News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

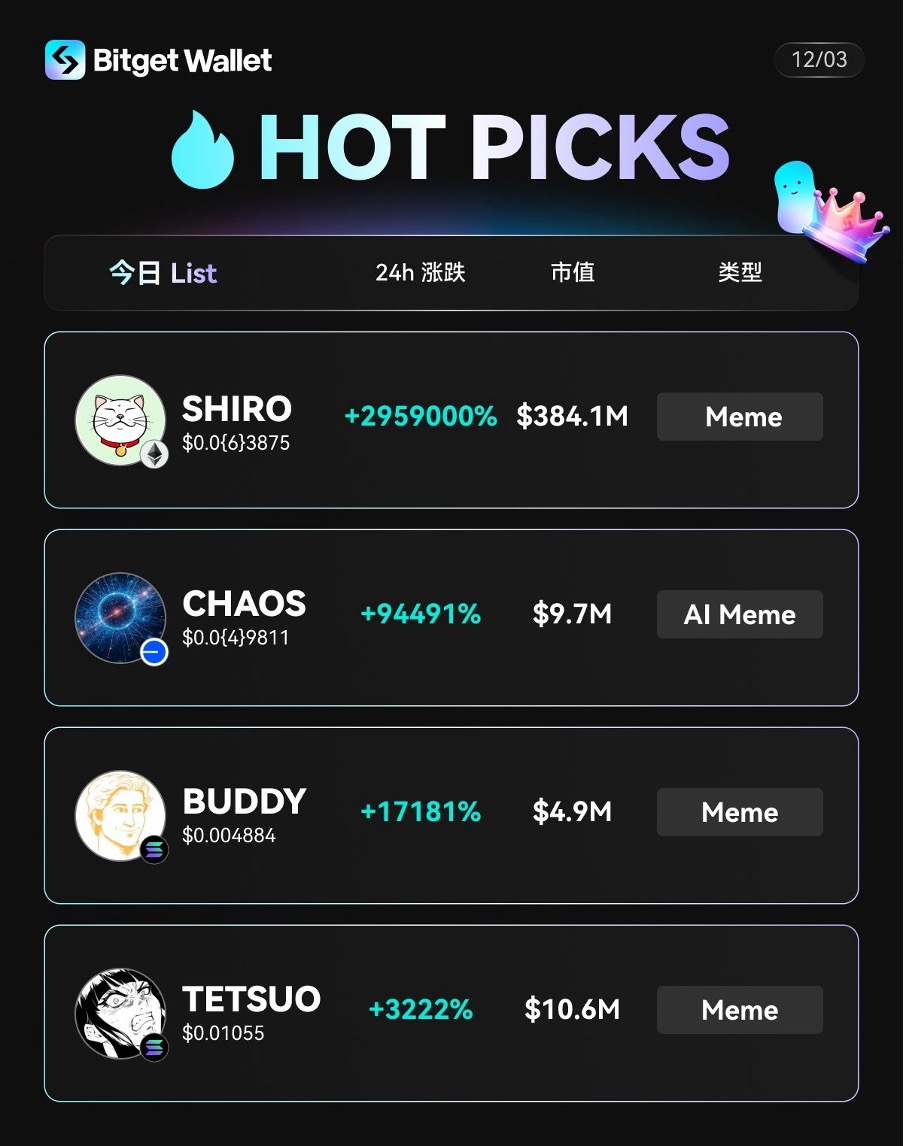

Today's Popular MEME Inventory

币币皆然 ·2024/12/03 09:54

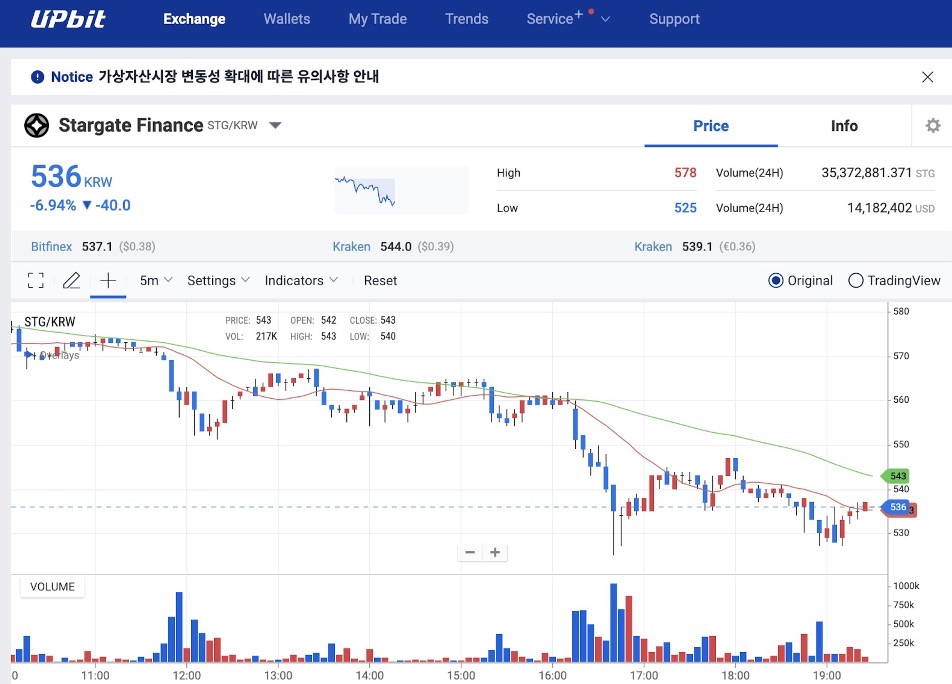

In-depth analysis of the STG pin incident: market maker liquidity issues and market risk warnings

Bugsbunny·2024/12/03 06:47

CATS: Three new features in the upcoming update

X·2024/12/03 06:23

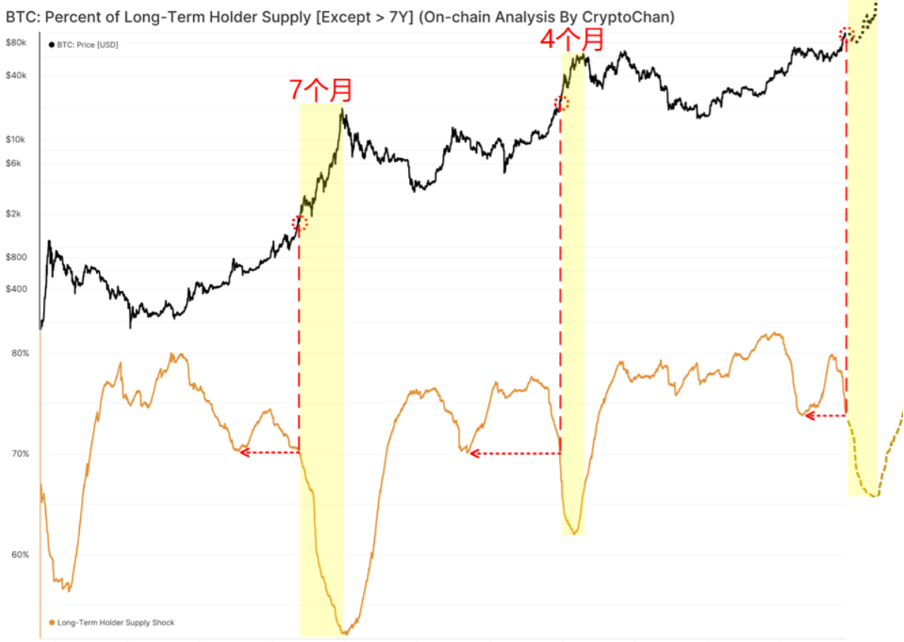

Final phase of BTC bull market: RHODL indicator breakthrough sparks price surge, $145,000 within reach

CryptoChan·2024/12/02 09:34

Flash

- 06:58OpenAI strengthens efforts to compete with Google AIJinse Finance reported that OpenAI CEO Sam Altman recently admitted in an internal memo that Google's progress in the field of artificial intelligence may bring "short-term economic headwinds" to the company. According to The Information, Altman acknowledged that Google's newly launched AI model may have temporarily taken the lead, and stated, "We know we still have work to do," and that public opinion "may be rather tough for a while." Altman specifically praised Google's "outstanding results" in the model pre-training phase, while OpenAI is developing a new model called Shallotpeat to address technical challenges. Although OpenAI's valuation remains as high as $500 billions, competitors including Anthropic and Google are accelerating their catch-up efforts, with the latter gradually narrowing the usage gap with ChatGPT through the Gemini chatbot.

- 06:58Oracle's stock price plummets, Ellison drops to third place on the billionaire list, Page rises to secondJinse Finance reported that Oracle founder Larry Ellison recently experienced a significant decline in wealth, with a cumulative evaporation of $130 billions during several consecutive weeks of stock price plunges, causing his ranking on the Bloomberg Billionaires Index to drop from second to third in the world. Meanwhile, the co-founder of a certain exchange, Larry Page, rose to second place globally for the first time with assets of $256.9 billions, second only to Elon Musk. This reversal is particularly dramatic. Just two months ago, Oracle's stock price soared 36% in a single day in September, and with optimistic expectations for surging demand for AI cloud infrastructure, Ellison's assets increased by $89 billions in a single day, briefly making him the world's richest person, surpassing Musk. However, the good times did not last long. Oracle's stock price subsequently fell 39% from its historical high, declining for six consecutive weeks, with the latest closing price at $198.76. In stark contrast is the performance of a certain exchange. Thanks to the positive market reception of the new model Gemini 3, the exchange's stock price has risen 58% so far this year, and increased another 3.5% in the latest trading day. Multiple institutions have pointed out that Gemini 3's reasoning ability and generative performance have significantly improved, and it is expected to further narrow the gap between the exchange and its main competitors in large model performance. Larry Page holds about 6% of the exchange's shares, and his assets have increased by $88.6 billions in 2025. Co-founder Sergey Brin has also reaped substantial gains this year, ranking fifth in the world with $239.9 billions. Musk continues to firmly hold the position of the world's richest person with $421.8 billions.

- 06:58Weekend Whale Movements Overview: "Calm Order King" switches from long to short and loses $3.2 million again, while two major short whales have unrealized profits exceeding $30 millionBlockBeats News, November 24, according to Coinbob Hot Address Monitor, since this Friday, some on-chain popular addresses have shifted their strategies, including: “Calm Order King”: On the 21st, closed long positions on BTC and SOL with a loss of $8.49 million, then switched to shorting. Current positions: BTC short $41.72 million, unrealized loss of $1.8 million (-172%), liquidation price $89,700; SOL short $30.89 million, unrealized loss of $1.45 million (-93%), liquidation price $138. “Ultimate Bear”: BTC short position size about $106 million, unrealized profit of $29.78 million, liquidation price $92,000, with a large withdrawal of $12 million over the weekend. “40x Short Master”: Since the 21st, took profit at the bottom on BTC shorts, position size: $24.06 million—$2.82 million, unrealized profit: $5.63 million (938%)—$400,000 (571%), liquidation price $113,000. Recently went long on HYPE in swing trades, earning $4.75 million in the past 7 days. “Largest ZEC Short on Hyperliquid”: Since the 21st, closed losing positions and averaged down on ZEC shorts, adding $2.83 million to positions in the past 6 hours, total position size $37.7 million, unrealized loss: $15.61 million—$11.35 million, average price: $384—$411, with a realized loss of about $3.5 million. “Aster Long Main Force”: On the 23rd, closed ASTER long positions at breakeven after ASTER fell below $1.2, with a small profit of $160,000. Today opened new FARTCOIN long positions, position size about $1.22 million, unrealized profit of $96,000 (78%).