Renowned CEO Reveals Two Different Levels That Will Wipe Out Major Bears and Bulls in Bitcoin Price

Joao Wedson, a cryptocurrency analyst and CEO of on-chain analytics company Alphractal, made noteworthy assessments regarding Bitcoin’s short-term price outlook and the latest on-chain data.

According to Wedson, the Bitcoin price is currently stuck between two critical levels in the short term. The analyst identifies the $90,500 level as a potential zone for the mass liquidation of short (bearish) positions, while noting that the $84,500 level represents a strong liquidation area for long (bullish) positions.

Wedson stated that the current price is moving between these two liquidity pools, and that a sharp price movement is likely to occur if one side is liquidated. He argued that short-term volatility remains high during this process and that there is an active liquidity hunt in the market.

On-chain analysis shared by Alphractal points to a more cautious picture. According to the company, on-chain transactions are no longer generating high profitability. In particular, the decline in the SOPR Trend Signal indicator, which measures whether Bitcoin is being moved at a profit or loss, reveals that transfers are increasingly occurring at lower profit levels or close to a loss.

Alphractal stated that this decline in the SOPR Trend Signal is historically characteristic of bear markets and that a true price bottom can only be confirmed when “green signals” reappear on the indicator. Current data suggests this process could take months to complete.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Faith Hits New Highs as Long-Term Holders Talk of a Historic Endgame

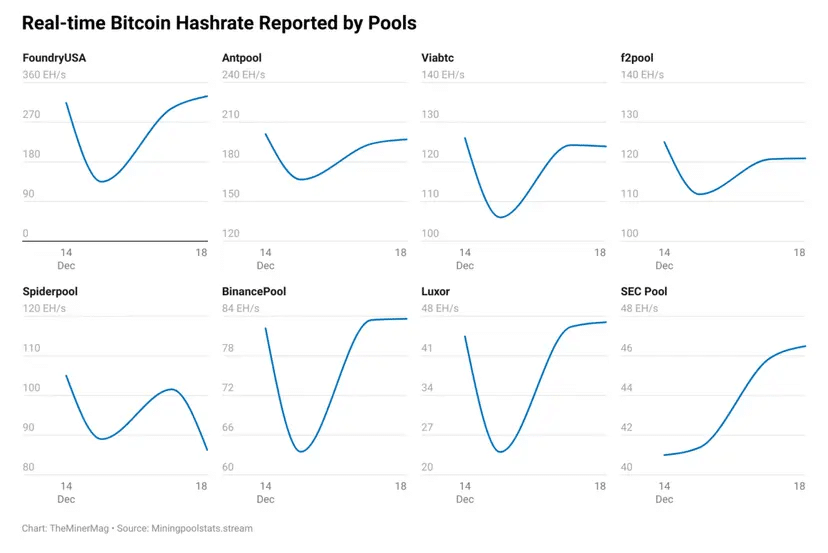

Bitcoin Mining Recovers Quickly After China Crackdown Claims, Network Metrics Stay Strong

Fasttoken Rallies Nearly 200% Despite Bearish Crypto Market

Cardano price slowly forms a bullish pattern as DEX volume jumps