Three Financial Giants Predict Why Crypto Faces Its Hardest Test Yet in 2026

By:BeInCrypto

This year, crypto looked less like an experiment and more like a maturing market, shaped by institutional consolidation, faster-moving regulation, and growing macroeconomic pressure. As the industry moves toward 2026, its direction will depend on which assets can withstand institutional scrutiny and how recession risk, monetary policy shifts, and stablecoin adoption reshape cryptos place within the dollar-based financial order. Institutional Capital Forces Crypto Consolidation Throughout 2025, BeInCrypto spoke with veteran investors and leading economists to assess where the crypto industry is headed and what lies ahead for a sector long defined by uncertainty. Shark Tank investor Kevin OLeary starts from a simple premise. As institutional capital moves in, crypto shifts away from endless token hunting and toward a narrow set of assets that can justify long-term allocation. He pointed to his own experience as a case study. OLeary began as a crypto skeptic, but as regulation started to take shape, he chose to gain exposure. At first, that meant buying broadly. His portfolio grew to 27 tokens. He later concluded that the approach was excessive. Today, he holds just three cryptocurrencies, which he said are more than enough for his needs. If you statistically look at the volatility of just Bitcoin and Ethereum and a stablecoin for liquidity Thats all I need to own, OLeary told BeInCrypto in a podcast episode. For OLeary, each asset serves a specific function. He described Bitcoin as an inflation hedge, often comparing it to digital gold defined by scarcity and decentralization. Ethereum, by contrast, serves not as a currency but as core infrastructure for a new financial system, with long-term growth tied to its technology. Stablecoins, he noted, were held for flexibility rather than upside. 🦈 Kevin OLeary says Ethereum is not just a trend but a market shift.What drives this shift: scalability, trust, or something bigger? BeInCrypto (@beincrypto) September 9, 2025 That framework informs his outlook for 2026. As regulation advances and institutional participation deepens, OLeary expects capital to concentrate around Bitcoin and Ethereum as the markets core holdings. Other tokens will struggle to justify sustained allocation and will compete largely on the margins. In that environment, crypto investing shifts away from speculation and toward disciplined portfolio construction, closer to how traditional asset classes are managed. But even as investors narrow their holdings, the issue of who ultimately controls cryptos monetary rails is becoming more complicated. Dollar Control Moves Onchain While investors like OLeary focus on narrowing exposure, Greek economist and former finance minister Yanis Varoufakis pointed to a different shift. In a BeInCrypto podcast episode, he argued that control over cryptos monetary infrastructure is tightening, particularly as stablecoins move under closer state and corporate oversight. Varoufakis pointed to recent US policy as a turning point. By advancing legislation such as the GENIUS Act, Washington is embracing a stablecoin-based extension of the dollar system. Rather than challenging the existing financial order, stablecoins are being positioned to reinforce it. He linked this approach to the logic of the so-called Mar-a-Lago Accord, which seeks to weaken the dollars exchange value while preserving its dominance in global payments. That contradiction sits at the center of his concern. Varoufakis warned that this model outsources monetary power to private issuers, increasing financial concentration while reducing public accountability. The risks, he said, extend beyond the US, as dollar-backed stablecoins spread across foreign economies. As we speak, there are Malaysian companies, Indonesian companies, and companies here in Europe that increasingly use Tether which is a huge problem. Suddenly, these countries end up with central banks that do not control their money supply. So their capacity to effect monetary policy diminishes and that introduces instability, Varoufakis said in a BeInCrypto podcast episode. Looking ahead to 2026, he described stablecoins as a systemic fault line. A major failure could trigger a cross-border financial shock, exposing cryptos deepest vulnerability, not volatility, but its growing entanglement with legacy power structures. These risks remain largely theoretical in calm conditions. The real test comes when growth slows, liquidity tightens, and markets begin to strain. Former economic advisor to Ronald Reagan, Steve Hanke, warned that such a stress test is approaching. Economic Slowdown Stress Tests Markets In a BeInCrypto podcast episode, the Johns Hopkins professor of applied economics said the US economy is heading toward a recession, driven not by inflation but by policy uncertainty and weak monetary growth. Hanke pointed to inconsistent tariff policy and expanding fiscal deficits as key drags on investment and confidence. When you have that, investors that are investing in, lets say, a new factory or something, hunker down and say, well, were going to wait and let the dust settle to see whats going to happen. They stop investing, Hanke said. As economic conditions deteriorate, Hanke expects the Federal Reserve to continue to respond with looser monetary policy. He did not address crypto directly. His macro outlook, however, defines the conditions under which crypto will be tested. Tight liquidity followed by sudden easing has historically exposed weaknesses across financial markets, particularly in systems reliant on leverage or fragile confidence. For crypto, the implication is structural rather than speculative. In an environment shaped by recession risk and policy volatility, stress reveals what growth conceals. What endures is not what expands fastest, but what is built to withstand contraction. Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

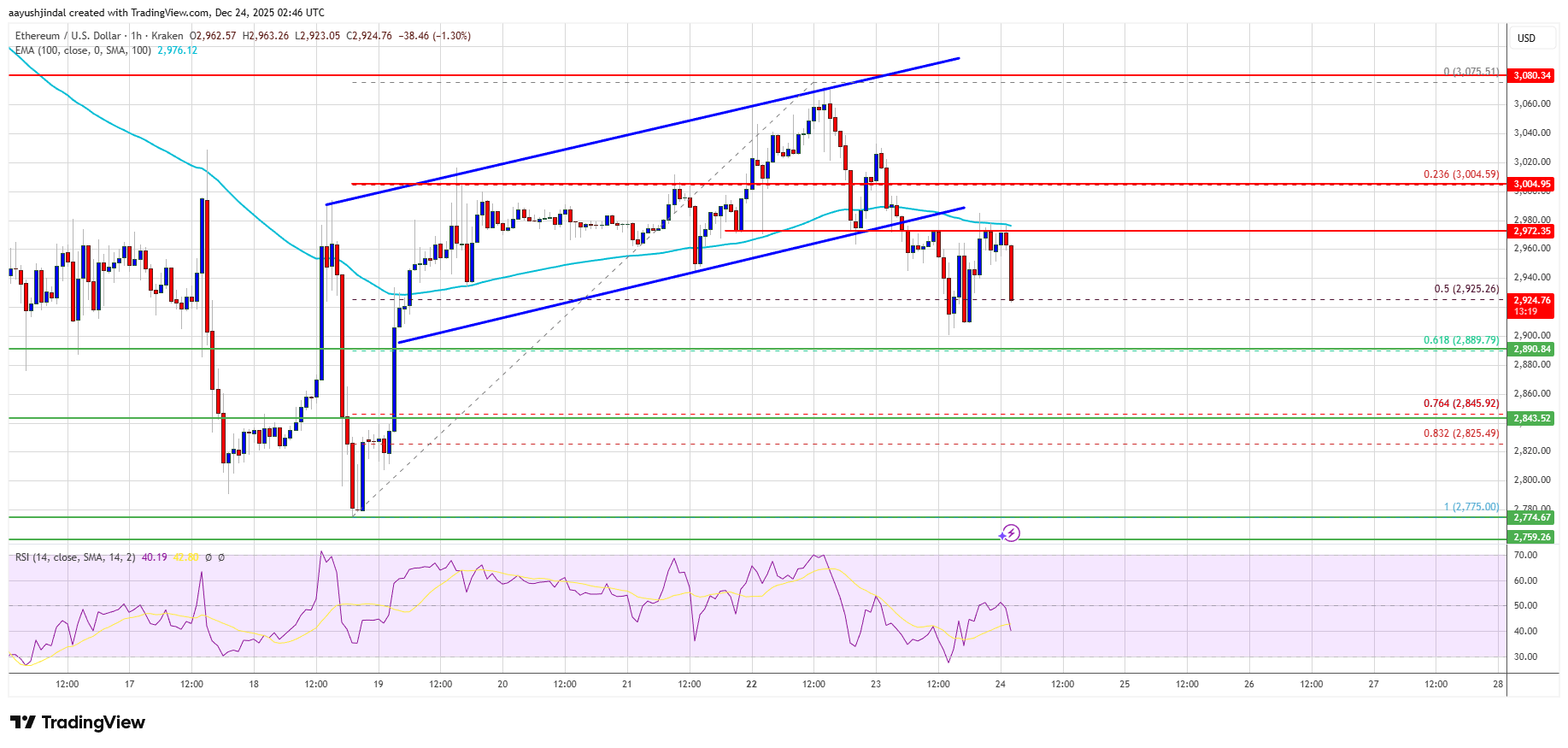

Ethereum Price Flashes Bearish Bias, Bulls Lose Short-Term Control

Newsbtc•2025/12/24 03:30

Post-Bear Market Structure: 5 Altcoins to Watch as 2026 Wave Formation Begins

Cryptonewsland•2025/12/24 03:27

Bitcoin Stuck Between $85K and $90K? $24B Options Trap Expires in 2 Days

BeInCrypto•2025/12/24 03:24

Sanctions push Russia toward a tighter, broader crypto rulebook

Crypto.News•2025/12/24 03:18

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,317.95

-0.96%

Ethereum

ETH

$2,945.35

-1.59%

Tether USDt

USDT

$0.9993

-0.01%

BNB

BNB

$840.63

-1.60%

XRP

XRP

$1.86

-1.66%

USDC

USDC

$0.9998

-0.01%

Solana

SOL

$122.65

-2.39%

TRON

TRX

$0.2832

-0.30%

Dogecoin

DOGE

$0.1285

-2.95%

Cardano

ADA

$0.3599

-2.32%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now