Cryptocurrency Markets Face Intense End-of-Week Pressure

2025/12/19 09:50

2025/12/19 09:50By:

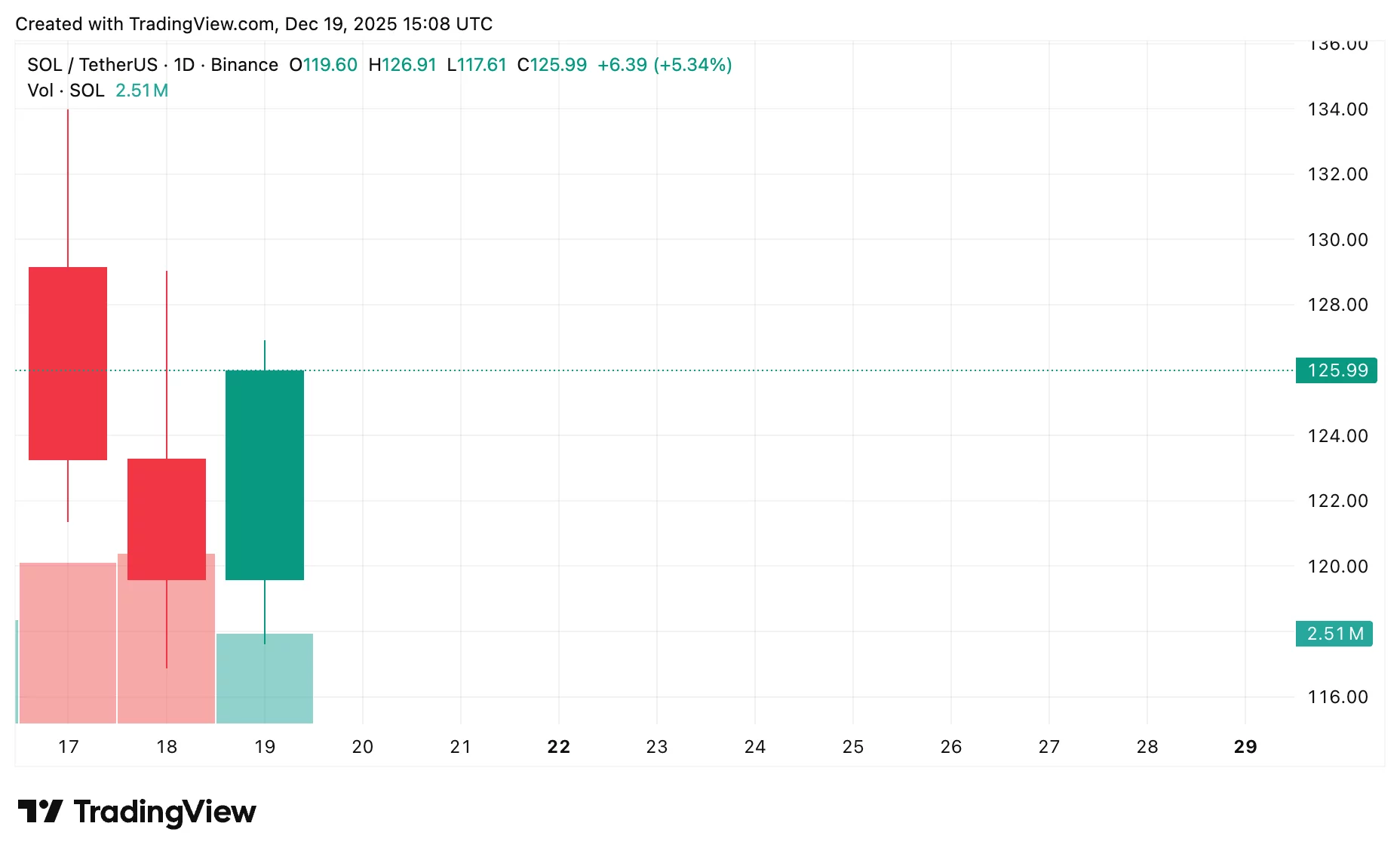

Summarize the content using AI ChatGPT Grok As the week draws to a close, the cryptocurrency markets are encountering a significant options expiry. On December 19, around 31,000 Bitcoin $90,357.50 options contracts are set to expire. Although the total value of these contracts is $2.7 billion, which is below the average in terms of volume, the fragile market conditions have turned this expiration into a focal point for investors. The ongoing selling pressure throughout the week has amplified the psychological impact of the options expiry. Contents Current Status of Bitcoin and Ethereum Options Weakness Persists in the Spot Market Current Status of Bitcoin and Ethereum Options Several global developments are contributing to the ongoing sales pressure. Notable factors include rumors of new and stricter regulations on Bitcoin mining in China, prolonged uncertainties about crypto regulations in the U.S., and fears that the Bank of Japan may increase interest rates, all of which have diminished investor risk tolerance. In this climate, investors are adopting more cautious positions. The put/call ratio for this week’s Bitcoin options is at 0.8, indicating that the number of call options slightly exceeds that of put options among the expiring contracts. According to Coinglass data, the “maximum pain” level is estimated at approximately $88,000. The highest concentration of open positions is at the $100,000 mark, with around $2.3 billion worth of open positions on Deribit. Additionally, $85,000 sees $2.1 billion in open positions, capturing attention. In terms of Ethereum $3,093.86, the situation is more balanced. As approximately 155,000 ETH options contracts reach expiration, their total monetary value stands at $460 million. The put/call ratio is measured at 1.1, with the maximum pain level hovering around $3,100. The total open interest in ETH options has dropped to $11 billion, continuing a downward trend since late August. Weakness Persists in the Spot Market Simultaneously with the options expiration, the outlook in spot markets is also concerning investors. The total cryptocurrency market cap has dipped below $3 trillion once again, reaching its lowest point since April. After a brief surge following the U.S. inflation data, Bitcoin struggled and fell back to $84,500 before arduously regaining the $85,000 level. Analysts point to structural weakness in this region from a technical perspective. Similarly, Ethereum remains under pressure. Its price fell briefly below $2,800 but managed to hold at this level for now. In the altcoin market, losses were more pronounced. XRP, Solana $132.93, and Cardano $0.4101 lost over 4% in value within the day, centered in the wave of selling. In addition to these developments, recent reports of a major U.S.-based crypto fund reducing its Bitcoin holdings in favor of increasing cash positions have negatively affected market risk perception. Experts highlight that such corporate moves could heighten volatility in the short term. A similar situation occurred in the previous month, where Bitcoin’s price was under pressure several days before a large options expiration, but followed a horizontal trend after expiration due to reduced volume. This phenomenon keeps expectations cautious concerning the post-expiration period.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Fed Payment Accounts: A Game-Changer for Crypto Firm Access?

Bitcoinworld•2025/12/19 16:57

U.S. Politicians Demand Stricter Measures Against Crypto Trading

Cointurk•2025/12/19 16:51

Solana price prediction: Will SOL hold $125 in late 2025?

Crypto.News•2025/12/19 16:51

A Giant Altcoin Whale Is in Mourning: Sold It All Out Today, Missed Out on $5 Million by Not Selling Earlier

BitcoinSistemi•2025/12/19 16:51

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,050.97

-0.02%

Ethereum

ETH

$2,968.25

+0.68%

Tether USDt

USDT

$0.9994

-0.02%

BNB

BNB

$848.83

+0.34%

XRP

XRP

$1.89

-0.96%

USDC

USDC

$0.9998

+0.00%

Solana

SOL

$125.57

-1.14%

TRON

TRX

$0.2784

-1.06%

Dogecoin

DOGE

$0.1314

+2.02%

Cardano

ADA

$0.3753

+0.94%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now