News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After Polymarket's valuation reached $9 billion, what other money-making opportunities do we have?

Before trading perpetual contracts, you must understand that this is a zero-sum game.

MetaDAO platform token has surged more than fourfold this month.

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

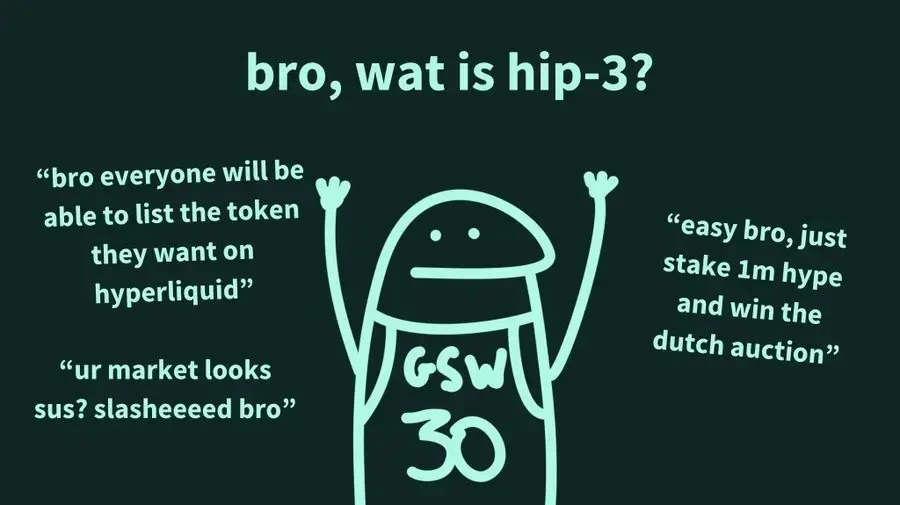

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

Yieldbasis recently completed a $5 million funding round (accounting for 2.5% of total supply) through Kraken and Legion, with a fully diluted valuation (FDV) of $200 million.

- 04:40Sun Wukong has launched contract trading for AIA, COAI, STBL, and AVNT.ChainCatcher news, the world's first Chinese decentralized perpetual contract exchange, Sun Wukong, has added new USDT-margined contract trading pairs: AIA/USDT, COAI/USDT, STBL/USDT, and AVNT/USDT, supporting up to 20x leverage. According to official social media sources, Sun Wukong launched a special welcome event on October 12, offering users an airdrop reward of 5 million SUN tokens. Currently, 86% of the prize pool has been claimed. The event will last for 72 hours and is still ongoing.

- 04:40The total market capitalization of stablecoins has increased by approximately $10 billion over the past three weeks, now surpassing $310 billions and reaching a new all-time high.ChainCatcher reported that the total market capitalization of stablecoins has surpassed $310 billion, setting a new all-time high. It currently stands at $310,788,054,325, with a 24-hour market cap increase of 0.3%. Among them, Tether (USDT) ranks first with a market cap of $179.969 billion, while USDC ranks second with a market cap of $75.835 billion. Historical data shows that the total market capitalization of stablecoins surpassed $300 billion around September 25, which means it has grown by approximately $10 billion over the past three weeks.

- 04:23Garrett Jin sarcastically explains precise short selling: There aren't that many conspiracies in the world; being bullish in the long term doesn't prevent short selling in the short term.Jinse Finance reported that Garrett Jin, the whale who accurately shorted before the previous crash and publicly sold over $4.23 billions worth of BTC to switch positions to ETH, stated: Our clients hold a large amount of spot cryptocurrencies, and the short positions before the crash were only partial hedges. If liquidity is sufficient, we could build more positions. Considering the losses in spot positions, clients are actually bearing losses overall. We are optimistic about the crypto market in the long term, but that doesn't mean we won't hedge in the short term. If shorting during price drops is to be condemned, then should longs during price increases also be criticized? Currently, the crypto market is highly correlated with the US stock market. If you don't keep up with the latest information, you'll fall behind. Everyone wants to profit from the market—do you have any expertise or training that allows you to beat the market? If you can't answer that, then you are the source of profit. There aren't that many conspiracies in this world, so stop making excuses for your ignorance and lack of professionalism.