News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Crucial Insight: Decoding BTC Perpetual Futures Long/Short Ratios on Top 3 Exchanges

Bitcoinworld·2025/12/17 06:15

Why is Magma Finance up today? Will it reach $1? Price prediction

币界网·2025/12/17 06:15

JZXN in Discussions to Acquire $1B in Tokens from AI Trading Firm at a Discount

DeFi Planet·2025/12/17 06:13

BitMine buys the dip, adding $140 million worth of ETH to treasury: onchain analysts

The Block·2025/12/17 06:09

XRP Faces a Familiar Bearish Test

TimesTabloid·2025/12/17 06:03

Remarkable Surge: Bitcoin Lightning Network Capacity Hits Highest Level in Over a Year

Bitcoinworld·2025/12/17 05:57

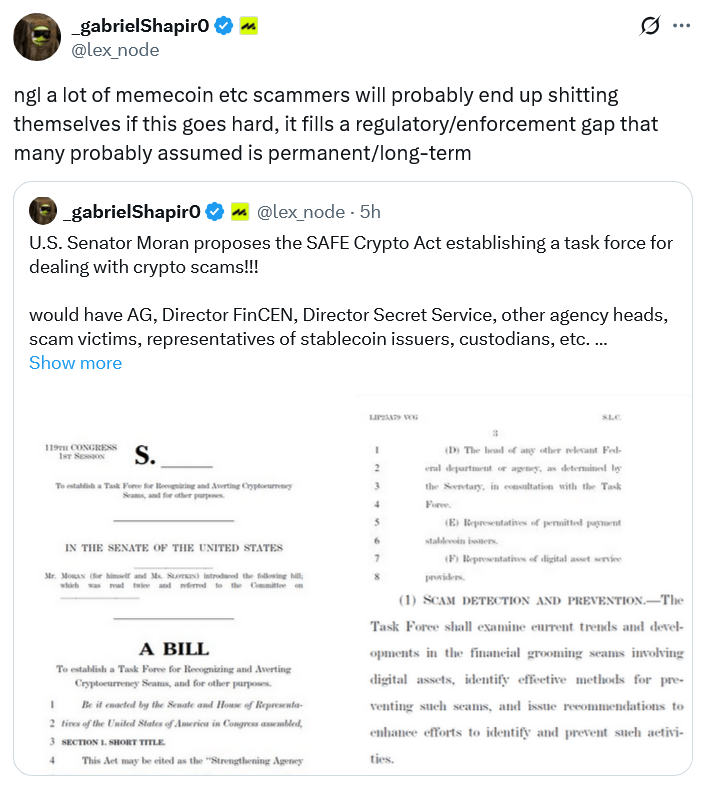

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

币界网·2025/12/17 05:48

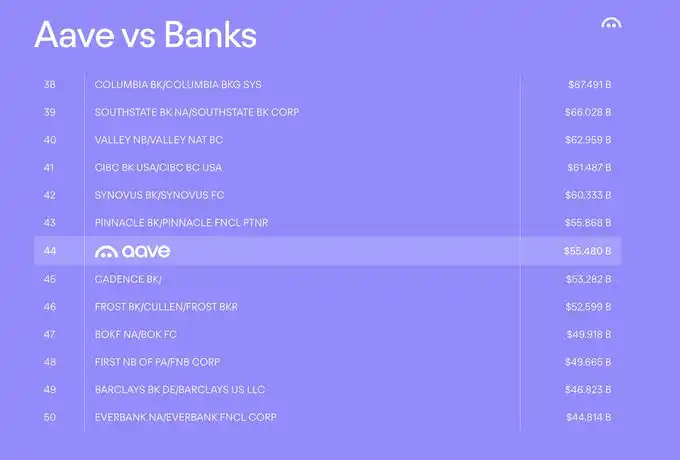

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms

BlockBeats·2025/12/17 05:48

Flash

- 06:20Matrixport: The short-term outlook for Bitcoin has weakened, and altcoins may continue to face pressure.Matrixport released a daily chart analysis stating that driven by the decline in Bitcoin dominance, our tactical model had issued a rebound signal, giving altcoin traders a brief window of opportunity to operate. However, as the total cryptocurrency market capitalization turned down again, this signal quickly reversed. For altcoin investors, the past one or two years have been challenging, if not extremely difficult. During this period, our model mostly favored allocating to Bitcoin rather than altcoins. Historically, it is rare for altcoins to continuously underperform during a Bitcoin bull market. Now that Bitcoin’s short-term outlook has weakened, the pressure on altcoins is likely to persist. In this market environment, traders should focus on leading high-quality coins and prioritize strict risk control discipline. The market structure has shifted from the previous simple "only long and dollar-cost averaging" model to a new phase that requires precise timing for entry, active position adjustment, and a strong emphasis on capital preservation.

- 06:19The dYdX governance team plans to distribute $100,000 to traders who suffered losses due to liquidation in the first two weeks of December.the dYdX Foundation posted on platform X that the dYdX governance team is reviewing a proposal to distribute a total of 100,000 USD worth of DYDX tokens to the top 100 affected traders who incurred actual losses due to forced liquidations in the first two weeks of December. This is the first disbursement of funds on a biweekly basis under the community-approved $1 million liquidation rebate pilot program.

- 06:19Analysis: Retail Investors Have Shifted to a Bearish Outlook, Often Signaling a Potential Rebound in the Crypto MarketBlockBeats News, December 17, according to Cointelegraph, retail investors' sentiment toward cryptocurrency has generally turned bearish. According to Santiment's data, historically, this is a bullish contrarian signal, as when retail investors expect further decline, the price usually bounces back.

News