading further waned. About ninety minutes before the close, the tech-heavy index dropped by 1.5%, with the chip sector seeing even steeper declines.

However, perhaps even more frustrating for crypto bulls is the continued strong rally in precious metals—silver rose another 5% to a new high, and gold rose 1%, approaching its all-time high. There was a time when Bitcoin holders hoped that Bitcoin would become the asset of choice when the Federal Reserve eased monetary policy or when stocks ran into trouble. Instead, it is now gold, silver, and even copper that are attracting investment.

This week's crypto scoreboard is not a pretty sight. Bitcoin is down 8%, Ethereum down 15%, Solana down 12%, and XRP down 12%.

Where is the floor?

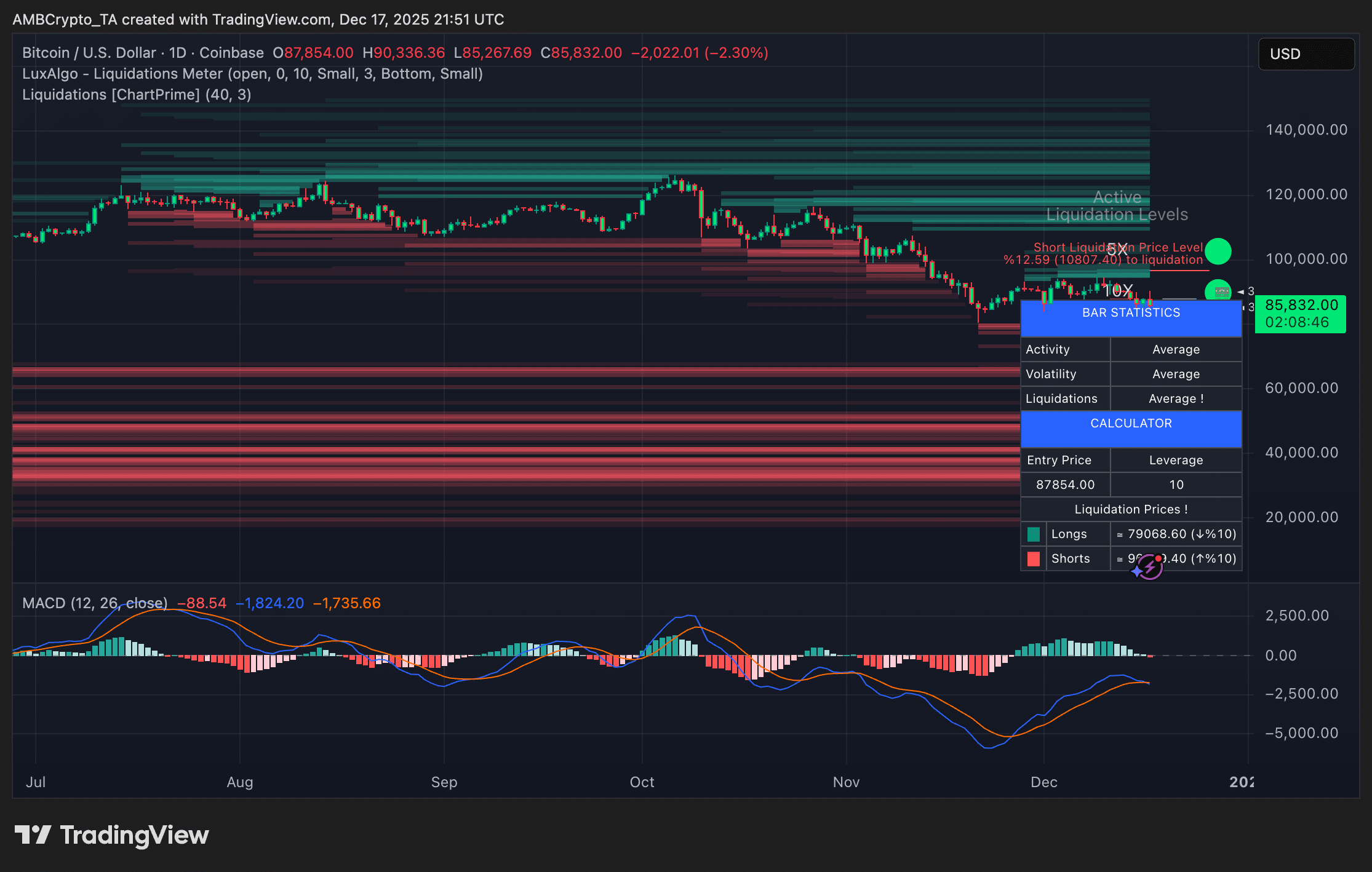

According to Jasper De Maere, a desk strategist at Wintermute, Bitcoin may be trapped between $86,000 and $92,000. He added that since the current consolidation range has experienced high volatility, today's sudden price swings are not unusual as traders face liquidations.

De Maere warns that technical indicators should not be overinterpreted at this time, and expects more profit-taking in the next two weeks, mainly due to year-end portfolio adjustments and tax considerations. "People are reducing positions to take a break... brief rebounds are quickly sold off."

He expects Bitcoin's sideways movement to continue until a new catalyst emerges, one possibility being the large options expiry at the end of December.

While a bottom has not yet been signaled, De Maere says the market is starting to show those signs. "I feel like we're in maximum pain," he said. "In the short term, I would say we are absolutely oversold."