News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

DBR Operation Suggestions from the Perspective of Chan Theory

远山洞见·2025/01/02 11:00

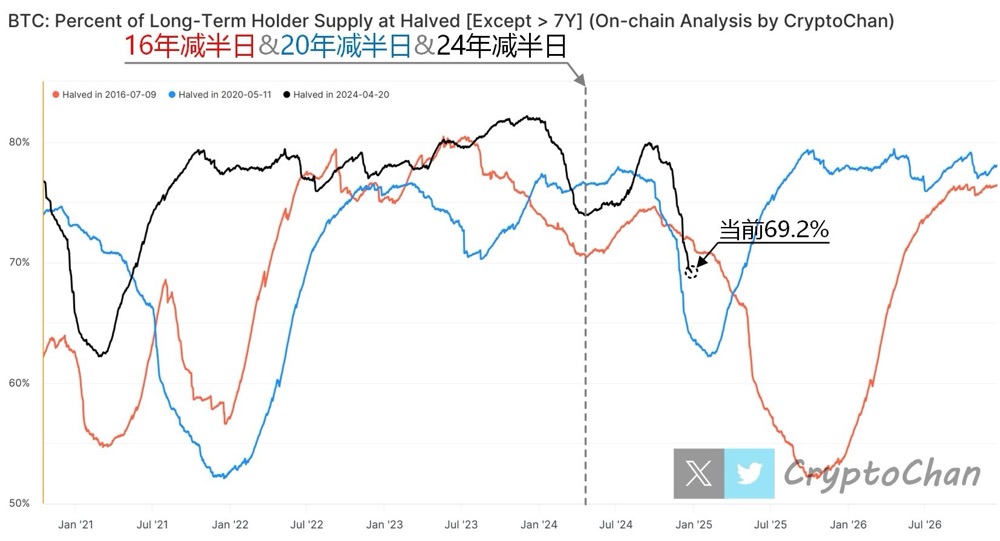

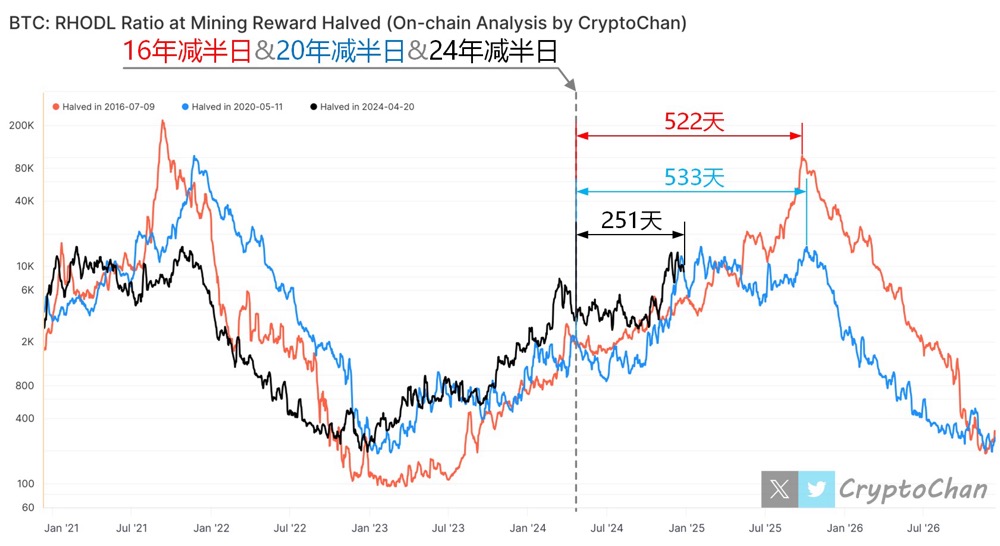

251 days after Bitcoin's 2024 halving, on-chain data points to key bull market stages

CryptoChan·2024/12/26 06:25

Flash

- 08:08Musk: AI5 chip is about to complete tape-out, AI6 chip development has already startedJinse Finance reported that Musk stated: The AI5 chip is about to complete tape-out, and the development of the AI6 chip has already begun. Our goal is to bring a new artificial intelligence chip design into mass production every 12 months. We expect that the total number of chips eventually produced will exceed the sum of all other artificial intelligence chips.

- 07:20Web3Labs: Official X account hacked and false information posted, full recovery efforts underwayChainCatcher News, according to the official announcement, the official Twitter account of Web3Labs was hacked by an unidentified attacker in the early hours today. Currently, all information posted by this account is false. Web3Labs reminds users not to trust, click, forward, or interact with any related content. The Web3Labs team is contacting the official Twitter platform team in hopes of regaining control of the account as soon as possible.

- 07:02U.S. tech giants spark a bond issuance boomJinse Finance reported that recently, a wave of bond issuance has suddenly swept through major US tech giants. The combined issuance volume of Amazon, Alphabet (Google's parent company), Meta, and Oracle has already approached $90 billion. According to foreign media statistics, US companies have issued over $200 billion in corporate bonds this year to fund artificial intelligence-related infrastructure projects. This has raised questions about whether the market can absorb such a massive supply, while also intensifying concerns over the rapidly increasing AI-related expenditures. These concerns have also "air-raided" the US stock market, triggering a significant correction since early November. Data shows that since November, the tech-heavy Nasdaq index has fallen by more than 6%, while the S&P 500 and Dow Jones indices have dropped by 3.47% and 2.77%, respectively. In addition, the US Tech Seven Giants Index has declined by 5.73%, and the Philadelphia Semiconductor Index has plummeted by over 11%. On an individual stock basis, in the single week of November 14 alone, AMD fell by more than 17%, Micron Technology dropped nearly 16%, Microsoft fell by over 7%, Qualcomm dropped over 6%, and Amazon and Nvidia both fell by nearly 6%. (Broker China)