News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Bitcoin community is facing internal division over the purpose of the blockchain, with the core controversy centered on whether to modify the code to accommodate more non-financial transaction data. The Core camp supports relaxing restrictions to expand use cases and increase miner revenue, while the Knots camp opposes this and has launched its own client software. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

Bulls face another “bloodbath”! After losing the key psychological level of $4,000, gold faces more tests this week...

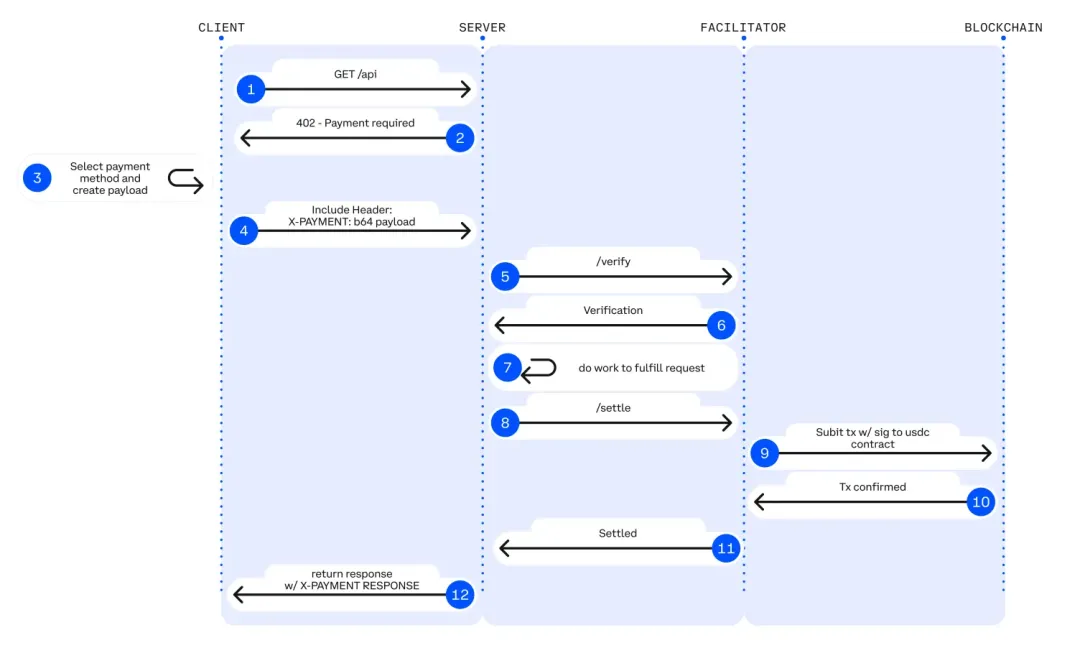

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

- 23:32Ethereum financial firm ETHZilla sells $40 million worth of ETH to advance $250 million stock buyback planChainCatcher news, according to The Block, Ethereum financial company ETHZilla (ticker ETHZ) has sold approximately $40 million worth of Ethereum holdings to repurchase shares. In August, the ETHZilla board authorized a share repurchase program of up to $250 million. Since selling Ethereum on October 24, ETHZilla has spent about $12 million to repurchase approximately 600,000 common shares. In a press release on Monday, the company stated: "ETHZilla plans to use the remaining proceeds from the Ethereum sale for additional share repurchases and intends to continue selling Ethereum to repurchase shares until the discount of its share price to net asset value (NAV) returns to normal levels." Chairman McAndrew Rudisill said that when ETHZ's "share price trades at a significant discount to NAV," the company will continue to repurchase shares, which both reduces the number of common shares in circulation and increases its NAV valuation. According to the announcement released on Monday, the company still holds about $400 million worth of Ethereum on its balance sheet.

- 23:25Overview of Major Overnight Developments on October 2821:00-7:00 Keywords: US stocks, interest rate cut, Mercor 1. All three major US stock indexes continued to reach new highs; 2. Grayscale Solana Trust ETF is scheduled to be listed on October 29; 3. Bitwise confirmed that its Solana Staking ETF will open for trading tonight, with the ticker BSOL; 4. The probability of the Federal Reserve cutting interest rates by 25 basis points in October is 97.3%; 5. Canary Capital confirmed that its LTC and HBAR ETFs will open for trading on Nasdaq tonight; 6. AI startup Mercor raised $350 million at a $10 billion valuation.

- 23:14Bitwise Solana Staking ETF to be listed on the New York Stock Exchange on TuesdayChainCatcher news, according to market sources, asset management company Bitwise announced on the X platform that it will launch the Bitwise Solana Staking ETF on Tuesday at the New York Stock Exchange, with the ticker symbol BSOL. The company stated that this is the first ETP to be "100% directly invested in spot SOL." Meanwhile, other companies are also planning to launch a series of cryptocurrency ETFs. One exchange stated that it plans to list its Litecoin ETF and HBAR ETF on Tuesday. According to a person familiar with the matter, another exchange plans to list on Wednesday. After a one-week U.S. government shutdown, the SEC issued guidance on the listing procedures for company cryptocurrency ETFs. The SEC stated that companies can submit S-1 registration statements for listing without needing to delay amendments. As companies submit their final S-1 registration statements, this means they can become effective within 20 days. Before the shutdown, the SEC approved listing standards for three exchanges and amended related rules, so dozens of cryptocurrency ETF applications may be approved more quickly. Companies hoping to launch cryptocurrency ETFs without SEC approval need to meet listing standards. To launch an ETF, companies need to submit the final S-1 registration statement and Form 8-A, some of which have already started to be submitted.