News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

From the Only Survivor of Crypto Social to "Wallet-First": Farcaster’s Misunderstood Shift

Wallets are an addition, not a replacement; they drive social interaction, not encroach upon it.

BlockBeats·2025/12/12 03:20

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

深潮·2025/12/12 02:38

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

Cointime·2025/12/12 02:36

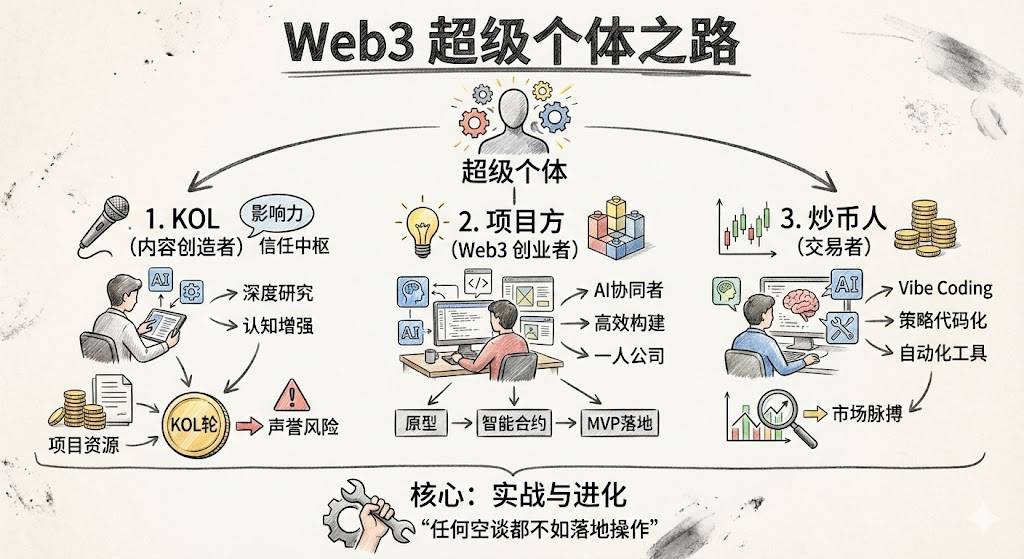

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.

深潮·2025/12/12 02:36

Big Short Burry warns: Fed's RMP aims to cover up banking system vulnerabilities, essentially restarting QE

Michael Burry warned that the Federal Reserve has effectively restarted quantitative easing under the guise of "reserve management purchases," exposing that the banking system is still reliant on central bank liquidity for survival.

ForesightNews·2025/12/12 02:12

Crypto : Trading Volumes Collapse as the Market Stalls, According to JPMorgan

Cointribune·2025/12/12 01:57

Bitcoin : After the Rate Cut, Traders Prepare for an Explosive 2026

Cointribune·2025/12/12 01:57

Crucial Bitcoin Options Worth $3.67 Billion Expire Today: What Traders Must Know

BitcoinWorld·2025/12/12 01:51

Flash

- 05:06Yilihua: Three Factors Including Strengthened Wall Street Consensus Drive Bullish Outlook for EthereumChainCatcher news, Liquid Capital (formerly LD Capital) founder Yi Lihua stated on social media that he remains firmly bullish on Ethereum. The reasons are as follows: First, the strengthening of Wall Street consensus: SEC Chairman's latest statement that "finance is migrating on-chain," and American political and economic elites are jointly promoting the tokenization of US Treasury bonds, with Ethereum as the core carrier. Second, the Fusaka upgrade is reshaping value: Blob fees have surged, with over 1,500 ETH burned in a single day, accounting for 98%. The prosperity of L2 is strongly feeding back to the mainnet, and deflation is imminent. Third, extreme technical cleansing: speculative leverage has dropped to a historical low of 4%, and CEX holdings are only 10%. ETH/BTC is consolidating and resisting declines, shorts are exhausted, and a short squeeze is imminent. In the rate-cutting cycle, capital is rotating from BTC to ETH, which has practical utility.

- 05:05Ethereum spot ETFs saw a total net outflow of $42.3734 million yesterday, with only the 21Shares ETF TETH recording a net inflow.According to ChainCatcher, based on SoSoValue data, the total net outflow of Ethereum spot ETFs is $42.3734 million. The Ethereum spot ETF with the highest single-day net inflow yesterday was the 21Shares ETF TETH, with a single-day net inflow of $2.0845 million. Currently, TETH's historical total net inflow has reached $23.2565 million. The Ethereum spot ETF with the highest single-day net outflow yesterday was the Grayscale Ethereum Trust ETF ETHE, with a single-day net outflow of $31.2175 million. Currently, ETHE's historical total net outflow has reached $5.005 billion. As of press time, the total net asset value of Ethereum spot ETFs is $20.309 billion, with an ETF net asset ratio (market value as a percentage of Ethereum's total market value) of 5.22%. The historical cumulative net inflow has reached $13.108 billion.

- 04:53Analysis: Bitcoin "accumulator" addresses have added 75,000 bitcoins this monthAccording to ChainCatcher, CryptoQuant analyst DarkFrost stated that the group of Bitcoin "accumulators" increased their holdings by more than 75,000 bitcoins between the 1st and 10th of this month. Of these, 40,000 bitcoins were accumulated just from the 9th to the 10th. These addresses currently hold approximately 315,000 bitcoins, and this trend continues to rise. These investors are continuing to accumulate, seemingly unaffected by current market conditions or momentum. In addition, DarkFrost summarized the characteristics of "accumulator" addresses as follows: no outflows; the minimum amount of bitcoin purchased in the most recent transaction; at least two purchase events (inflows); the address must hold a minimum total bitcoin balance; must have been active at least once in the past 7 years; known exchange and miner addresses are excluded; no smart contracts.

News