News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

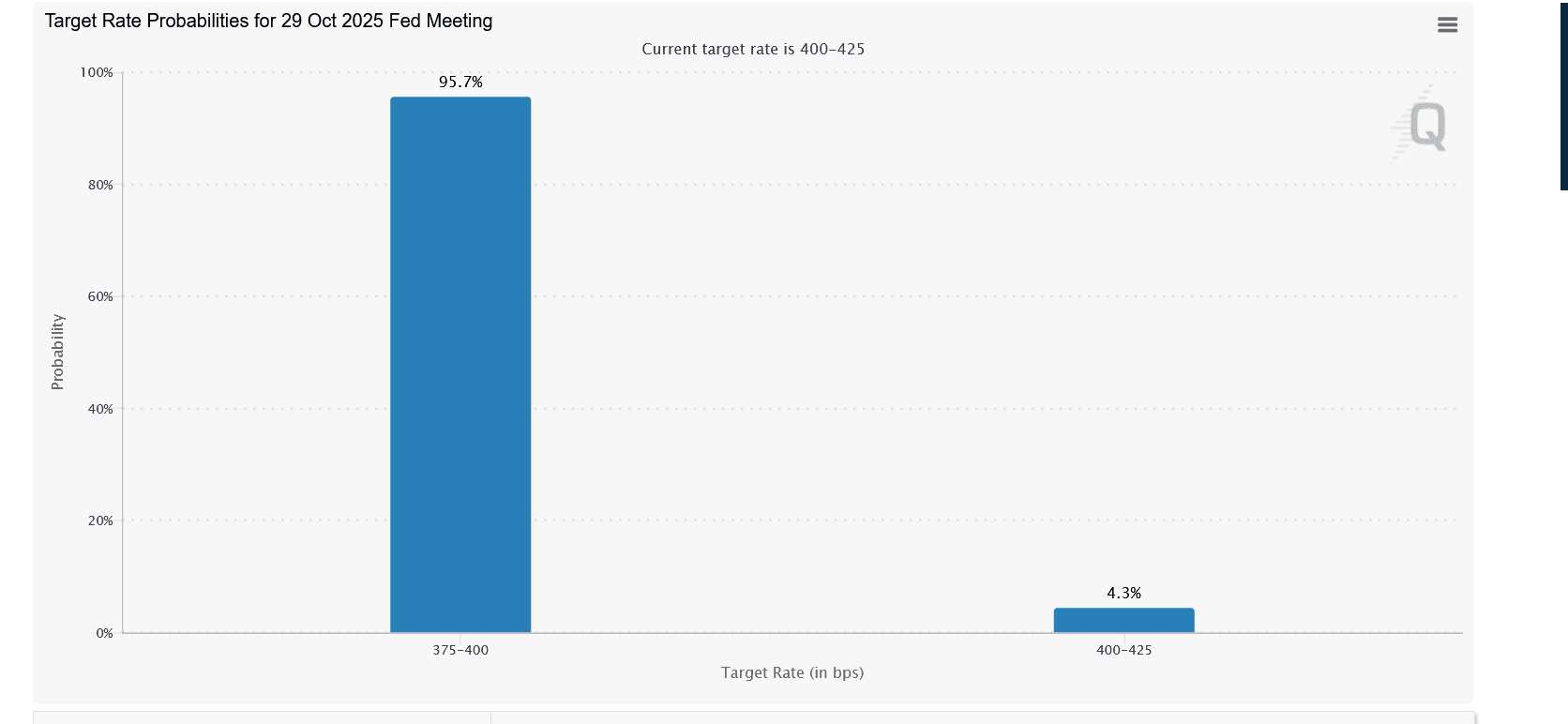

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.

Quick Take Summary is AI generated, newsroom reviewed. Tom Lee and Arthur Hayes predict Ethereum could reach $10,000 by end of 2025. Institutional adoption and clearer regulations support growth. Ethereum upgrades improve speed, efficiency, and scalability. Investors should research and diversify before investing.References BULLISH: Tom Lee and Arthur Hayes call for a $10k $ETH price.

After the meme craze fades, perhaps it's time to refocus on the prediction market.

- 12:33Bessent: The only factor dragging down the US economy is a government shutdownChainCatcher news, according to Golden Ten Data, U.S. Treasury Secretary Bessent stated that the only factor dragging down the U.S. economy is a government shutdown, and some data show that a government shutdown causes an economic loss of $15 billion per day. The U.S. investment boom is sustainable and has just begun; there is pent-up demand, the U.S. is opening its doors to business, and the artificial intelligence boom is just starting.

- 12:14Publicly listed company Parataxis discloses bitcoin holdings exceeding 150 BTCChainCatcher news, according to Decrypt, Korean listed company Parataxis Holdings announced that it increased its bitcoin holdings during the market correction, and the company's current bitcoin holdings have exceeded 150 BTC. In addition, the company plans to acquire 1,150 ASIC miners and will establish a vertically integrated BTC yield platform.

- 12:02Data: LuBian labeled address transfers 2,129 BTC to a new address again, worth approximately $238.6 millionChainCatcher news, according to monitoring by PeckShield, the LuBian labeled address has once again transferred 2,129 BTC to a new address, valued at 238.6 million USD.