News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Near blessing, AI-driven, a glimpse of SenderAI's future prospects

远山洞见·2024/11/25 09:40

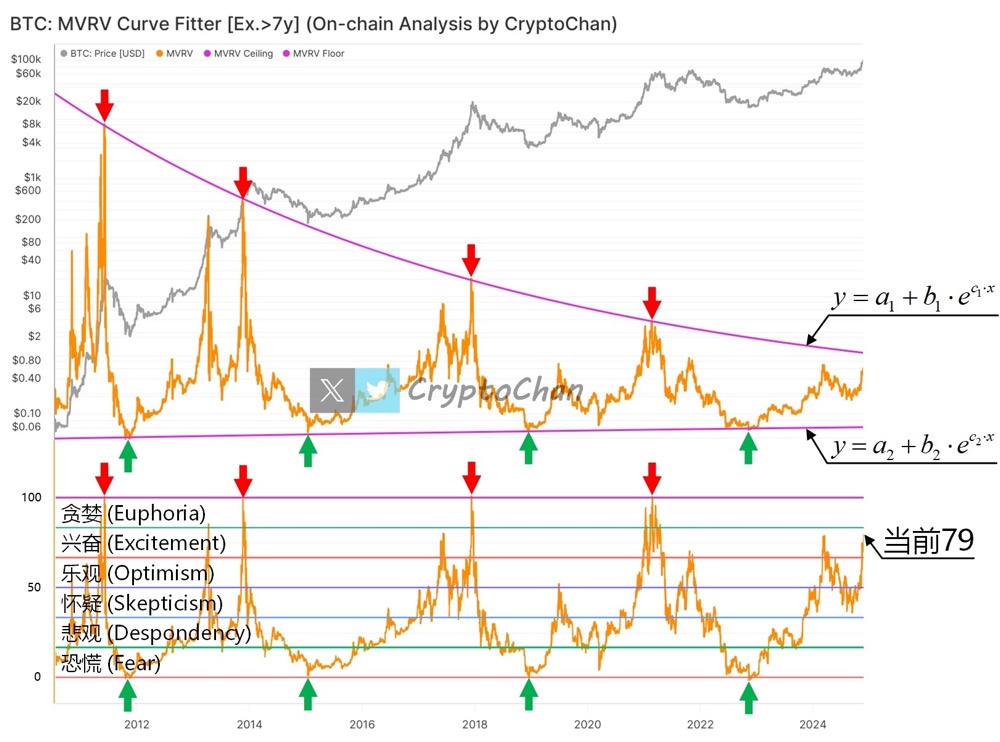

Precision tool for identifying market bottoms? Bitcoin MVRV indicator reappears, currently scoring 79

CryptoChan·2024/11/25 07:16

Zircuit Launches ZRC Token – Pioneering the Next Era of Decentralised Finance

Daily Hodl·2024/11/25 07:08

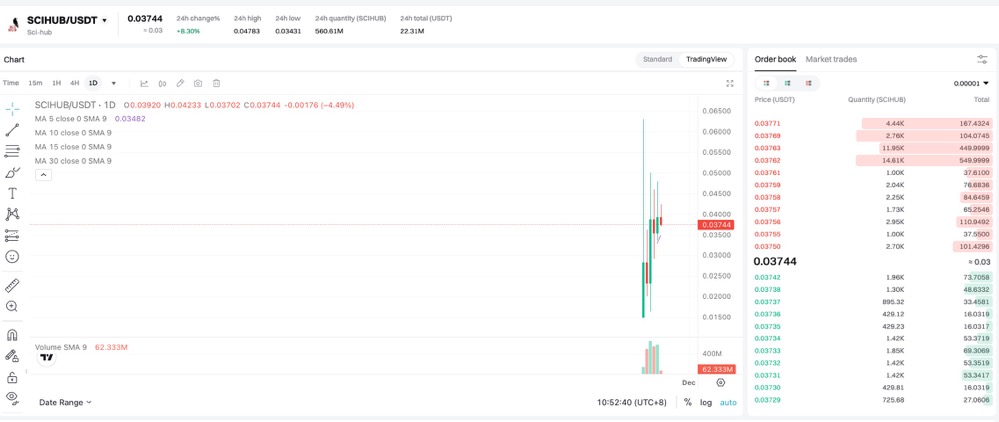

CryptoRock: Why I'm All in $scihub - Confessions of a Rebellious Hacker

推特观点精选·2024/11/23 03:09

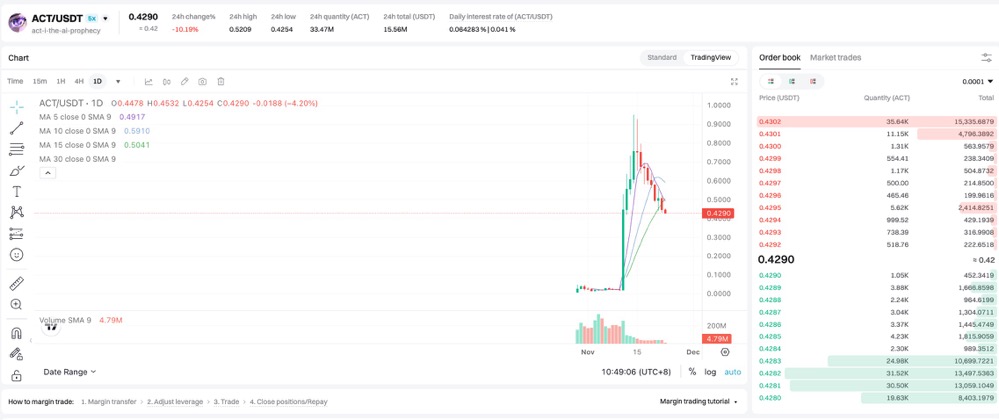

Meta Gorgonite: Why the potential of $ACT is far from exhausted

推特观点精选·2024/11/23 02:50

Zeus: Robust fundamentals of Aptos - Stripe and Circle support, promising future

Twitter Opinion Selection·2024/11/23 02:44

Yuyue: A Detailed Explanation of the Origin and New Narrative Leader of DeSci + Meme $RIF

推特观点精选·2024/11/23 02:43

Sun and Moon Xiao Chu: Why do I continue to increase positions during the pullback of $PNUT and $ACT

Twitter Opinion Selection·2024/11/23 02:24

Flash

- 17:20Berachain privacy terms revealed: Brevan Howard's $25 million investment can be refunded after TGE, while other investors were unaware of this arrangement.ChainCatcher reported that Berachain granted one of its Series B lead investors, Brevan Howard, the right to have its investment refunded without risk after the TGE, without the knowledge of other investors. It is reported that Berachain has raised at least $142 million in total, with its token valued at $1.5 billion in the last funding round. This round was co-led by Framework Ventures and Nova Digital, the crypto arm of the $34 billion hedge fund Brevan Howard. A former employee, who requested anonymity, recalled that Berachain co-founder, known as "Papa Bear," once pointed out that Brevan's participation could enhance the project's legitimacy. However, the Series B terms were particularly favorable to Brevan's Nova Digital fund. According to documents, Berachain granted the fund the right to refund its $25 million Series B investment for up to one year after the token generation event on February 6, 2025. This clause means that, unlike traditional venture capital, Brevan's fund bears zero principal risk: if the BERA token performs well, the fund can enjoy the returns; if it performs poorly, the fund can request a full refund. Four lawyers specializing in the crypto field stated that it is extremely rare for a project to grant investors a refund right after the TGE. Two of the lawyers noted that even when refund rights appear in token financing, they are usually only triggered if the project fails to issue the token. If Nova Digital exercises its refund right (the current token price has dropped about 66% from the $3 investment price, so exercising the right makes financial sense), Berachain may be forced to raise $25 million in cash to repay its own investor. According to project documents, tokens purchased by Berachain investors are subject to a one-year lock-up period, so if Nova exercises the refund right, it may forfeit its BERA allocation. It is still unclear whether Nova fund's refund right is legal—especially since other investors were not informed of this clause. Nova Digital's deadline to exercise the refund right is February 6, 2026.

- 17:03CME Group U.S. Treasury open interest reaches a record high of 35 million contractsJinse Finance reported that CME Group announced today that its highly liquid US Treasury futures and options products reached a record open interest (OI) of 35,120,066 contracts on November 20. Meanwhile, CME Group's interest rate futures and options products reached a trading volume of 44,839,732 contracts on November 21, marking the second highest single-day volume in history. Agha Mirza, CME Group's Global Head of Rates and OTC Products, stated: "Against the backdrop of economic growth and uncertainty around the pace of Federal Reserve rate cuts, market participants are turning to our markets for unparalleled trading efficiency and liquidity across the yield curve."

- 16:29Amazon will invest $50 billion to expand AI and supercomputing infrastructure for U.S. government agenciesJinse Finance reported that Amazon will invest up to $50 billion to expand artificial intelligence and supercomputing infrastructure for U.S. government agencies. The investment plan will begin in 2026.