News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

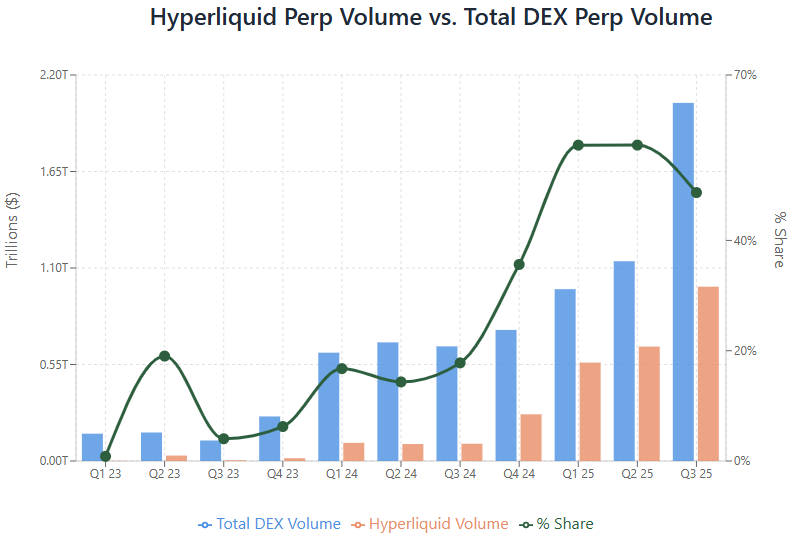

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

The US and UK have jointly taken action against one of the largest investment fraud networks in history, seizing a record amount of funds.

On the surface, it is a DEX, but in reality, 40% of the initial supply will be used to fund public goods.

You can say it doesn't understand mining, but never say it doesn't understand gaming.

Where does the next opportunity lie?

- 07:33The U.S. Department of Justice confirms it has seized 127,271 BTC related to a pig-butchering scam case.ChainCatcher News, according to a joint announcement by the U.S. Attorney's Office for the Eastern District of New York and the National Security Division, the U.S. government has filed a civil forfeiture lawsuit for approximately 127,271 bitcoins (currently valued at about $15 billion), and confirmed that these funds are now in U.S. custody. The announcement stated that these crypto assets were obtained by the defendants through fraud and money laundering activities, and were originally stored in non-custodial wallets controlled by them. The U.S. authorities have now obtained the private keys and taken over the storage addresses of the funds. The Department of Justice stated that this is the largest crypto asset seizure operation in U.S. history.

- 07:334E: The Crypto Market May Introduce a "Circuit Breaker Mechanism" as Powell Sends Strong Rate Cut SignalsOctober 15 news, according to 4E observation, the recent sharp decline in the crypto market has exposed structural issues in exchange liquidation and risk control. Some platforms profited during extreme market conditions, while others lost hundreds of millions of dollars. Industry reports point out that automated liquidation systems designed to provide liquidity have instead amplified market chaos during violent fluctuations, prompting institutions to re-examine risk management. 10x Research noted that the industry is exploring whether to adopt traditional finance's "Circuit Breakers" to limit extreme volatility. If implemented, this mechanism could permanently change the volatility structure and profit logic of the crypto market. The report recalls that a similar systemic reflection last occurred after Elon Musk announced in 2021 that Tesla would stop accepting bitcoin payments. On the macro side, Federal Reserve Chairman Powell warned in a speech early this morning that the U.S. labor market is cooling, hinting at support for another 25 basis point rate cut. He pointed out, "The downside risk to employment has increased," and even if official data is delayed due to a government shutdown, the Fed's internal research is sufficient to support a rate cut decision. As a result, the yield on 30-year U.S. Treasury bonds fell to 4.60%, hitting a new low since April.In addition, Republican Congressman Troy Downing has proposed the "Retirement Investment Choice Act," which aims to include cryptocurrencies and private equity in the investment scope of 401(k) retirement plans. This means that the executive order from the Trump era is expected to be formally legislated, paving the way for crypto assets to further integrate into mainstream investment channels.4E reminds investors: If the "Circuit Breakers" mechanism is officially introduced, it will mark a key step for the crypto market towards institutionalization and risk control. However, short-term liquidity and volatility structures may undergo drastic changes, so close attention should be paid to the chain reactions of market system reforms.

- 07:32Hong Kong licensed asset management company Tiantu Investment completes issuance of 200 million RMB corporate bondsAccording to Jinse Finance, as reported by the Hong Kong Stock Exchange, Hong Kong licensed asset management company Tiantu Investment has announced the completion of the issuance of its 2025 privately placed corporate bonds (Phase I) for professional investors. The total size is 200 millions RMB. Previously, Tiantu Investment announced in August this year that it plans to jointly establish a virtual asset investment fund with HashKey Capital and explore more forms of cooperation.

Trending news

More[Bitpush Daily News Highlights] The US plans to confiscate 127,000 BTC, potentially increasing its bitcoin holdings to 324,000 BTC; Powell hints at possible rate cuts due to weak hiring and rising unemployment; Japan to introduce new regulations banning crypto insider trading; US Republicans propose a bill to codify Trump’s executive order allowing 401(k) investments in cryptocurrency and private equity.

Hong Kong licensed asset management company Tiantu Investment completes issuance of 200 million RMB corporate bonds

![[Bitpush Daily News Highlights] The US plans to confiscate 127,000 BTC, potentially increasing its bitcoin holdings to 324,000 BTC; Powell hints at possible rate cuts due to weak hiring and rising unemployment; Japan to introduce new regulations banning crypto insider trading; US Republicans propose a bill to codify Trump’s executive order allowing 401(k) investments in cryptocurrency and private equity.](https://img.bgstatic.com/multiLang/image/social/b0411719ec6c4657208c834dbbc069d31760470562725.png)