News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Holesky testnet shutdown begins this week, with operators deactivating nodes over ten days. Ethereum Foundation cites completion of Fusaka testing and technical evolution as reasons for closure. Validators should migrate to Hoodi, while developers move to Sepolia for application testing. The shift marks Ethereum’s new modular testnet era, ensuring faster, cleaner, and scalable testing environments.References 🚨 UPDATE: Ethereum Foundation announces Hol

A monologue from an ETH Maxi.

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

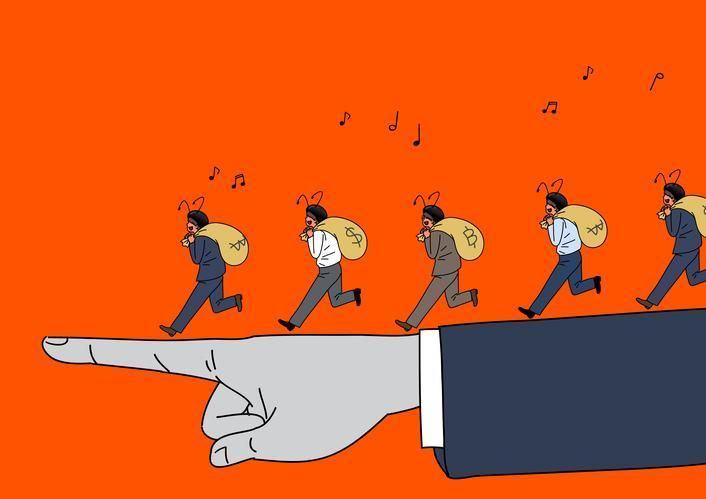

For exchanges and market makers, keeping retail investors trading continuously, engaging in repeated speculation, and retaining them long-term is far more profitable than "flushing out retail investors once a year."

Everyone should have their own mission, no matter how big or small, as long as it makes you happy.

A brutal "Squid Game".

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

- 08:33Current mainstream CEX and DEX funding rates indicate the market is slightly returning to neutral after further declines.BlockBeats News, October 21, according to Coinglass data, the current funding rates on major CEX and DEX platforms show that although the market has started a new round of decline since early this morning, funding rates for multiple asset trading pairs have further returned to neutral. Overall, the sentiment still leans bearish. The specific funding rates are shown in the figure below. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the underlying asset prices, usually applied to perpetual contracts. It is a mechanism for capital exchange between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts for traders, so that contract prices remain close to the underlying asset prices. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish.

- 08:33"Calm Order King" takes profit on a 20x leveraged SOL short order, still holds $26.78 million positionBlockBeats News, October 21 — According to on-chain AI analysis tool CoinBob (@CoinbobAI_bot), tracking and analysis show that in the past hour, the smart money trader known as "Calm Order King" has closed more than 2,000 SOL short positions, and has simultaneously placed batch orders to close shorts at prices between $181.7 and $182.5. Monitoring data indicates that this address opened SOL positions at an average price of $189.4, with a floating yield exceeding 60%. In the past 24 hours, profits have reached nearly $1.07 million, and the current total notional value of holdings is approximately $26.78 million. This trader has grown his principal from $3 million at the beginning of this month to nearly $20 million. He prefers high-leverage positions in major cryptocurrencies. He has repeatedly executed precise short trades on SOL, with single-trade profits reaching $5.1 million and a monthly win rate of over 90%. He is now closely watched by the on-chain swing trading community.

- 08:32A certain whale address bought 183.12 WBTC on-chain an hour ago, possibly starting a new round of trading.BlockBeats News, on October 21, according to on-chain analyst Ai Aunt (@ai_9684xtpa), address 0x6e1...90733 purchased 183.12 WBTC on-chain at an average price of $109,219 in the past hour, possibly starting a new round of trading; previously, in July, he made a profit of approximately $651,000 through WBTC trading.