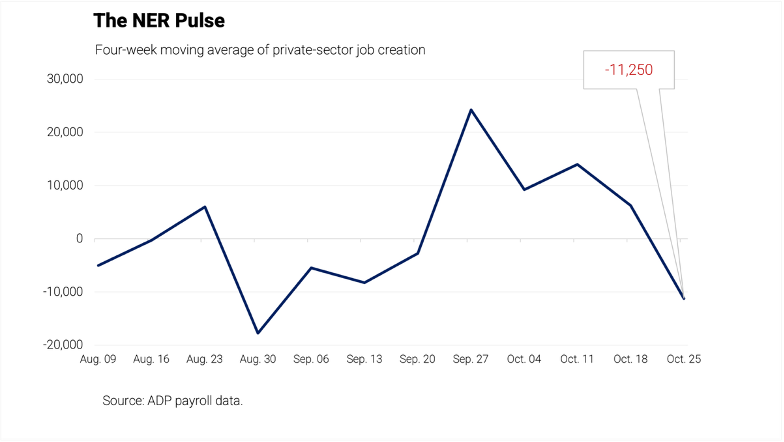

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

Recently, several well-known companies announced large-scale layoffs, sparking concerns in the market about a possible further weakening of the labor market. The new weekly employment report from ADP released today has confirmed these worries.

Data released by ADP on Tuesday showed that in the four weeks ending October 25, U.S. companies laid off an average of 11,250 employees per week. This data indicates that compared to the first half of October, the labor market slowed down in the second half of the month.

In total, 45,000 jobs were cut during the month (excluding government workers), marking the largest monthly employment decline since March 2023.

After the data was released, swap data linked to policy meeting dates showed that the money market increased its bets on a Federal Reserve rate cut, with pricing indicating a probability of over 60% for a rate cut next month.

This data comes as several companies have announced layoff plans in recent weeks. A report from outplacement firm Challenger, Gray & Christmas Inc. showed that the number of layoffs announced by employers in October hit the highest level for the same period in over 20 years, raising concerns about the health of the labor market.

The longest government shutdown in U.S. history led to delays in the release of key economic data such as the September and October employment reports. Investors have relied on other indicators such as ADP to fill the data gap. Last month, ADP announced that it would henceforth release a four-week moving average of total private sector employment changes, publishing it only three times a month (not during the week of the monthly report release).

These figures are preliminary and may change as new data is added. The latest monthly report released by ADP last week showed that after two consecutive months of decline, the U.S. private sector added 42,000 jobs in October.

Although this growth was welcomed, it was not broad-based. Education and healthcare, as well as trade, transportation, and utilities led the growth. In professional business services, information, and leisure and hospitality, employers cut jobs for the third consecutive month.

The report at the time added: "Despite the limited increase, the data for October is still positive, which has reassured many economists and investors. These market observers generally believe that due to declining labor demand and supply shortages, employment growth will remain sluggish for some time to come."

ADP Chief Economist Nela Richardson stated that as both labor supply and demand are slowing, economists are looking for a new breakeven rate. This is the minimum number of new jobs the economy needs to add each month to keep the unemployment rate stable. Looking ahead, the breakeven rate may no longer be a stable constant, but is more likely to keep changing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 3rd - 10th)

Core Data (Hong Kong Time, 16:00 on November 3 → 16:00 on November 10) BTC/USD: -1.0% ($1...)

On-chain financial management, danger! Run away quickly!

Is the "neutral" model truly neutral? A series of hidden dangers are lurking beneath the surface.

A sober reflection on the $2.5 billion FDV: Monad's public offering document reveals the true face of "transparency with restraint"

The Monad (MON) token is about to be publicly sold on Coinbase, with disclosure documents detailing the project architecture, financing, token distribution, sales rules, and risk warnings, emphasizing transparent operations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of the content are still being iteratively updated.

Uniswap launches token burn and fee distribution, reshaping DeFi protocol revenue model