ALGO Gains 3.02% as Operations Resume and Financing Advances

- Largo resumes operations in late 2025, aiming to boost production and secure $23.4M+ $84.2M in financing to defer debt repayments until 2026. - The vanadium market faces pressure from oversupply and sanctions, while U.S. FeV prices remain 24% higher than Europe’s due to regional demand disparities. - ALGO surges 3.02% amid Largo’s operational progress, though its 1-year price dropped 46.97% amid broader market volatility and sector challenges.

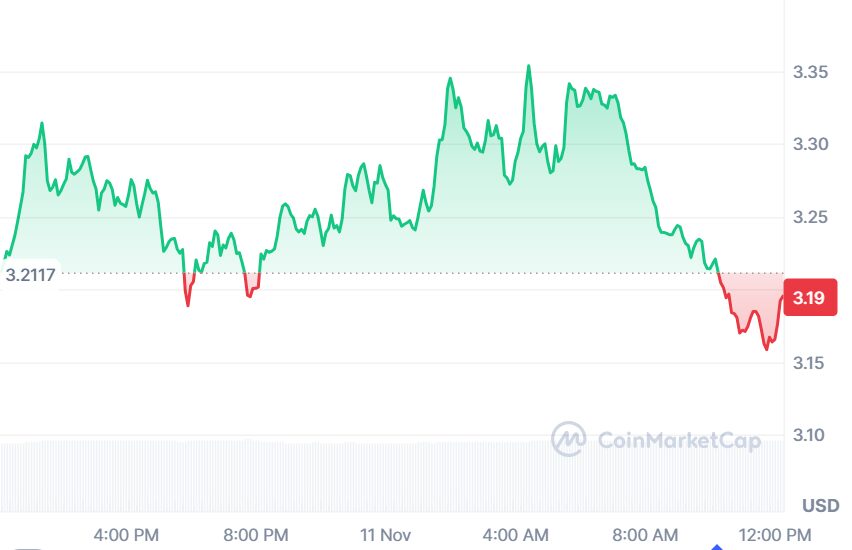

As of November 13, 2025,

Largo, a prominent company in the vanadium industry, shared notable updates following its Q3 2025 earnings report. The firm stated that operations are set to restart in late November 2025, with plans to ramp up to higher production volumes by the end of the year. These actions are in line with Largo’s strategy to enhance both its output and financial health.

After releasing its third-quarter results,

Largo also resolved a dispute with a business partner regarding the delivery of 900 tonnes of V₂O₅. The company agreed to supply the remaining amount by January 2026 and has given the partner the option to purchase an extra 0–500 tonnes between June and October 2028. This settlement underscores Largo’s dedication to meeting its commitments and sustaining partnerships in a competitive market.

The vanadium market continues to face difficulties. Prices in Europe and China have been pressured by weak demand from the steel and infrastructure industries, as well as excess supply from producers in China and Russia. On October 23, 2025, the European Union imposed sanctions on the largest vanadium producer outside China, further affecting the market. In contrast, the U.S. FeV market remains more robust, with prices 24% higher than those in Europe as of November 7, 2025. This difference illustrates how regional demand and policy changes can influence vanadium pricing.

Backtest Hypothesis

When examining ALGO’s price trends, it is crucial to factor in the role of major technical indicators and overall market momentum. Conducting a systematic backtest can help evaluate how effective a strategy based on certain price movements might be. For instance, one could test a method that focuses on a 5% increase in closing prices paired with a specific resistance level, using historical market data.

To perform such a backtest, it is necessary to define exactly what constitutes a “5% increase.” Is this a single day’s close-to-close gain, or does it refer to something like an intraday high compared to the previous close? Likewise, the resistance criterion must be specified—this might involve a 52-week high, a recent swing high (such as the highest point in the last 20 days), or a technical measure like the upper Bollinger Band. These choices will shape the backtest’s parameters and the types of market conditions it examines.

In addition, the rules for how long to hold a position or when to exit must be clearly set. Should the test track returns over a predetermined period, or should it use a rule such as exiting after reaching a certain profit or stop-loss? These factors are essential for building a thorough and reliable backtest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Clearer Regulations and Growing Institutional Interest Propel Crypto Market to $2.4 Trillion as Industry Evolves

- U.S. crypto market surges to $2.4T as institutional adoption, regulatory clarity, and macro optimism drive gains. - Bitcoin and Ethereum rebound post-government shutdown, with crypto-linked stocks like SBET and GLXY rising 3-5% pre-market. - Regulatory frameworks like CLARITY Act and Project Crypto aim to resolve ambiguity, boosting institutional confidence. - Analysts caution volatility risks despite ETF inflows and blockchain adoption milestones, urging diversified long-term strategies.

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest