News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

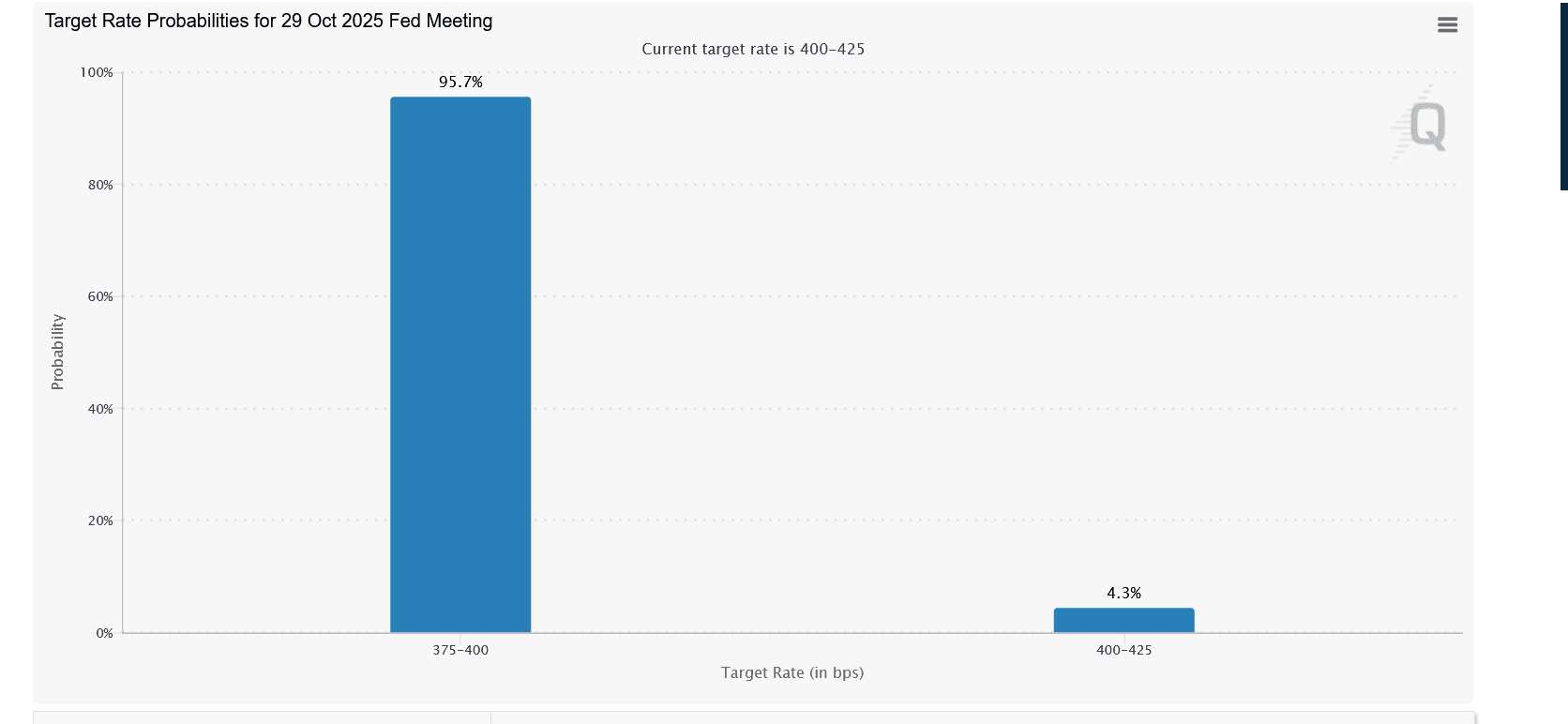

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.

Quick Take Summary is AI generated, newsroom reviewed. Tom Lee and Arthur Hayes predict Ethereum could reach $10,000 by end of 2025. Institutional adoption and clearer regulations support growth. Ethereum upgrades improve speed, efficiency, and scalability. Investors should research and diversify before investing.References BULLISH: Tom Lee and Arthur Hayes call for a $10k $ETH price.

After the meme craze fades, perhaps it's time to refocus on the prediction market.

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

- 11:44Data: sUSDD TVL surpasses 1 million USD, offering 12% APY savings yieldChainCatcher News, according to official sources, the total value locked (TVL) of the decentralized stablecoin USDD interest-bearing token sUSDD has surpassed 1 million USD. sUSDD was officially launched on October 6, providing a decentralized and transparent savings system. Users can convert USDD to sUSDD, and after depositing, they can automatically enjoy an annual percentage yield (APY) of 12% without the need for staking or locking, thus achieving asset appreciation. According to the official statement, the launch of sUSDD makes crypto asset savings more accessible, safer, and user-friendly, marking a new chapter for DeFi. Risk Warning

- 11:44RootData Recognized on Crypto Research KOL A++ List, Ranked Alongside Arkham and CryptoQuantChainCatcher reported that RootData was recently rated as an A++ level product by a well-known crypto research KOL, drawing widespread attention in the industry. In the "Crypto Research Hubs & Media" 2025 ranking list released by @the_tradeguru, RootData received the highest A-level rating (A++), with a particular emphasis on its professional capabilities in data visualization, macro research, and on-chain data interpretation. It was listed alongside top-tier research institutions such as a certain exchange's Research, Kaiko, The Block, and a certain exchange's Institute. The Tradeguru has been well-known in the industry for its systematic ranking of tool products. Previous rankings have focused on crypto research, data analysis, and information platforms, sparking resonance and heated discussions among users.

- 11:38Nano Labs Board Approves Share Repurchase Program of up to $25 MillionChainCatcher News, according to GlobeNewswire, Web 3.0 infrastructure and product solutions provider Nano Labs Ltd (Nasdaq: NA) announced that its board of directors has approved a stock repurchase program, under which the company may repurchase shares worth up to $25 million over the next 12 months depending on market conditions. According to the share repurchase program, the company may periodically repurchase its ordinary shares through open market transactions, privately negotiated transactions, block trades, or any combination thereof, subject to applicable securities laws and the company's insider trading policies.