News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

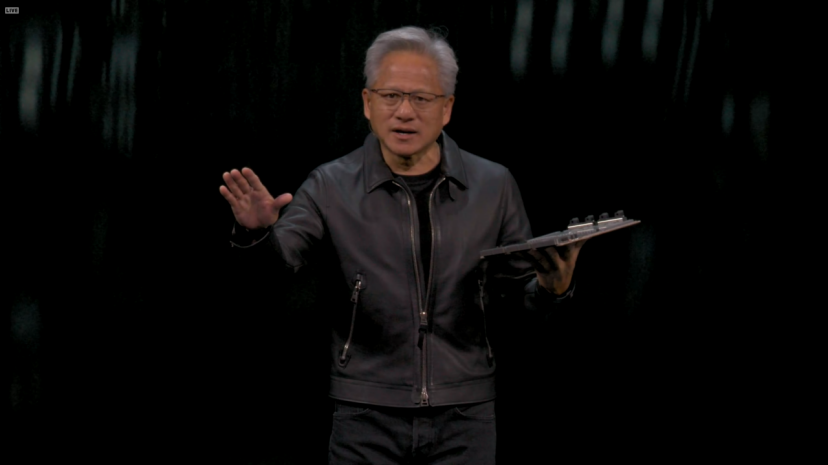

Jensen Huang unveiled some major announcements at the 2025 GTC.

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.

Michael Saylor says Bitcoin could reach $150K by 2025, backed by regulatory clarity and strong market sentiment.Regulatory Clarity Fuels OptimismMarket Sentiment Remains Strong

The Fed cuts rates by 25 bps to 3.75–4%, but markets show little reaction as the move was widely expected.Why Markets Didn’t FlinchEyes on December: Will There Be Another Cut?

- 07:43Trader Eugene: The market's "hell difficulty" continues for another week, with more whales being liquidatedBlockBeats News, on October 30, trader Eugene Ng Ah Sio posted on his personal channel, stating, "The hell-level difficulty of the market has continued for another week, and I see more whales being harvested." A week ago, trader Eugene had said, "I still maintain the view that the market is currently at hell-level difficulty, and I advise against making major trades (whether long or short) until I believe market conditions have eased. But for now, all I see is excellent traders being repeatedly harvested by the market like sashimi (including my own small-scale short-term trades, which are no exception)."

- 07:43World Gold Council: Global gold demand in Q3 hits record high for single-quarter gold demandBlockBeats News, on October 30, data released by the World Gold Council on October 30 shows that in the third quarter of 2025, global gold demand (including over-the-counter transactions) reached 1,313 tons, with a total demand value of $146 billion, setting a new record for single-quarter gold demand.

- 07:42Bitunix Analyst: The Federal Reserve Cuts Interest Rates by 25 Basis Points as Expected, Internal Disagreements Trigger Market VolatilityBlockBeats News, on October 30, the Federal Reserve announced a 25 basis point rate cut to 3.75%-4.00% and will end its balance sheet reduction plan on December 1. The decision saw two dissenting votes: one advocated for a 50 basis point cut, while the other supported maintaining the current rate, indicating a significant rise in internal disagreements. After the meeting, Powell struck a cautious tone, emphasizing that a rate cut in December is "far from certain" and admitted that the lack of data increases decision-making risks. As a result, U.S. stocks plunged from their highs, both the U.S. dollar and Treasury yields rose, and gold fell by more than $40. From a macro perspective, the end of the Federal Reserve's balance sheet reduction signals a turning point in liquidity, but the uncertainty of policy outlook has increased, leading the market to reprice the pace of rate cuts. Risk assets are under short-term pressure, and volatility has significantly increased. Bitunix analysts pointed out that the BTC liquidation map shows support in the $109,600–$108,000 range; if this level is breached, it may trigger a chain liquidation. The resistance levels are at $112,300 and $116,000. Against the backdrop of liquidity reallocation and a strengthening U.S. dollar, the crypto market may enter a period of consolidation and adjustment. In the short term, caution is needed regarding safe-haven capital flows triggered by macro policy uncertainty, as the market enters a new stage of "structural repricing."