Using the "Internet of Value" as an analogy: A 5-minute quick analysis of the essence of cryptocurrency investment

Author: Jeff Dorman, Chief Investment Officer at Arca

Translation: Felix, PANews

Original Title: After Bitcoin Hits New Highs, How to Quickly Explain Crypto Investing to Those Around You?

With Bitcoin reaching new highs and cryptocurrencies sweeping across Wall Street and Washington, now is the perfect time to once again explain crypto investing to those around you. Most "industry experts," crypto KOLs, and mainstream media do a poor job of explaining this asset class to new investors, and the constant misinformation actually deters more people rather than excites them.

Most people are not even aware of the world of token investing (beyond Bitcoin and meme coins). But now, with ETH, SOL, BNB, HYPE, stablecoins, and Polymarket appearing in the news every day, they are starting to pay attention. Investors don't care about the underlying technology, libertarian idealism, or decentralization. What they care about is how to achieve growth and profit.

For nearly a decade, I have been communicating with new crypto investors, and the following explanation resonates with them the most because it explains crypto investing in a way that investors can understand. Even those with preconceived negative opinions will understand the industry after reading the explanation below.

So, if you want to try again to explain blockchain to the public, here is the simplest (and fastest) explanation I have found.

Beginner's Guide: Understand Blockchain in 5 Minutes

-

The Internet enables you to communicate instantly, without borders, and at no cost.

-

Blockchain enables you to send assets instantly, without borders, and at no cost.

The first asset sent via blockchain was a completely fictional crypto asset called Bitcoin (BTC), which was sent through the newly created Bitcoin blockchain. Bitcoin is the biggest outlier/smokescreen in investment history. Its success is miraculous and unique, and should not be studied or applied to anything else. Although the Bitcoin asset and the Bitcoin blockchain were the first pioneers, it does not mean they are the only blockchain or asset that can be sent in a similar way. Bitcoin demonstrated a single use case of this technology, but it is not the only use case. Similarly, SPY was the first exchange-traded fund (ETF) in the US, but since then, many other products can be packaged in ETFs.

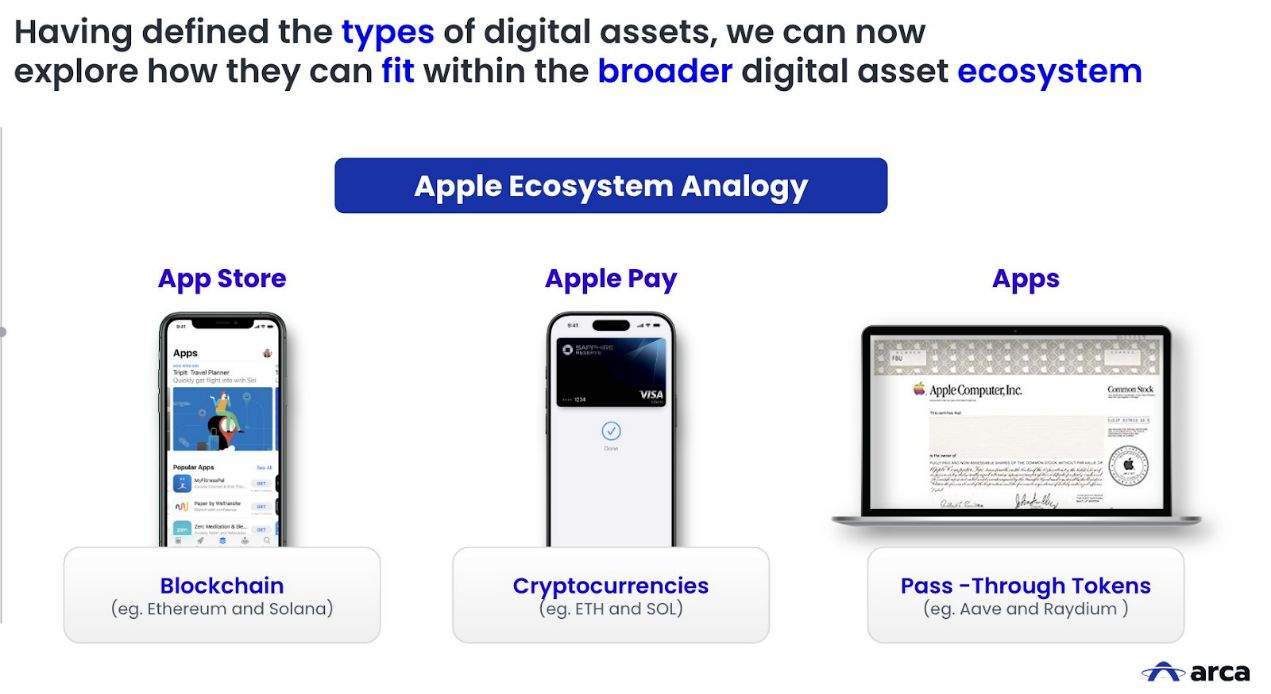

Other blockchains (such as smart contract platforms like Solana and Ethereum) are more flexible than the Bitcoin blockchain, allowing the creation and transfer of other assets. In fact, you can think of smart contract platform protocols as an app store that anyone can develop for. Just as your app store allows you to access banking, games, maps, collectibles, and social apps on IOS or Android operating systems, your smart contract platform protocol allows you to access banking (DeFi, stablecoins), games (Polymarket), collectibles (NFTs), maps (Hivemapper), and social (Pump.Fun) blockchain applications.

-

Crypto applications = Companies

-

Smart contract protocols = App stores

Blockchains have their own tokens, just as Apple and Google have their own stocks, but many applications within these platforms also have their own tokens, which, if the tokenomics are well designed, can serve as a quasi-equity form for the business. This is no different from many IOS or Android app companies having their own publicly listed stocks.

The apps on your phone create value for Apple or Google, just as these crypto applications create value for the smart contract protocol blockchains they are built on. When applications are used (generating revenue), both the app company and the operating system/blockchain's stock (or token) appreciate in value. Of course, since any asset can be created out of thin air and transferred via blockchain, there will also be some "junk" assets (such as meme coins), or assets that are loosely associated with a company but have no value drivers for the token itself (such as XRP). Tokens come in many forms, largely depending on who issues them and how the tokenomics are constructed.

But don't most crypto startups fail? Of course, just as the "Internet bubble" era spawned all kinds of startups, most of which ended in failure, most native crypto blockchains and applications will also fail. But currently, blockchain development is about to bid farewell to the ".-crypto" stage (where all investable tokens are issued by some emerging crypto company) and usher in a new phase where those century-old, established companies will also adopt blockchain technology and issue tokens. Today, no one refers to a company as an "Internet company (.com)" because every company is an "Internet company (.com)." Every business operates on the Internet. Walmart, JPMorgan, and Domino's Pizza are all Internet companies today, even though they existed before the Internet; they were not born because of the Internet, but grew with its help. The same will soon be true for crypto.

About 99% of global assets (stocks, bonds, and real estate) have not yet been transferred via blockchain. But these assets are likely to be tokenized and transferred via blockchain in the near future, replacing the large number of meaningless crypto assets that exist today.

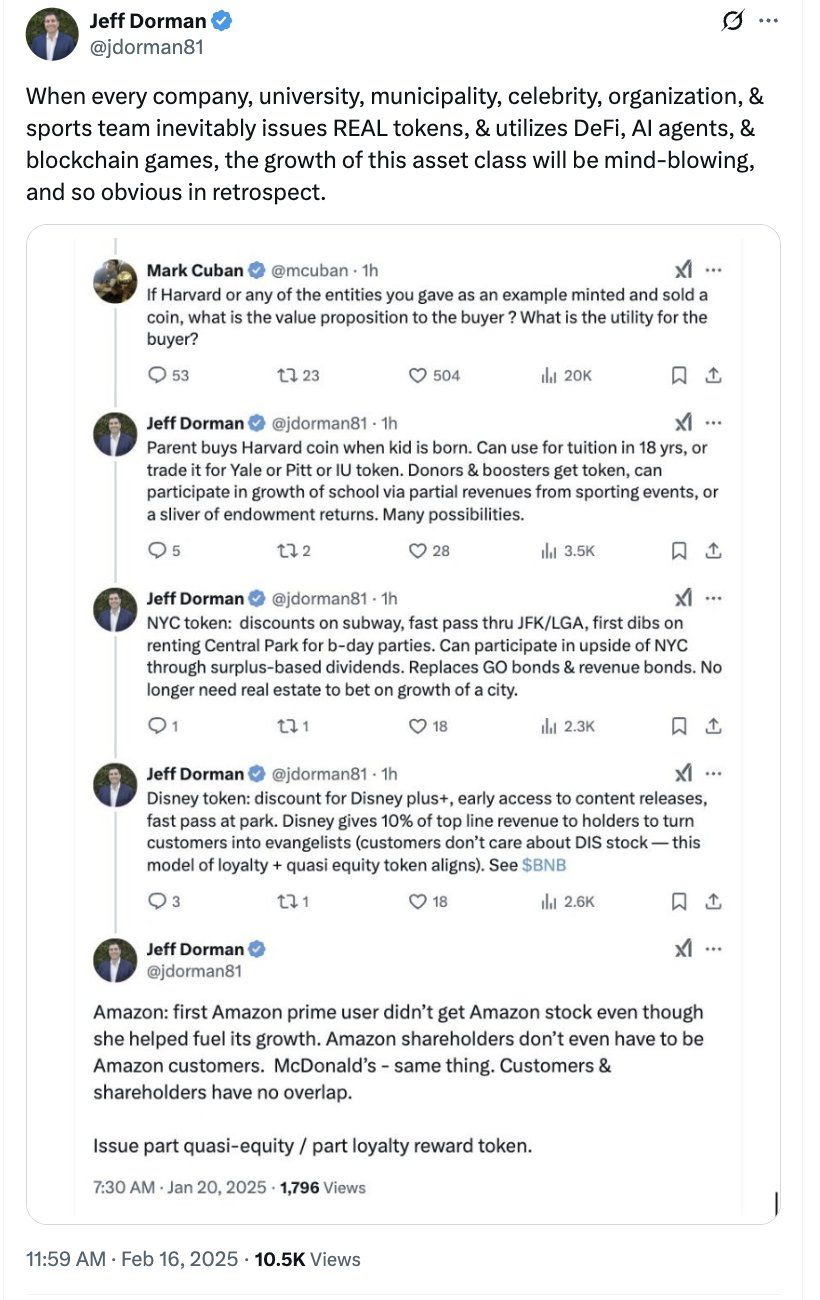

Today, a company can both tokenize existing assets (such as stocks and bonds) and issue new tokens as hybrid tokens. In the future, every company, university, municipality, celebrity, organization, and sports team will inevitably issue their own tokens, which can become a third asset in their capital structure.

-

Stocks = Claims on cash flow

-

Bonds = Claims on assets

-

Tokens = Claims on revenue growth and a hybrid claim as a loyalty rewards card used within the company ecosystem

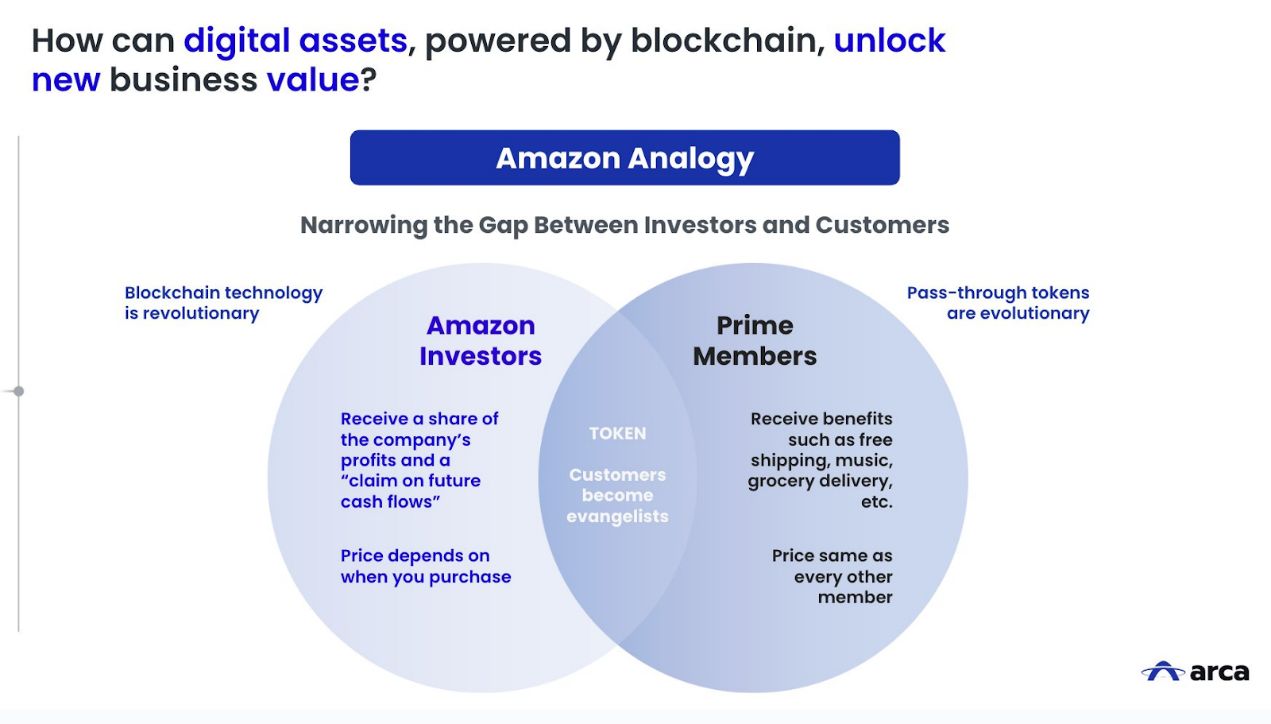

These tokens are often the most powerful capital formation and customer guidance mechanisms ever created, as they unite all customers and stakeholders, turning them into promoters and loyal users. Tokens are both a way to benefit from a company's success and a medium of exchange for company services. This is completely different from today's corporate structure, where investors and customers are often at odds.

-

McDonald's shareholders are not customers, and McDonald's customers are not shareholders.

-

Uber drivers and passengers cannot benefit from Uber's success.

-

Delta Air Lines SkyMiles members do not care about Delta's profits or growth, so they do not help Delta grow; Delta shareholders also do not care about the customer experience.

-

Content creators do not benefit from the success of Twitter and Instagram.

-

Chefs and delivery workers do not benefit from DoorDash's success.

Tokens can instantly change this status quo. Take Binance or Hyperliquid as examples—customers of these exchanges are early token holders (through trading or airdrops). You can use HYPE and BNB tokens as collateral to trade on the exchange and profit from their growth through token buybacks. Therefore, customers actually become quasi-equity holders, benefiting from the company's financial success, which drives increased product usage, higher revenue, and in turn, pushes up token prices. But as a customer of their products, you can also benefit from holding HYPE or BNB tokens (through discounts, collateral, and paying gas fees on their blockchains). This is a perfect hybrid model that instantly aligns all stakeholders and turns customers into loyal users and promoters.

Thus, you can imagine a world where your investments and payments become the same asset. For example, buying a real Tesla with TSLA stock, or paying for your Amazon shopping with AMZN stock.

This builds an extremely simple investment thesis for the next five years, eliminating most of the "nonsense" in crypto investing.

Investment Thesis

Blockchain technology has proven to be extremely efficient in asset transfer and asset trading, but most of the world's popular assets (stocks, bonds, real estate) are not yet tradable on blockchains (mainly due to regulatory and workflow issues). As the barriers between crypto-native assets and traditional financial assets are broken down, more and more tokenized assets will be issued, transferred, and traded on-chain.

The beneficiaries will be those specific smart contract platform protocol blockchains (L1) that support this growth and trading, the DeFi applications built on these chains, the stablecoins and stablecoin providers on these chains, and a select few applications in niche areas such as gaming and artificial intelligence that help you navigate on-chain. However, it's difficult to determine which chains will win, as there are currently almost no assets on-chain in the world. If large asset issuers like the US government, Walmart, JPMorgan, and Apple suddenly decide to issue assets on a particular L1, that L1 would become the most important blockchain overnight.

Even now, the world has not yet witnessed the true potential of blockchain, as most global assets have not yet been integrated into blockchain systems. Everything that has happened in the blockchain space so far has largely been experimental, a trial run before the real giants (stocks, bonds, real estate, and new tokens issued by companies, universities, municipalities, sports teams, etc.) arrive.

Therefore, although crypto traders are often obsessed with short-term trading, chasing flashy and worthless tokens (such as meme coins), the long-term investment thesis revolves around a plain, globally universal, and permissionless financial system that makes investing, banking, and spending more efficient and transparent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

YZi Labs Pledges $1B Builders Fund to Amplify BNB Investments

Boosting BNB Chain Development Amid Record Highs with a Hefty Investment

BlackRock’s Bitcoin ETF Tops with $3.5B Inflows, Outshining S&P 500 ETFs

Outperforming Major Indices: BlackRock's Bitcoin ETF Dominates with 10% of Total Net ETF Flows

Can the Mantle (MNT) Price Surge Maintain Momentum After a 130% Monthly Increase?

Surge in Daily Trading Volumes Indicates Strong Bullish Sentiment for Mantle's Continued Price Rally

BTC may have exited the old cycle: Was October the peak, or is this the beginning of a new cycle?

Since the new cycle began from BTC's low point in November 2022, it has experienced several phases, including long-term accumulation, ETF fund inflows, the halving event, and policy-driven fluctuations. Currently, BTC is at a key juncture between the old and new cycles. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.