Retail confidence often weakens when prices remain flat, a period when institutions typically increase exposure. In recent weeks, Ripple [XRP] has shown a growing divergence between institutional activity and broader market sentiment.

On social media, commentary around XRP turned sharply negative, reflecting rising pessimism among retail traders. Yet, capital continued to flow into XRP-linked investment products.

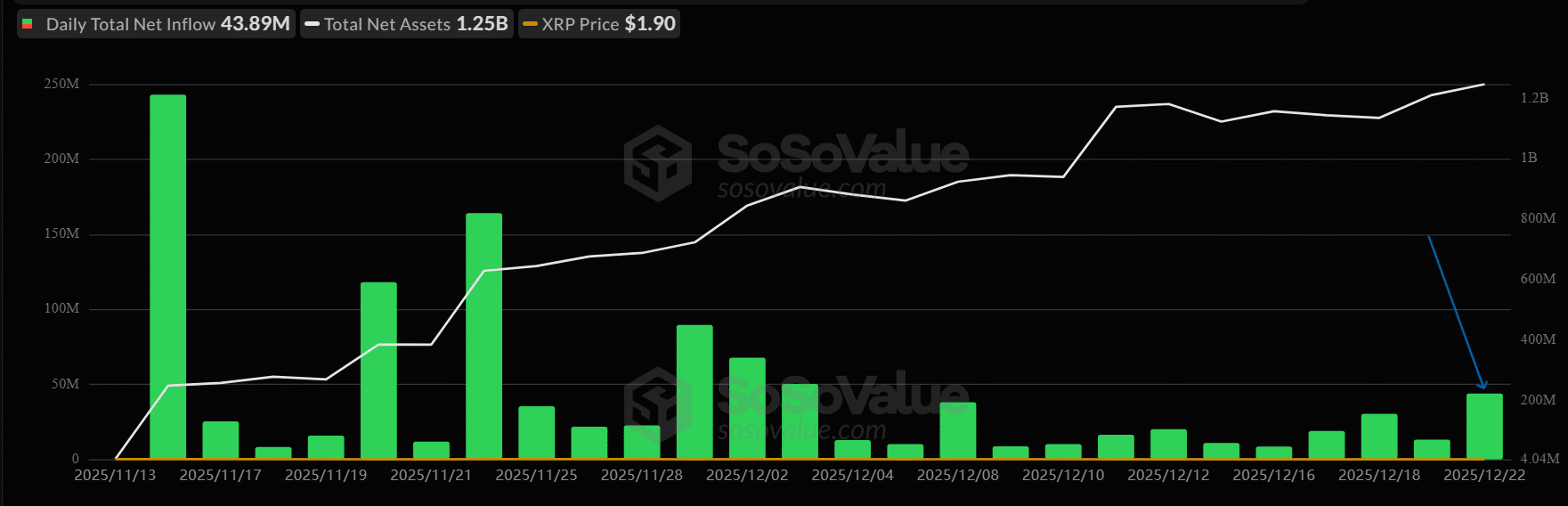

XRP ETFs recorded $43.89 million in inflows over the past two weeks, marking their strongest stretch since launch. This extended their winning streak to six consecutive weeks without any outflows.

The divergence highlights a critical inflection point where sentiment and capital flows are moving in opposite directions.

Could institutional adoption outweigh deteriorating sentiment pressure in XRP’s near-term market structure?

Institutional RWA expansion strengthens XRPL adoption

On the 25th of November, Archax enabled access to UK asset manager abrdn’s tokenized U.S. dollar money market fund on the XRP Ledger.

The fund is part of abrdn’s $3.8 billion U.S. dollar Liquidity Fund (Lux) and represents the first of its kind on XRPL. Ripple contributed $5 million to the fund as part of its broader real‑world asset strategy.

This launch expanded XRPL’s role in institutional decentralized finance and real‑world asset tokenization.

It also built on Archax and Ripple’s ongoing collaboration to deliver regulated capital markets infrastructure on‑chain.

The initiative is designed to improve settlement efficiency and reduce operational friction for institutional participants. As Duncan Moir, Senior Investment Manager at abrdn, explained:

“The next evolution of financial market infrastructure will be driven by broader adoption of digital securities,”

He earlier highlighted efficiency gains from moving investment and settlement processes fully on-chain. The XRP Ledger was cited for its institutional-grade functionality and built-in compliance features.

Sentiment deterioration contrasted with ETF inflows

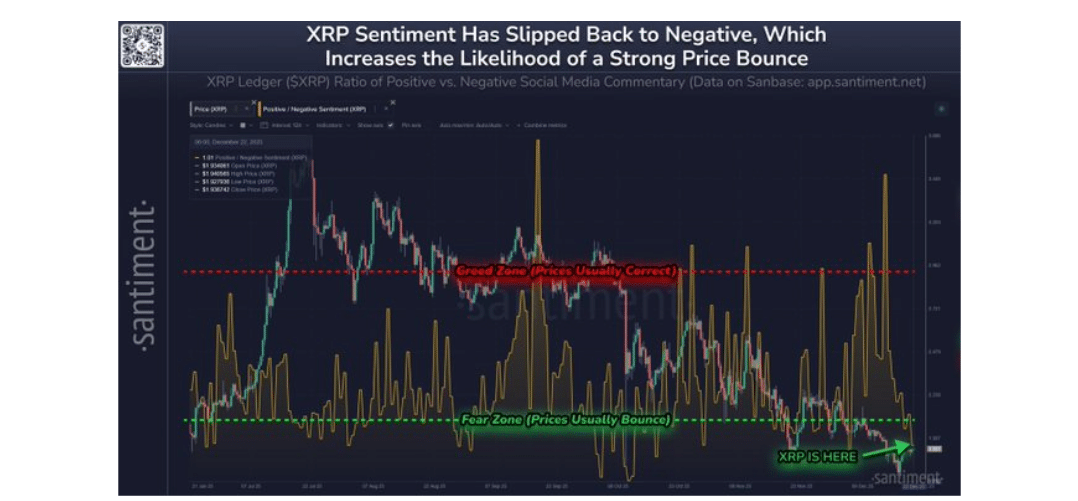

At press time, XRP Social Sentiment fell well below historical norms, as negative commentary intensified across trading platforms.

Retail participation weakened as pessimism increased, even while institutional-facing developments continued progressing quietly.

Source: Santiment

The sentiment shift reflected declining retail confidence in XRP’s short-term price prospects.

Despite this, XRP recorded $43.89 million in ETF inflows on the 23rd of December, the highest level over the prior two weeks. XRP ETFs have continued attracting capital without interruption since launch, indicating sustained institutional participation.

Source: SosoValue

Cumulative ETF inflows surpassed $1.2 billion, highlighting continued institutional accumulation despite retail disengagement.

Final Thoughts

- XRP institutional adoption and ETF inflows strengthened despite sharply deteriorating social sentiment.

- The divergence left XRP positioned between sentiment-driven pressure and sustained institutional demand.