News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 28)|S. today. Trump nominates Michael Selig as CFTC Chairman. Stablecoin USD1 enters partnership with Enso.2Research Report|In-Depth Analysis and Market Cap of Common Protocol (COMMON)3Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

DEX Terminal Finance, incubated by Ethena, surpasses $280 million in TVL before launch

The spot decentralized exchange platform Terminal Finance is specifically designed for trading yield-bearing stablecoins and institutional assets.

BlockBeats·2025/10/28 19:43

River will launch its public offering on October 29.

This public offering uses a 48-hour Dutch auction with uniform settlement at the lowest price. After the auction ends, immediate claiming and refunds will be available.

BlockBeats·2025/10/28 19:43

The Fed's Five-Way Power Struggle: Crypto Market Faces a Critical Turning Point

AICoin·2025/10/28 19:37

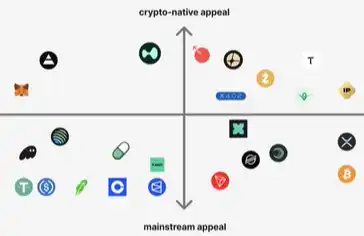

What drives the price surge of cryptocurrencies with no revenue?

Bitpush·2025/10/28 19:19

Is this week’s crypto news a “trick or treat” week?

This week's top cryptocurrency headlines include Solana's new stablecoin, Microsoft's investment in OpenAI, Nvidia's investment in Nokia, and the Federal Reserve's interest rate cut decision. Is the market "trick or treat" or "treat"?

Cryptoticker·2025/10/28 19:13

SharpLink plans $200M Ethereum deployment with Linea partnership

Cryptobriefing·2025/10/28 18:27

Price predictions 10/27: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE

Cointelegraph·2025/10/28 18:00

Bitcoin analysts say this must happen for BTC price to take out $115K

Cointelegraph·2025/10/28 18:00

Flash

- 20:09Data: Multiple tokens experience a surge followed by a pullback, AVA drops over 12%According to ChainCatcher, spot data from a certain exchange shows that the market has experienced significant volatility. Multiple tokens have shown a "surge and pullback" pattern, with AVA dropping by 12.81% over 24 hours, followed by AUDIO with a decline of 7.7%. In addition, ADX, LRC, AI, and GPS have also experienced a "surge and pullback" pattern, with declines of 6.2%, 7.8%, 6.5%, and 10.32% respectively. The remaining token INIT also showed a "surge and pullback" pattern, with a decline of 7.2%.

- 20:09The three major U.S. stock indexes continue to hit new highs, Nvidia rises nearly 5%ChainCatcher news, according to Golden Ten Data, at the close of the US stock market on Tuesday, the three major indexes continued to hit new highs. The Dow Jones initially closed up 0.34%, the S&P 500 rose 0.2%, and the Nasdaq gained 0.8%. Nvidia (NVDA.O) rose nearly 5%, with a market value closing at 4.89 trillions USD. Tesla (TSLA.O) rose nearly 2%, Intel (INTC.O) gained 5%, and Nokia (NOK.N) surged 23%. The Nasdaq Golden Dragon China Index closed down 1.2%, Alibaba (BABA.N) fell more than 1%, and Bilibili (BILI.O) rose 5%.

- 20:02Jensen Huang refutes AI bubble claims, says new chips will generate $500 billion in revenueJinse Finance reported that Nvidia (NVDA.O) CEO Jensen Huang on Tuesday dismissed concerns about an artificial intelligence bubble, stating that the company’s latest chips will generate $500 billion in revenue over the next five quarters. At the GTC conference held in Washington, Huang pointed out that the Blackwell processor and the next-generation Rubin model are driving unprecedented sales growth. The conference highlighted the company’s collaborations with a certain exchange, Palantir, and CrowdStrike, among others, to integrate AI into various products. Nvidia also launched a new system connecting quantum computers with AI chips. “We have reached an inflection point in a virtuous cycle,” Huang told thousands of attendees at a conference center near the White House. “This is truly extraordinary.” The core of Huang’s speech focused on a turning point in the AI industry, arguing that current AI models are now powerful enough that customers are willing to pay for them, which legitimizes the construction of expensive computing infrastructure. This view eased market concerns about an AI investment bubble and pushed Nvidia’s stock price up more than 5% on Tuesday, breaking through $200 for the first time.