Solana News Today: Solana’s Bold Bet on Scarcity: Will Reducing Supply Ignite a Price Rally?

- Solana accelerates disinflation to create scarcity, reducing future supply by 22M SOL. - This aims to stabilize value by limiting new tokens, aligning with deflationary market trends. - ETF inflows boost institutional interest, but retail participation remains low. - Market reactions are mixed, with optimism about price growth and caution on execution risks.

Solana’s Bold Economic Revamp: Pursuing Token Scarcity

Solana (SOL) is in the midst of a significant economic transformation, as developers introduce a proposal to dramatically speed up disinflation in order to foster long-term scarcity for the token. This initiative, which seeks to cut the timeline to reach a 1.5% terminal inflation rate in half, could eliminate around 22 million

According to several in-depth reports, the proposal would double the current rate of disinflation, reducing the time to terminal inflation from 6.2 years to just 3.1 years. By slashing the annual inflation rate by 50%, the network will issue new SOL at a much slower pace, restricting the influx of tokens into the market. This change responds to the broader investor appetite for assets with deflationary traits—a trend that has historically fueled price gains in the crypto sector. “Cutting 22 million SOL from future issuance is a substantial reduction in potential liquidity, which may help stabilize the token’s price over time,”

Traders are watching these developments closely. At present, Solana is trading near $125.8, maintaining its ground despite the overall turbulence in the crypto market. Technical experts point to a crucial support level at $95.26; a sustained move above this mark could open the door for a challenge of the previous all-time high around $295. Nonetheless, some bearish signals remain, such as a drop in futures open interest (OI) to $7.2 billion from a September peak of $17 billion,

This drive for scarcity is part of a larger plan to boost Solana’s attractiveness beyond its technical strengths. While the network already leads in transaction speed and ecosystem activity, the economic shift is designed to reinforce its status as a store of value. “It’s no longer just about fast transactions—it’s about building a scarcity story that benefits long-term investors,” one analyst explained. The proposal has sparked lively debate among market participants, with some seeing it as a trigger for continued price appreciation, while others warn of possible implementation challenges.

Meanwhile, Solana’s ecosystem is steadily growing.

The outcome of the economic proposal will depend on community support and market forces. Should it pass, the reduced token supply could create a supply-demand imbalance, especially as network activity and application development accelerate. “A smaller influx of new tokens, combined with rising demand, could put upward pressure on prices,”

For now, Solana’s supporters remain upbeat. The network’s unique combination of technical prowess and economic innovation has made it a standout in the crypto world. As the proposal moves forward, the market will be watching to see if this bold approach to scarcity is embraced—or if it becomes another lesson in the unpredictable world of digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

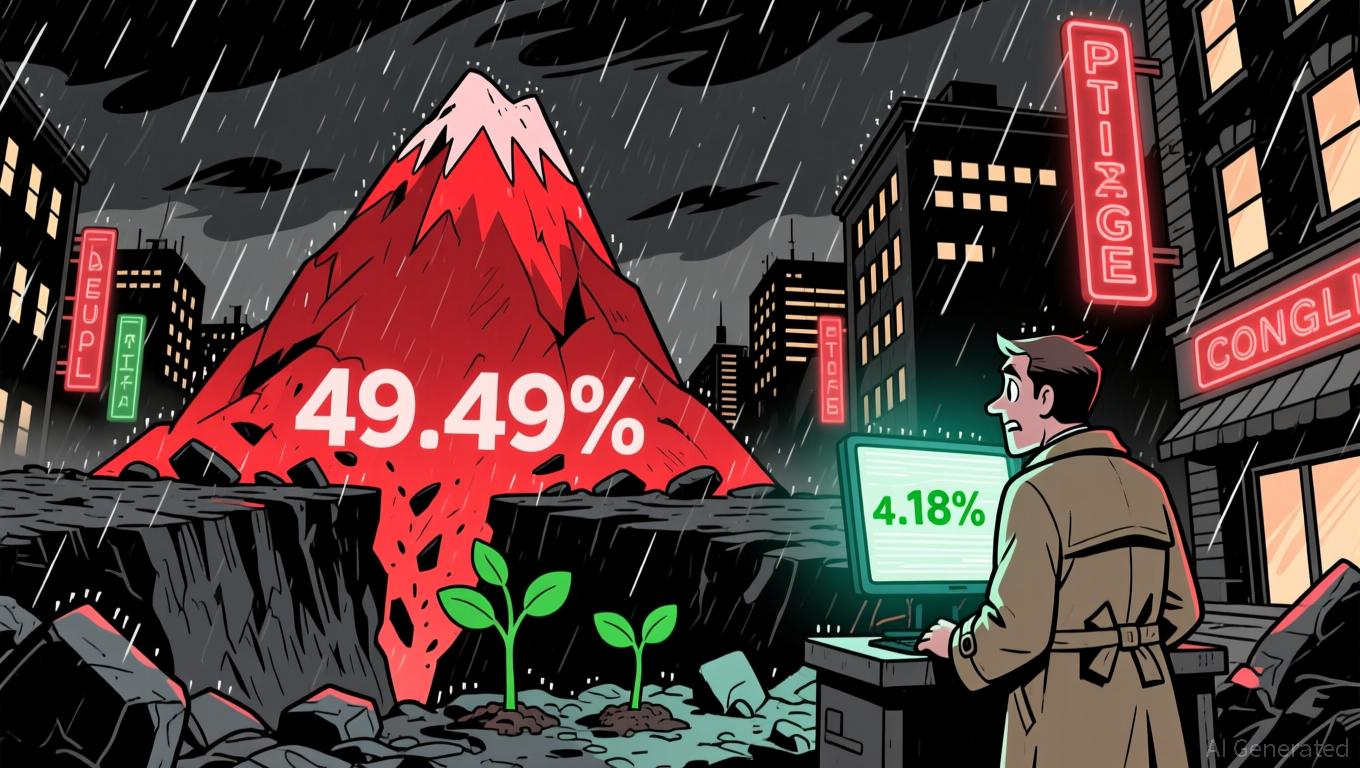

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi