News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 06) | Monad Plans to Launch Mainnet and Native Token MON on November 24; U.S. Government Shutdown May Delay Crypto Market Structure Legislation Until 20262Bitcoin and Ether ETFs record fifth consecutive day of outflows as crypto prices remain under pressure3Monero (XMR) jumps to 5-month high as privacy coins lead surprise market rally

Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock

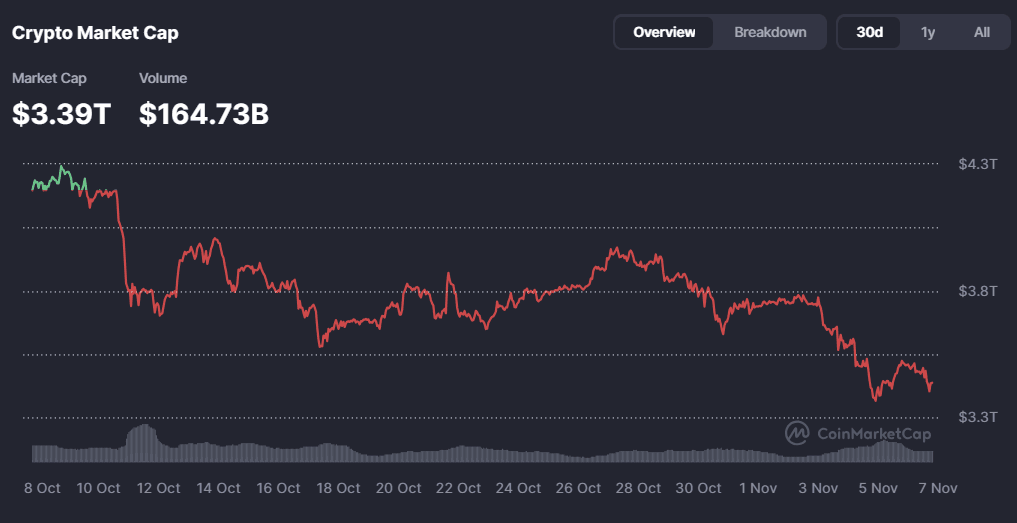

A Citi report indicates that the liquidation event in the crypto market on October 10 may have damaged investors' risk appetite.

ForesightNews·2025/11/07 02:13

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Bitcoin holds above $100,000, but for how long?

market pulse·2025/11/06 22:42

Bitcoin’s valuation metric hints at a ‘possible bottom’ forming: Analysis

Cointelegraph·2025/11/06 21:24

Flash

- 02:43Sam Altman: OpenAI does not seek government guarantees for data centers, expects revenue to grow to $100 billions by 2030Foresight News reported that Sam Altman published a lengthy article stating that OpenAI does not seek or wish for government guarantees for data centers, and believes that governments should not pick winners or use taxpayer funds to bail out failing companies. If OpenAI fails, other companies will continue the work. He suggested that governments should build and own AI infrastructure themselves, with the profits belonging to the government, and may provide low-cost capital to establish a national reserve of computing power, but this should be for the benefit of the government rather than private companies. OpenAI expects its annualized revenue to exceed $20 billions this year and reach several hundred billions of dollars by 2030, with approximately $1.4 trillions in investment commitments anticipated over the next eight years. Revenue sources will include enterprise products, new consumer devices, robotics, AI scientific discoveries, and other categories; direct sales of computing power; and possible future issuance of equity or debt. OpenAI does not seek to be "too big to fail"; if it fails, the market should handle it. In addition, it hopes that artificial intelligence can be widely accessible and affordable. This technology is expected to have enormous market demand and improve people's lives in many ways.

- 02:43Data: Ark Invest increases its holdings of BitMine shares by approximately $8.06 millionAccording to ChainCatcher, monitored by Ark Invest Tracker, Ark Invest led by Cathie Wood increased its holdings by 215,709 shares of BitMine stock (approximately 8.06 million US dollars) yesterday.

- 02:42Hourglass: Stable deposit event will reopen for another 24 hoursForesight News reported that Hourglass tweeted, "Due to excessive access to the Stable pre-deposit vault, we are making the following adjustments to ensure all users can participate fairly and have sufficient time. Users can deposit through the Hourglass frontend or directly on-chain; the deposit function will reopen for 24 hours, with a maximum deposit of $1 million per wallet and a minimum deposit of $1,000 remaining unchanged. Before completing KYC verification, funds can always be withdrawn at a 1:1 ratio; if users have previously made successful deposits, those deposits are still included and will be considered eligible; users have 72 hours after the deposit window closes to submit KYC information; if the total eligible deposits exceed $500 million, allocation will be made on a pro-rata basis. The final allocation (denominated in USDT) will be settled to the Stable mainnet no later than December 31."