Author | Wu Says Blockchain

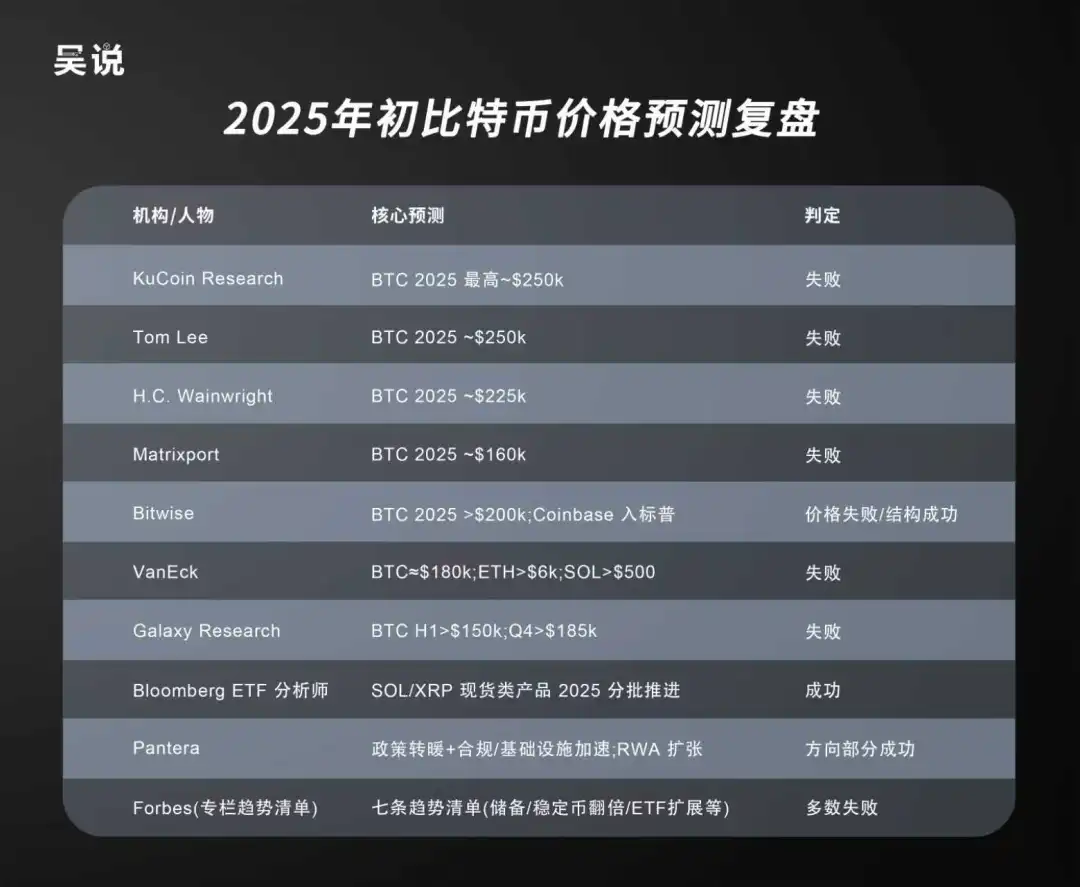

From the end of 2024 to the beginning of 2025, the crypto market was highly unified in its narrative for a new cycle: the aftermath of the halving, the diffusion of ETFs and institutionalization, and expectations of more favorable regulation were widely seen as the core drivers pushing BTC and overall risk assets higher. Against this backdrop, many institutions and well-known figures gave aggressive annual target prices (especially in the $200,000–$250,000 range), while others focused on “industry structural changes,” such as the expansion of compliant product supply, further mainstreaming of exchanges and crypto companies, and continued growth in tracks like RWA/stablecoins. Looking back at the actual market performance in 2025, price point forecasts generally overestimated the strength and sustainability of the rally, while predictions related to regulation and industry structure were relatively easier to realize.

KuCoin Research

KuCoin Research's “2025 Crypto Market Outlook” is based on the core view of “post-halving historical trends + institutional/ETF-driven growth,” predicting that BTC could test a high of around $250,000 in 2025. They also forecast the overall crypto market cap (excluding BTC) to reach about $3.4 trillion by the end of 2025, entering a stronger altcoin season. On the regulatory and product side, they expect more crypto ETFs such as Solana and XRP to be approved/launched in 2025. In terms of application and structural trends, they emphasize RWA tokenization, AI Agents, and the expansion of stablecoin scale (exceeding $400B by the end of 2025) as main themes.

Looking back: the main failure was in “price strength”—BTC’s annual peak was just above $126,000, falling back to around $88,000 by year-end, a clear gap from the $250,000 target. Successes/partial successes were more evident in “structural and supply-side trends”: 2025 did see the launch and trading of compliant products for SOL/XRP (e.g., BSOL began trading on 2025-10-28, XRPC on 2025-11-13), aligning with their “ETF diffusion, increased product supply” prediction. However, targets like “stablecoins >$400B by year-end” were closer to unfulfilled/possibly overly optimistic.

Tom Lee

In January 2025, Tom Lee publicly mentioned a BTC target of $250,000, mainly citing “regulatory tailwinds, market resilience, and improved liquidity.” The result: based on BTC’s actual price path in 2025, this target was significantly missed.

H.C.Wainwright

In January 2025, H.C.Wainwright raised their year-end BTC target to $225,000. Their reasoning included historical cycle patterns, expectations of a more favorable regulatory environment, and increased institutional interest. Ultimately, this target was clearly not met. The reason, similar to Tom Lee and most “$200,000-level” forecasts: they viewed the “favorable environment” as a linear upward driver, but underestimated the market’s sensitivity to macro risks and leverage crowding at high levels—meaning that once a pullback is triggered, the market tends to “clear risk” first, rather than continue to price in the narrative at ever-higher future levels.

Matrixport

In December 2024, Matrixport described 2025 as BTC’s “breakout year,” giving a relatively “lower than the $200,000–$250,000 camp” target price of $160,000. Compared to $225,000/$250,000, this target had a lower “threshold” and seemed more like a reasonable upper bound after sentiment and liquidity improved, but it still was not achieved in 2025.

Bitwise

In December 2024, Bitwise’s “Top 10 Predictions for 2025” started off aggressively: they believed BTC, ETH, and SOL would hit all-time highs, and BTC would trade above $200,000 in 2025. They also bet on a set of more “industry structure” judgments—such as Coinbase entering the S&P 500, a significant expansion in stablecoin and tokenized asset scale, and a reopening of the crypto IPO market.

In terms of results, the “price point” prediction was significantly missed: although BTC peaked in October 2025, it was still well below its annual high by year-end, let alone $200,000. On the other hand, the “mainstream adoption” part was closer to reality: Coinbase was officially included in the S&P 500 in May 2025, and the IPO/listing wave also saw landmark progress in 2025.

VanEck

VanEck’s “Top 10 Predictions for 2025” not only gave price targets but also a very specific cycle path: they predicted the bull market would reach a mid-term peak in Q1, with cycle top targets of BTC around $180,000, ETH above $6,000, SOL above $500, and SUI above $10. They then expected BTC might pull back 30%, with altcoins seeing up to 60% retracements, before regaining momentum by year-end.

Comparing to the actual 2025 path, the framework of “sharp pullbacks, high volatility” was not far off, but the key hard targets ($180,000/$6,000/$500/$10) were not achieved overall.

Galaxy Research

In its 2025 forecast released at the end of 2024, Galaxy Research wrote BTC’s core logic very plainly: adoption at the institutional, corporate, and national levels would push BTC above $150,000 in the first half of the year, and test or exceed $185,000 in Q4. They also made a package of industry predictions, including stablecoin growth, DeFi expansion, and increased institutional participation.

In reality, BTC did experience a clear upward phase in 2025, but overall did not approach their $150,000/$185,000 targets. The likely reason: adoption is a “slow variable”—it can change long-term boundary conditions, but is hard to offset the “fast variables” of macro shocks, crowded positions, and leverage liquidations. When significant pullbacks occurred during the year, the market tended to first price in risk contraction and deleveraging, rather than continue to discount the adoption narrative to ever-higher future extremes.

Bloomberg

At the end of 2024, Bloomberg ETF analysts (such as Eric Balchunas) publicly discussed the “approval pace of altcoin spot ETFs” as an important variable for 2025: they believed Solana and XRP spot ETFs could enter the real path in 2025, but also clearly indicated that approvals would not “all land at the same time,” but would more likely be stretched out by regulatory processes and advanced in batches.

Looking back, this judgment was largely accurate (both in direction and pace): on October 28, 2025, Bitwise’s Solana Staking ETF (BSOL) began trading; then on November 13, 2025, the Canary XRP ETF (XRPC) also began trading on Nasdaq. The two indeed launched “one after another, not simultaneously.”

Pantera

Pantera’s 2025 crypto outlook focused on “warmer policy environment + accelerated industry compliance/infrastructure,” with a particular emphasis on the continued expansion of RWA/real-world asset tokenization and other structural trends.

Looking back, the successful part was mainly in “direction”—policy/regulatory promotion and industry structural progress were clearly evident during the year; the failed/underwhelming part was mainly in “price strength”—Pantera itself also admitted that 2025’s price performance was below many people’s expectations, with the market experiencing stronger volatility and pullbacks after surging.

Forbes

Some Forbes columns/opinion pieces also gave “Seven Major Trends for the Crypto Industry in 2025” at the beginning of the year, including “major economies establishing strategic bitcoin reserves,” “stablecoin market cap doubling to $400 billion,” “BTC DeFi rapidly growing with L2,” and “crypto ETFs expanding to Ethereum staking and Solana,” among others.

Looking back, some of these “trend lists” were closer to being realized (for example, there was indeed progress in ETF product lines and regulatory environment improvement during the year), but predictions that assumed multiple aggressive variables would “all go smoothly throughout the year” were generally too optimistic—especially targets like “$8 trillion total market cap,” “tech giants following Tesla in increasing BTC holdings,” and “stablecoins doubling to $400 billion by year-end,” which were much harder to achieve in a single year. The result was “a few confirmed, most unmet.”

Conclusion

Overall, the wins and losses of these early 2025 forecasts are not complicated: the more they bet on a single price point, and the more extreme the target ($200,000–$250,000), the more likely they were to fail; the more they bet on regulatory processes, product supply, and industry structural changes, the more likely they were to be partially or directionally correct. The 2025 market was more like a “new high—pullback—repricing” high-volatility path: macro risks and leverage clearing repeatedly interrupted trends, so “logical correctness” did not necessarily translate into “year-end price realization.” In contrast, supply-side changes such as the launch of compliant products and increased mainstream institutional participation were more verifiable, and thus performed more steadily in hindsight.